Investing in Biopolymers

Last month Eastman Chemical Company (EMN: NYSE) announced an expansion of its urethane extrusion line at one of its specialty chemical plants. This one located near Martinsville, Virginia makes paint protection films and window films. Urethane is perfect to protect surfaces in a home or business. It is not brittle like plastic, but has excellent tolerance for grease and oils. When exposed to the elements it does not rot or degrade over time like rubber.

Shareholders likely cheered the development in Virginia for potential addition to market share. Eastman grabbed $9.6 billion in sales from the specialty chemicals market in 2017, earning $1.4 billion in net income or...

Amyris, Cosan JV Launches 100% Renewable Base Oils

Jim Lane Portrait of a breakout: Amyris (AMRS), Cosan (CZZ) JV Novii launches “next generation of revolutionary oils” touting “unmatched value” and “unbeatable economics” In California, Novvi unveiled two new 100 percent renewable base oil products, a 100 percent renewable polyalphaolefin (PAO) Group IV and a 100 percent renewable version of its NovaSpec Group III+ base oil. Both will be manufactured at the company’s production facility in Houston. Base oils are blended with additives to make the engine oils and lubricants sold on the market today. So, here’s the technical scoop. Novvi’s 100 percent renewable...

Solazyme’s Detours on the Way to Algae Biofuel

by Debra Fiakas CFA Investors who took the time to read my last two posts on algae-based biofuel – “Algae Takes Flight” and “Emission Standards Driving Aviation Fuel Sourcing” - might have wondered why there was no mention of Solazyme, Inc. (SZYM: Nasdaq). California-based Solazyme has been pursuing algae-based oils for transportation since 2004, and managed to record its first product sales in 2011. However, that revenue was not from biofuel. On the long road to finding a scalable and efficient way to get renewable fuel from algae, Solazyme scientists found an interesting extract...

BioAmber Gets Little Love From Investors on Valentine’s Day

by Debra Fiakas

Management of sustainable chemical developer BioAmber (BIOA: NYSE; BIOA: TSX) have not been feeling much love from the capital markets. The BioAmber team just wants some consideration for its proprietary platform for production of bio-based succinic acid. Historically succinic acid has been produced from fossil fuel and sold as an intermediate input for use in drug compounds, agriculture and food production. BioAmber has fine tuned a fermentation process to transform organic materials such as dextrose sugars into a bio-succinic acid.

BioAmber’s woes began last fall when the New York Stock Exchange sent the company a notice of non-compliance with NYSE...

The Hocky-Stick Growth of Biobased Intermediates

Super-cali-thali-terpa-butyl-peta what? Jim Lane The new trend in biofuels is not a biofuel at all – it’s an (usually unpronounceable) intermediate that can be refined into an array of fuels, chemicals, flavors, fragrances, and construction or packaging materials. Ptera-buta-thalic-what? We can hardly pronounce them, but we sure need to know about them. Amyris (AMRS), KiOR (KIOR), Renmatix, Virdia, Blue Sugars, Proterro, Sucre Source, Sweetwater Energy, Genomatica – hot companies all, what do they have in common? Instead of making a finished end-product, they make an intermediate which is then upgraded to a finished product, typically...

Bioplastics Maker Avantium’s IPO Plans

Jim Lane Here’s our 10-minute version of the filing, slightly re-organized to make sense to Earthlings instead of aliens from the Planet Prospectus. In the Netherlands, bioplastics maker Avantium is planning an initial public offering and listing of all shares on Euronext Amsterdam and Euronext Brussels. The company expects to raise up to €100 million (USD$106 million) and complete the offering by the end of the current quarter. More than half of the offering has already been secured via commitments from cornerstone investors. Avantium’s YXY technology converts plant-based sugar into chemicals and plastics, including 2,5-furandicarboxylic acid, a precursor...

BioAmber Sets Price Range for IPO

Jim Lane 8 million share offering at $15-$17 aims to raise $128 million. “We are selling 8,000,000 shares of common stock,” begins BioAmber’s latest SEC update, written in IPO-legalese. “The initial public offering price of our common stock is expected to be between $15.00 and $17.00 per share, which is the equivalent of €11.48 and €13.01 per share, based on an assumed Bloomberg BFIX Rate for USDEUR at the pricing of this offering. If completed, it would be the first successful IPO in the sector since Ceres (CERE) and Renewable Energy Group (REGI)...

Solazyme Shares Soar On Sasol Deal

Jim Lane Bioenergy’s #1 company surges on the exchanges after big Sasol, AkzoNobel partnership announcements. In California, Solazyme (SZYM) announced a Q2 loss of $25.8M, compared to a Q2 2012 loss of $19.2M, on revenues of $11.2M, down from $13.2M for Q2 2012, as government funded revenues declined as expected. Excluding the government sector, sales jumped 28% year on year despite the lack of the big capacity that Moema and Clinton will represent when completed. Product gross margins were a very healthy 70%, in line with guidance. Solazyme shares were up 12.95 percent today at market close....

Amyris’ Mysterious Partner

Jim Lane In California, Amyris (AMRS) has a new partner, described fetchingly yet with near-to-complete vagueness as a “a leader in food ingredients and nutraceuticals” which is roughly as helpful as describing a person as “someone who enjoys ice cream”. Some ice cream there is, nevertheless, in this agreement, which will bring a short-term collaboration investment of $10 million, an equity investment of up to $20 million at $1.40 per share, and $100 million in annual revenue starting in 2017 connected to the production and cost improvement of fermentation molecules. One thing, and the only one, we discover...

Biofuels M&A: 2017 Review and Outlook

by Bruce Comer, Ocean Park Advisors

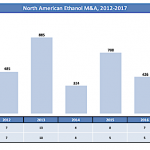

More industry players chose to develop and build new capacity rather than buy plants

The North American biofuels industry experienced the fewest merger and acquisition transactions in recent history in 2017. There were only six M&A transactions, with a total estimated value of more than $100 million. They involved eight plants with 297 million gallons per year (MGPY) of production capacity. Half of these deals were for non-operating plants. A fourth deal was for a sub-scale demonstration plant. Contributing to the limited deal flow, two historically active acquirers, Green Plains and REG, did not close...

Amyris In The Age Of Rapid Change

by Jim Lane

Last month, Amyris (AMRS) and Chevron (CVX) announced that Novvi and Chevron have entered into an agreement to jointly develop and bring to market novel renewable base oil technologies. Novvi is Amyris’ JV with Cosan (CZZ) to produce targeted hydrocarbon molecules from plant sugar for automotive, industrial, marine, and construction applications at unbeatable economics. Think lubricants for engines and machines.

Since launching its first commercial production in 2014, Novvi has been steadily increasing its base oil production to keep up with robust and growing demand for a variety of automotive, marine and industrial applications. Meanwhile, Chevron has one of...

Leather Without The Cow

Flokser launches Artificial Leather based on DuPont Tate & Lyle, BioAmber ingredients Jim Lane In Canada, BioAmber (BIOA) announced that the Flokser Group has successfully developed an innovative artificial leather fabric using bio-based materials supplied by DuPont (DD) Tate & Lyle Bio Products and BioAmber. Flokser has launched this new synthetic leather fabric under its SERTEX brand. The novel fabric comprises a polyester polyol made from BioAmber’s Bio-SA bio-based succinic acid and DuPont Tate & Lyle Bio Products’ Susterra bio-based 1,3-propanediol. Flokser’s artificial leather fabric has 70% renewable content and delivers improved performance. It provides better scratch resistance...

From Fuel To Fudge

by Debra Fiakas CFA This week the last reminder of the renewable fuels business that was once called Solazyme will be gone. The old Solazyme has abandoned the goal of producing renewable fuels using the oils from algae. Instead, under a new name TerraVia, the company is directing its algae cultivation and harvesting knowhow toward growing edible algae for food and personal care products. To make the change complete the old stock symbol ‘SYZM’ gives way this week to a new trading symbol ‘TVIA.’ No doubt there is more than just a little hope in Terra...

Amyris: Biochemical Bargain?

Industrial bio-chemical developer Amyris, Inc. (AMRS: Nasdaq) has been in the headlines recently - some pointing to solid fundamental progress, others ‘not so much.’ Amyris recently announced a new relationship with Givaudan (GIVN: VX), a supplier of active ingredients for cosmetics. The two have agreed to collaborate in research and development on proprietary fragrances. Earlier this month Amyris announced the launch by Takasago International Corporation (TYO: 4914) of a new fragrance created with Amyris’ technology. Cosmetics and fragrances present large market opportunities and the strength of demand for personal care products supports strong profit margins. The relationships are likely...

Why Traffic Lights Are Turning Green For BioAmber

Jim Lane As many technologies pivot or delay, one train keeps chugging on its route to biosuccinic acid, and markets like BDO, resins and polyols. What is it about the business model that keeps on working? What can every integrated biorefinery learn from its approach? In Minneapolis, BioAmber (BIOA) just announced a contract to supply a minimum of 80% of PTTMCC Biochem’s total bio-succinic acid needs until the end of 2017. PTTMCC Biochem is a joint venture established by Mitsubishi Chemical and PTT, Thailand’s largest oil and gas company, to produce and sell polybutylene succinate (PBS),...

Can Amyris Find The Ingredients Of Success?

In late August 2018, sustainable ingredients developer Amyris (AMRS: Nasdaq) staged a successful secondary offering by a selling stockholders, Foris Ventures and Vivo Capital Fund. In conjunction with the offering the company raised $46.0 million in new capital through the exercise of warrants held by existing shareholders. Last week the shares closed over 40% higher than the $6.25 deal price. The chief executive officer lauded shareholders for their support and apparent endorsement of the company’s game plan to commercialize sustainable alternatives to petroleum-sourced materials used in fragrance, health and beauty products.

Amyris leadership should celebrate its loyal shareholders given how far the company drifted...