Top Performing Clean Energy Funds in 2010

Tom Konrad CFA When Bloomberg New Energy Finance (BNEF) released their clean energy league tables for 2010, the top of the list was my favorite exchange traded fund (ETF), the Powershares Cleantech Portfolio ETF (AMEX: PZD), with an annual return of 7.6%. Second place was the Winslow Green Growth (WGGFX) mutual fund (7.4% return), which is one of what I consider to be the three best clean energy mutual funds. But the one I consider to be the best, the Gabelli SRI Green Fund (SRIGX) was nowhere to be seen, despite the fact that it returned 12.1% in...

List of Clean Energy and Alternative Energy Mutual Funds

Alternative energy and clean energy mutual funds are open-ended funds that invest primarily (at least 50% of the portfolio) in the securities of clean energy and alternative energy companies. Closed-end funds are included in the list of alternative energy and clean energy ETFs.

This list was last updated on 2/20/2021.

Allianz RCM Global EcoTrendsSM Fund (ADGLECO.TT)

Calvert Global Energy Solutions Fund Class A (CGAEX); Class C (CGACX)

Calvert Green Bond Fund (CGAFX)

Ecofin Global Renewables Infrastructure Fund (ECOIX)

Erste WWF Stock Environment CZK (AT0000A044X2.VI)

Eventide Multi-Asset Income (ETNMX)

Fidelity Select Environment and Alternative Energy Portfolio (FSLEX)

Firsthand Alternative Energy (ALTEX)

Gabelli ESG Fund Class AAA (SRIGX); class C (SRICX)

Guinness Atkinson Alternative Energy...

Why Investors Should Pay Attention to Portfolio 21’s Top 10 Green Companies

Bill Paul Not every investor wants to be a green investor, but every investor – institutional and individual alike – should be prepared to take advantage of a company’s greenness. According to a recent study sponsored by Environmental Leader, an online publisher, consumers are willing to spend more on products and services that they consider to be environmentally-friendly. That’s why 82% of respondents said they plan to use more green messaging in their marketing. But how can an investor tell a genuinely green firm from the phony ones that practice “greenwashing?” One place to look is Portfolio 21. As...

Alternative Energy and Climate Change Mutual Funds, Part IV

Tom Konrad CFA Cherry picking the holdings of green energy mutual funds. So far in this series I've concentrated on trying to pick the best of the Alternative Energy and Climate Change Mutual Funds. This is a difficult task, because while I found in Part III that most of the funds' performance has been better than comparable index ETFs, these mutual funds' costs are quite high, even by the standards of most mutual funds, as I discussed in Part I. In part II, I tried looking at the sector breakdown of the funds' holdings, to see if...

Clean Energy Mutual Funds and ETFs

UPDATE 3/4/2011: An up-to-date article on selecting green mutual funds and ETFs can be found here. by Tom Konrad For new investors looking to green their portfolios with clean energy, the first thought is usually mutual funds. The following three are available in North America: Mutual Funds Expenses New Alternatives Fund (NALFX) 0.95% + Sales load Guinness Atkinson Alternative Energy Fund (GAAEX) 1.64% ...

Alternative Energy Mutual Funds and Exchange Traded Funds (ETFs)

UPDATE 3/4/2011: An up-to date article on selecting green mutual funds and ETFs can be found here. Mutual funds are often touted as an inexpensive way to achieve diversification. With declining brokerage commissions, this is often no longer true. If you are interested in investing in alternative energy, is a mutual fund or ETF right for you? Here are the currently available mutual funds and ETFs of which I'm aware with alternative energy type themes: Fund Name Emphasis Mgmt Style Load? Turnover Ticker Expense Ratio Guinness Atkinson...

Index Funds Are Climate Change Denial

Garvin Jabusch You probably know that index funds have become all the rage in investing over the past several years, as investors flock to their low fees and reject the gospel of active management. But you probably don’t know that investing in a broad-based index fund not only ignores rapid changes in the energy economy but also makes the investor complicit in climate change denial. And just as climate denial ignores the inherent risks of fossil fuels to environment, economy, and society, “set it and forget it” index investing ignores the inherent risks of fossil fuels and related stocks...

Alternative Energy Mutual Funds Post Stellar Performance, ETFs Variable

By Harris Roen Mutual Funds Alternative energy MFs have had stellar returns in the past three and 12 months, all showing gains in the double digits. ETFs have also done well on average, but returns are much more variable, as detailed below. Returns remain excellent for alternative energy MFs overall, with annual returns ranging from 54.5% to 15.8%. The average MF is up 31.3% for the year, and not a single fund posted a loss in the past 12 months. Three-month and one-month returns also look goodeven the funds that did not make...

Alternative Energy Mutual Funds and ETFs Returns Flatten

By Harris Roen Alternative Energy Mutual Fund Returns Alternative energy mutual funds have given back some of the gains they have enjoyed since the beginning of the year, though they are still up almost 20% on average. All MFs are in positive territory, with annual returns ranging from 9.8% to 40.9%. MFs are also up nicely for the week and month, but on average are down slightly in the past three months. These returns are very different than those of just five months ago, when alternative energy MFs were doing almost twice as well… ...

2015: a Mixed Year for Alternative Energy Funds

By Harris Roen Alternative Energy Mutual Funds Trade Flat for the Year Alternative energy mutual funds followed the overall stock market this year, closing about flat on average for 2015. The story gets more interesting, though, when you look at gains in the last quarter. Sectors such as solar and wind took a big hit by September, but then rebounded handsomely before years end. Green MFs were up 7% on average for the past three months, with 14 out of the 15 funds trading in the black… ETFs are Widely Lower 2015 was a year...

Shares of Daystar Technologies Purchased

DayStar Technologies Inc (DSTI) has been on my radar for some time and the recent operational update created some renewed interest in the company. The stock traded up nicely over the past couple of days and it is now trading back down to the near term support due to some profit taking on the news. I have been looking for a good entry point on this stock and I feel like today is the day to make the move. Technically, the downside of this stock is that it may not be able to hold its currently levels and could...

Renewable and Alternative Energy Mutual Funds Compared

If you can, you are better off in one of the clean energy ETFs, or even a portfolio of individual clean energy stocks (here are 10 clean energy picks for 2009.) However, it you want a mutual fund for the ease of investment, or you are looking to add one to a retirement plan, the Winslow Green Growth Fund comes out on top because of its emphasis on energy efficiency stocks (including these two Geothermal Heat Pump stocks), and its lower expenses.

Alternative Energy Funds Deliver Stunning Quarterly Returns, But Beware the Risks

By Harris Roen The Roen Financial Report closely covers the universe of almost 30 alternative energy Mutual Funds (MFs) and Exchange Traded Funds (ETFs). We use a proprietary ranking method to pick the best funds, looking at measures that include fees, risk, tax liability, and the financial health of individual holdings within each fund. Subscribers can see the complete list of funds, including rankings and technical breakdowns, in both Excel and PDF format by clicking here . Mutual Funds Alternative energy MFs showed improving ranks for this February update. In all, three funds were bumped up to...

How the Gabelli Green Growth Fund Got Its Five Stars

Tom Konrad, CFA An interview with John Segrich, CFA, portfolio manager at the the Gabelli Green Growth Fund (SRIGX). When I did my recent past performance comparison of clean energy mutual funds, I found that the Gabelli Green Growth Fund (SRIGX and SRICX) beat all its rivals by a long shot over the last three years, earning a coveted five-star rating from Morningstar. In general, I'm a skeptic about short-term past performance: If you look at enough funds, sooner or later you'll find one that has had great performance by sheer luck. Even when a few years'...

Do Falling Alternative Energy Funds Returns Signal Danger?

By Harris Roen Green Mutual Fund Returns Falter Returns for green mutual funds have slid as of late. Longer term, however, alternative energy MFs are still showing strong gains. All MFs are in positive territory for the past 12 months, and 6 out of 14 funds are up double digits. Three year returns have faired even better, showing an annualized return of 14.3% on average. Short term, however, almost all the funds have given up a significant amount of their recent gains. For example, Firsthand Alternative Energy (ALTEX), the MF with the best one-year returns, gave up...

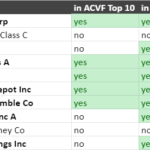

Are ESG Funds All That Different?

by Jan Schalkwijk, CFA

ESG investing is all the rage these days. That is, investing that includes the non-traditional environmental, social, and governance factors in the investment process. Its appeal to the broader investment industry is twofold:

1) The writing is on the wall: as wealth is passed down to younger generations who in the aggregate care more about values alignment, the asset management industry does not want to lose the assets and the fees they generate.

2) Thematic investing is popular and ESG is one of the hottest themes. Wall Street is not going to miss out. Much like crypto...