Maintaining and expanding the world’s electric power grids in order to avoid stupendous blackouts, add gigawatts of green power, and bring electricity to a billion additional people, will cost hundreds of billions of dollars over the next 10 years.

Retrofitting just the U.S. power grid will cost $130 billion, estimates the Electric Power Research Institute (EPRI). China has earmarked $135 billion to upgrade and expand its high-voltage grid. India will need to spend billions if it has any hope of reaching its goal of increasing electrical generation capacity to 200 GW by 2012 from roughly 150 GW currently. Among the many planned projects that will cost billions are the super grids that will connect North Sea offshore wind farms to northern Europe and North African desert solar installations to southern Europe.

Of the many players in the "global grid game," two in particular that appear to have strong long-term positions are Japan’s NGK Insulators Ltd. (Symbol NGKIF.PK) and Indo Tech Transformers Ltd., an Indian company that trades in Mumbai (Symbol 532717) in which General Electric Co. (Symbol GE) recently acquired a majority stake through a joint venture with a Mexican firm.

As Jesse Berst – whose web site, SmartGridNews, should be required reading – noted last month, "When it comes to the suppliers of grid-scale storage, there’s Japan’s NGK and its proven product line and then there is everybody else."

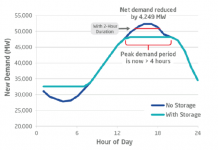

Given the growing need to "store" electricity from wind, solar and other so-called intermittent power sources, grid-scale energy storage will be a $4.1 billion market by 2018 compared with just $329 million in 2008, according to Pike Research, and NGK has already "garnered several significant multiyear battery orders," according to Berst.

To be sure, shares of power-storage companies (including NGK) have been performing well for many months. But with governments around the world due to spend upwards of $200 billion in green stimulus money this year and next, NGK’s upward climb would logically appear to have a ways to go.

As for Indo Tech, while it’s just one of several power transformer manufacturers in India, it’s the one that GE appears to be using to spearhead its growth in the fast-growing Indian power market. "As generation ramps up, I think there are going to be a lot of opportunities for growth in the transmission and distribution sector," GE Energy’s man in India was recently quoted as saying.

Think of Indo Tech as a purer play that may generate bigger absolute returns than GE itself will in a global market that everyone agrees is, and will continue, growing by leaps and bounds.

DISCLOSURE: No position.

DISCLAIMER: This is a news article. Please read terms and policy.

Bill Paul is Managing Editor of EnergyTechStocks.com.

NGK is far and away the current global leader in grid based storage with an installed base of roughly 400 MW, most of which is in Japan. That number pales in comparison to potential demand in the US which an upcoming report from Sandia pegs at 355,899 MW. Since grid-scale storage will be incredibly cost sensitive, NGK is not likely to retain its leadership position over the long term.