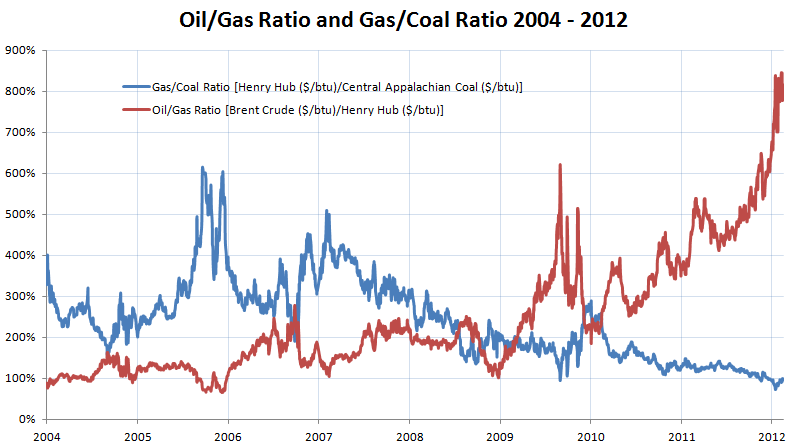

Both the gas/coal and oil/gas ratios are at record levels:

Sources: Natural Gas (EIA); Oil (EIA); Coal (EIA)

Natural gas is now cheaper than coal on a per unit energy basis, and a btu of natural gas also yields more electricity than coal. Only half of coal plants have scrubbers, with older plants now facing the decision of whether to upgrade or to switch to natural gas. Central Appalachian coal at $60/ton is now selling below its mining cost of $65 -$75/ton, which means there is limited scope for coal prices to adjust downwards should fuel switching accelerate.

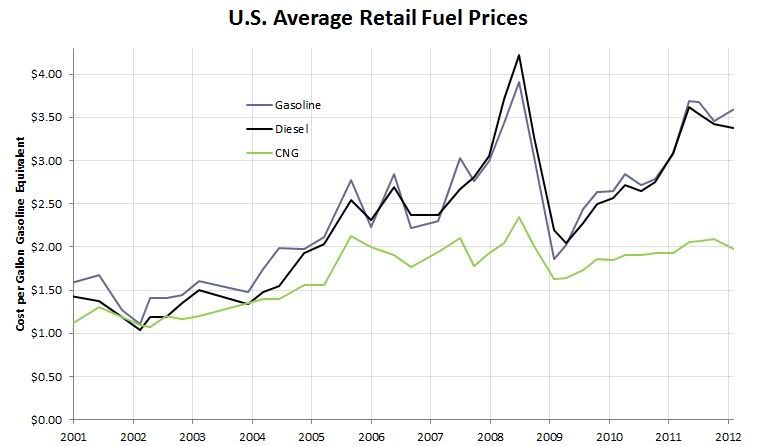

The oil gas ratio is at record levels also, which has translated to large differentials between CNG and gasoline/diesel (making for compelling payback period calculations):

Source: Alternative Fuels Data Center; Clean Energy Fuels

This presents an opportunity for Clean Energy Fuels if they can increase the volume of fuel they sell, as their margin per gallon of gasoline equivalent is currently in the range of 35c.

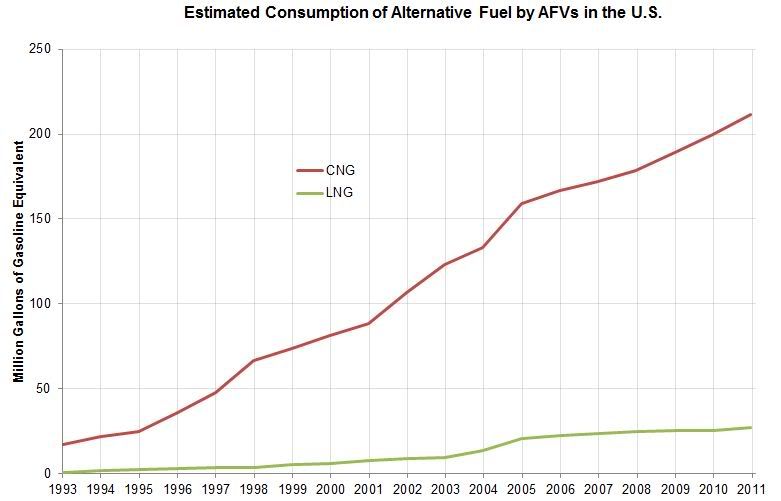

Source: Alternative Fuels Data Center; EIA Annual Energy Review 2010

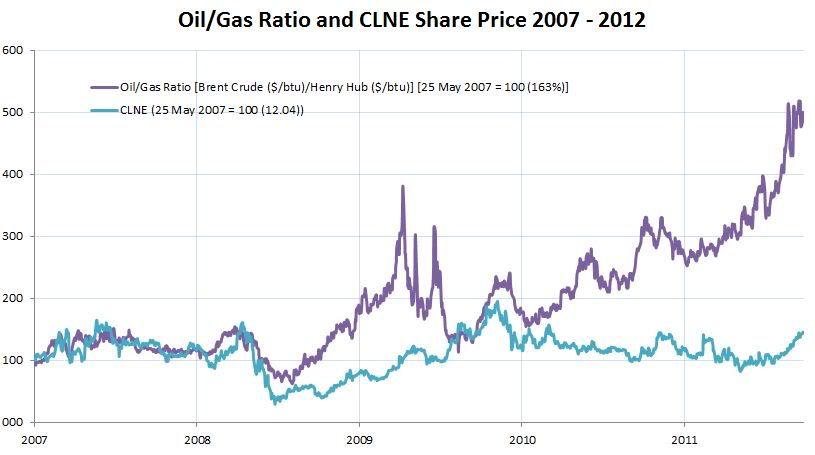

In 2010 2.4% of US primary energy consumption in the transport sector came from natural. With the possibility of a strike on Iran, the oil/gas ratio could go significantly higher, which may result in a knee jerk narrowing of the CLNE oil/gas ratio spread as hands are wrung about $4/gallon gas.

Disclosure: None