Gevo Soars: The Story Behind the Rise

by Jim Lane

What in the world has gone right with Gevo?

For years now, Gevo (Nasdaq:GEVO) has remained true to a vision of low-carbon, advanced renewable fuels, when so many others pivoted away to the world of ABF — Anything But Fuels. Some tried chemicals, cannabis, algae, natural gas, nutraceuticals, vegan foods — lately, protein has been all the rage. Gevo was one of the few true believers and paid the price of stock price punishment and near-extinction, for years.

While they weathered a debilitating patent battle with DuPont, until it settled and DuPont imploded. And the collapse of oil prices...

Another Biodiesel Plant Gets The Axe. Here’s Why.

by Jim Lane

In another small but sharp blow to the Trump Administration’s strategy for American manufacturing revival, news arrives from Texas of a second smaller biodiesel shuttering owing to “ challenging business conditions and continued federal policy uncertainty,” as Renewable Energy Group (REGI) phrased it in announcing the closure of its15 million gallons per year New Boston, Texas biorefinery. The company is currently working with plant employees on relocation opportunities within the production network.

The tax credit issue

The forces impacting the US biodiesel industry at present are complex, but REG in this case is pointing the blame at the biodiesel tax...

Biofuel Industry Reacts To EPA New Renewable Fuel Standard

Yay or Nay for EPA? RFS Volumes out for 2020, Biodiesel for 2021 – What’s the reaction from industry?

by Jim Lane

What’s the reaction from industry? Coal for Christmas?

Should Santa bring coal for EPA’s stocking this year? Do the biofuels and agriculture industries think the EPA just put coal in their stocking? Is it thumbs up or thumbs down from biofuel industry advocates on last week’s U.S. Environmental Protection Agency renewable fuel volumes? What about the exempted volumes?

The Ruling – Rotten or Respectable?

First, a bit on the EPA ruling that establishes the required renewable volumes under the Renewable Fuel Standard (RFS) program for...

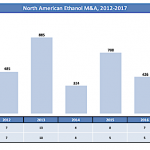

Biofuels M&A: 2017 Review and Outlook

by Bruce Comer, Ocean Park Advisors

More industry players chose to develop and build new capacity rather than buy plants

The North American biofuels industry experienced the fewest merger and acquisition transactions in recent history in 2017. There were only six M&A transactions, with a total estimated value of more than $100 million. They involved eight plants with 297 million gallons per year (MGPY) of production capacity. Half of these deals were for non-operating plants. A fourth deal was for a sub-scale demonstration plant. Contributing to the limited deal flow, two historically active acquirers, Green Plains and REG, did not close...

Biofuels & Biobased Earnings Roundup: Novozymes

by Jim Lane

The Top Line. In Denmark, Novozymes (Copenhagen:NZYM-B; OTC:NVZMY) reported 4% organic sales growth for the first half and a 5 percent jump in Q2 with bioenergy reporting a 14% jump. Overall, net profit grew 5% and the company affirmed its 2018 guidance. Sales dipped to DKK 7,018m from DKK 7,278m, and EBITDA was flat at DKK 2,464m, although we primarily attribute that to currency shifts.

The Big Highlights. Growth in Food & Beverages and Agriculture & Feed; Bioenergy particularly strong. Good ramp-up of recent product launches. +7% organic sales growth in emerging markets; Freshness & hygiene platform in Household Care developing according to...

EPA Reneges on Trump’s Biofuels Deal

by Jim Lane

“EPA Reneges on Trump’s Biofuels Deal”, said the Iowa Renewable Fuels Association in reacting to the US Environmental Protection Agency’s new plans for fulfilling federal renewable fuel requirements. EPA released a proposed supplemental rule for the Renewable Fuel Standard today, and the bioeconomy is up in arms, and the outrage is centered in farm country, once a Trump bastion of support.

“IRFA members continue to stand by President Trump’s strong biofuels deal announced on Oct. 4, which was worked out with our elected champions and provided the necessary certainty that 15 billion gallons would mean 15 billion gallons, even after...

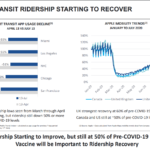

Earnings Roundup: Covanta, NFI Group, Green Plains Partners

by Tom Konrad, Ph.D., CFA

Earnings Season Continues

Below are three more updates on second quarter earnings which I've been sharing with my Patreon supporters. If you'd like to support my writing and see those thoughts in a more timely manner, consider becoming a patron. becoming a patron.

For everyone else, I'm reprinting those thoughts below.

Covanta Earnings

(published August 2nd)

Waste to energy company Covanta Holding Corp (CVA) saw most of its business recovering towards the end of the second quarter. Management is reluctant to predict if the positive trend will continue into the third quarter and for the rest of the year, but...

REG Enters Renewable Diesel With Syntroleum Purchase

Jim Lane In Oklahoma, and Iowa, Renewable Energy Group (REG; NASD:REGI) announced that it would acquire substantially all of the assets of Syntroleum Corporation (NASD:SYNM), and assume substantially all of the material liabilities of Syntroleum, for 3,796,000 shares of REG common stock worth $40.08 million at today’s market close. The purchase price subject to reduction in the event that the aggregate market value of the REG common stock to be issued would exceed $49 million or if the cash transferred to REG is less than $3.2 million). “This will help us grow our advanced biofuel business, enhance our intellectual...

ADM Separates Ethanol Business

Prelude to a spin-off?

by Jim Lane

The Archer Daniels Midland Company (ADM) is breaking news of breaking off their ethanol unit…and a tumbling 40% decline in profit.

In Chicago, Archer Daniels Midland Company reported their financial results for the quarter ended March 31, 2019, but most interesting to us, they are looking at separating their ethanol business with the option of spinning it off completely. They are also taking other actions to restructure and deal with challenges they say include weather issues and trade pressures.

ADM announced a “series of measures to continue to underpin long-term-value creation” which included:

“First, to meet growing customer...

A Decade Of Unexpected Curves In The Bioeconomy

By Jim Lane

Over the years we’ve all seen a lot of curveballs in the advanced bioeconomy. You see companies like Valero, which lobby the United States Congress with unbridled intensity to get rid of the Renewable Fuel Standard, on the verge of becoming the single-biggest producer of RINs in the United States (with news that they might take capacity at Diamond Green Diesel up to 540 million gallons).

You see companies like Solazyme which love the Renewable Fuel Standard and drive up to nearly a billion-dollar post-IPO valuation based on delivering fuels at volume, then announcing that there are even...

Rapidly Growing Alternative Energy Companies

The last post highlighted several companies in the alternative energy, conservation and environment technology fields that have delivered exceptional price performance over the last year. Prospects for growth in sales or earnings appeared to be key drivers of the price movement. It makes sense to seek indicators of growth as cues for those companies that may become tomorrow’s price movers.

Crystal Equity Research’s novel alternative energy indices were a good place to go on a ‘quest for growth.’

Beach Boys Index - Biodiesel

The two analysts who publish estimates for Renewable Energy Group (REGI: Nasdaq)apparently expect a surge in growth in the current year followed by a leveling...

Neste Sells 1 Billionth Gallon of Renewable Diesel

Neste reaches 1B gallons renewable diesel sale, runs in fire trucks, ambulances and school vehicles

In Texas, Neste U.S., Inc. (NEF.F, NESTE.HE, NTOIF, NTOIY) is celebrating its 1 billionth gallon of Neste MY Renewable Diesel sold in North America which has effectively helped reduce more than seven million metric tons of greenhouse gas emissions in the Earth’s atmosphere. This is the equivalent of removing 1.6 million passenger vehicles from the road for one year.

“There’s never been a better time to take a closer look at the steps we’re taking to ensure we’re leaving our planet in a healthier state for future generations,”...

Biochar’s Likely Market Impacts

Biochar is still mostly a research and cottage industry, yet it has the potential to impact returns for a broad range of investors. Tom Konrad, Ph.D., CFA Biochar, or amending soil with biomass-derived carbon, shows great potential to improve the productivity of soils, as well as to increase the utilization of fertilizers by plants, while sequestering carbon to reduce the drivers of climate change. On August 10, I went to the 2009 North American Biochar Conference to look at the potential for investors. Before I went, I took a look at the publicly traded companies...

Biofuels Rocking The Boats (and Ships)

Companies that rock the boat often end up leading the way for others. While some companies have paved the way for road transportation and others reached high in the sky for aviation, there are some big boats out there that are also looking for alternative renewable fuels. Here are some companies that are answering the call for the maritime and shipping sectors with viable biofuel alternatives, the technologies and innovations, the rough waves that still lie ahead, and how they can reach that destination on the horizon.

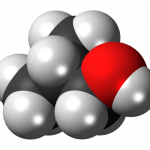

Gevo and Butanol

We start with Gevo (GEVO) and their butanol. Why butanol? It...

Making Cash From Rice Trash

by Jim Lane

In our three-part series this month on utilizing waste resources, we’ll turn to rice straw, which is a major headache for Chinese and Indian emissions. Praj and Gevo are working hard on perfecting a technology to address this.

Specifically, in the past month, Gevo (GEVO) also executed an agreement with Praj to develop jet fuel and isooctane from rice straw and other feedstocks. Gruber noted that “we believe this second-generation technology combination has great potential to address India’s rice straw burning problem and related air pollution, while generating low-carbon hydrocarbons for jet fuel and gasoline. Praj is a leader...

Velocys Rocks With Red Rocks

by Jim Lane

In the United Kingdom, renewable fuels company, Velocys (VLS.L, OXFCF), received a “notice to proceed” action to commence manufacturing of the Fischer-Tropsch reactors and catalyst for the Red Rock Biofuels biorefinery that will be located in Lakeview, Oregon. RRB has commenced construction of the biorefinery, which will incorporate Velocys’ technology, and produce low- carbon, renewable diesel and jet fuel. Velocys’ role will be as a licensor for its technology to the project.

Red Rock’s construction is estimated to take 18 months, with operations planned to start in 2020. RRB is a subsidiary of IR1 Group LLC, which has 325 million gallons...