Tom Konrad CFA

Power REIT (AMEX:PW) aims to be the first renewable energy infrastructure Real Estate Investment Trust (REIT).

The Renewable Energy REIT

![pwlogo5[1].jpg](http://www.altenergystocks.com/wp-content/uploads/2017/08/pwlogo5_1_.jpg) Renewable energy advocates have been calling for a change in the tax laws to allow renewable energy within the REIT structure. A REIT is allowed to pass profits directly through to investors. These profits are not subject to double-taxation like most corporate profits. Owning shares of a renewable REIT would be much like owning a slice of a wind or solar farm. This would open up the renewable energy investment opportunity to everyone, not just corporations and homeowners with with a roof suitable for solar.

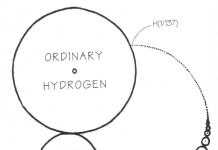

Renewable energy advocates have been calling for a change in the tax laws to allow renewable energy within the REIT structure. A REIT is allowed to pass profits directly through to investors. These profits are not subject to double-taxation like most corporate profits. Owning shares of a renewable REIT would be much like owning a slice of a wind or solar farm. This would open up the renewable energy investment opportunity to everyone, not just corporations and homeowners with with a roof suitable for solar.

The catch is that REITs are limited to certain types of real estate based assets, and without a new ruling from the IRS, wind and solar farms are out. Which is why renewable advocates have been calling for just such a ruling.

Power REIT CEO David Lesser has beaten them to the punch.

Lesser was an investment banker at Merrill Lynch, where he helped create a large number of REITs to provide more equity to over-indebted real estate property. That experience allowed him to see what the renewable advocates did not: there is a place in the existing REIT structure for renewable energy. It’s possible to strip out the real estate assets from a wind or solar farm, and put them into the REIT. Renewable energy developers are already familiar with complex ownership structures (thanks to our tax laws), so stripping out real estate assets should not be a big leap.

Power REIT

In order to implement his vision, Lesser and his team began buying the shares of what was then known as the Pittsburgh & West Virginia Railroad, an infrastructure REIT holding 112 miles of main line railroad real estate that is triple-net leased to Norfolk Southern Railroad (NYSE:NSC) for 99 years. The renamed PW still holds the railroad asset, and has no debt.

Based on the income from the railroad lease, PW pays a $0.40 annual dividend, for a 5.5% yield at the current stock price of $7.24. Lesser believes he can invest in renewable energy assets at yields in the 8.5% to 9% range. These will be financed with debt at around 6.5% and potentially additional equity. Any such transaction would bring an immediate increase in income per share.

Acquisitions have an added advantage of increased scale. Power REIT needs to grow in order to better manage the expenses of being public. Income from the existing railroad asset is insufficient to support these expenses.

One other potential upside lies in the railroad asset itself. PW has initiated litigation with Norfolk Southern, which management believes has failed to pay all its contractual obligations under the lease. The risks involved in this suit are limited to litigation costs, while the potential gains could be quite large for the microcap REIT.

Proxy Battle

The one hitch in Lesser’s plan was that he did not expect the actions of a disgruntled Pittsburgh & West Virginia shareholder, Paul Dorsey. Dorsey owns 1,000 shares (0.06%) of PW stock, but feels that he is entitled to a board seat because he had been coming to board meetings for the last decade. When Lesser (who is the largest shareholder, at 3% almost 10%) turned him down because he lacked relevant experience, Dorsey decided to take matters into his own hands.

Dorsey has run proxy battles in both 2011 and this year, seeking to replace the entire PW board with a slate led by himself and his brother. While he has no chance of winning due to lack of a business plan, experience, and backing by large shareholders, he has managed to scare smaller shareholders with a series of ad hominem attacks on Mr. Lesser in SEC filings. The company maintains that these filings lack basis in fact. I perused one of them myself, and feel that, even if all the allegations were true, Lesser would be better qualified than Dorsey to run the company. (The allegations are mostly about poor performance of REITs under Lesser’s watch, but they at least claim that Lesser has extensive experience with running REITs. The period of poor performance is cherry-picked to coincide with a period of poor performance of REITs as an asset class and ignores dividend payments, which are significant.)

Buying Opportunity

Nevertheless, leading up to PW’s annual meeting tomorrow, small shareholders (who do not have the time or expertise to analyze the issues involved) are getting spooked, and the stock has fallen from the mid $9 range to the $6 range today in the last few days.

Because I believe the current selling is irrational and motivated by fear, I’ve been buying agressively all the way down, and PW is approaching the size of my largest individual holding. I believe Lesser and other insiders would also be buying, if they could. They were actively buying last year when the stock was in the $12.50 range. Unfortunately for them, but perhaps fortunately for those of us with money to invest, they are most likely barred from buying by SEC rules. So long as they believe they are near a material announcement, such as a deal to acquire assets, they cannot trade the stock.

Hence, there are few buyers who are both aware of the opportunity presented by Power REIT, and able to grab the shares dumped by skittish small shareholders.

If and when a deal materializes, I expect the stock to head up rapidly. As I said above, insiders seem to believe such a deal is close. Why else have they not been buying the stock at such a large discount to the $12.50 they were buying it at last year?

Disclosure: Long PW.

This article was first published on the author’s Forbes.com blog, Green Stocks.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed f

or informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.