By Harris Roen

General Electric (GE) is a standout company that supplies products and services in the alternative energy and environmental fields. GE also has a robust stake in smart grid technology; its energy division alone has products that include power delivery, smart metering, charging systems, and power sensing. According to Cleantech, GE is a player in 5 of the 6 critical business areas affecting smart grid development.

As part of their commitment to shape the future of the smart grid, GE committed $200 million for entrepreneurs, students and other innovators as a “call to action” for ideas on smart grid, renewable energy and efficiency. 19 GE also has a fantastic Web site that worth visiting, that allows viewers to visualize and understand what a smart grid can do, at http://ge.ecomagination.com/smartgrid/#/landing_page.

It must be understood that General Electric is one of the largest companies in the worldperiod. It is in the top 15 of publicly traded companies in measures like sales, gross income, market capitalization and shares outstanding. GE has 23 major business groups ranging from energy to health care to entertainment to finance. GE employs over 300,000 people in over 100 countries worldwide, and netted over $9.8 billion in the past 12 months.

GE can fix your neighbor’s dishwasher or build a nuclear power plant in Asia. Accordingly when looking at GE as in investment, the overall company must be considered, not just areas of interest to the Paradigm Portfolio. Here the news is goodsecond quarter 2010 earnings were up a whopping 15% from the previous quarter!

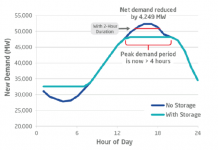

The chart on the above shows that GE is still attractively priced compared to historic norms. The 4 columns in the chart show ratios of the current price per share of the stock compared to 4 different measures: sales per share, book value per share, earnings per share and free cash flow per share (FCFPS).

The top of the bars show the highest annual average since 2003 (note that Price/FCFPS exceeds the height of the chart). The bottom of the bar shows the lowest annual average, and cross bar shows current levels.

GE has a price/earnings ratio around 17. While this is higher than the 9 to 10 p/e range when GE was recommended for inclusion in the Paradigm Portfolio in May 2009, it is still within historic norms. Other measures on the chart are well below historic norms.

This means that even if sales, earnings and cash flow remain the same for this company, the stock price has a good chance of appreciating. For all these reasons I am still optimistic about GE, which looks like a reasonably priced company in the $13/share to $17/share range.

DISCLOSURE: None.

This is the third part of a three-part series drawn from “Smart Grid Investment Opportunities: Understanding the Smart Grid Investment Landscape”, a special supplement to the “ROEN FINANCIAL REPORT” ISSN 1947-8364 (print) ISSN 1947-8372 (online), published monthly for $69 per year print or $59 per year e-mail by Swiftwood Press LLC, 82 Church Street, Suite 303, Burlington, VT 05401. © Copyright 2010 Swiftwood Press LLC. All rights reserved; reprinting by permission only. For reprints please contact us at cservice@swiftwood.com. POSTMASTER: Send address changes to Roen Financial Report, 82 Church Street, Suite 303, Burlington, VT 05401. Application to Mail at Periodicals Postage Prices is Pending at Burlington VT and additional Mailing offices.

DISCLAIMER: Swiftwood Press LLC is a publishing firm located in the State of Vermont. Swiftwood Press LLC is not an Investment Advisory firm. Advice and/or recommendations presented in this newsletter are of a general nature and are not to be construed as individual investment advice. Considerations such as risk tolerance, asset allocation, investment time horizon, and other factors are critical to making informed investment decisions. It is therefore recommended that individuals seek advice from their personal investment advisor before investing.

These published hypothetical results may not reflect the impact that material economic and market factors might have had on an advisor’s decision making if the advisor were actually managing client assets. Hypothetical performance does not reflect advisory fees, brokerage or other commissions, and any other expenses that an investor would have paid.

Some of the information given in this publication has been produced by unaffiliated third parties and, while it is deemed reliable, Swiftwood Press LLC does not guarantee its timeliness, sequence, accuracy, adequacy, or completeness, and makes no warranties with respect to results obtained from its use. Data sources include, but are not limited to, Thomson Reuters, National Bureau of Economic Research, FRED® (Federal Reserve Economic Data), Morningstar, American Association of Individual Investors, MSN Money, sentimenTrader, and Yahoo Finance.