Ten Clean Energy Stocks For 2018

Tom Konrad Ph.D., CFA

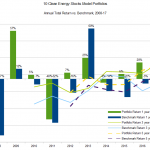

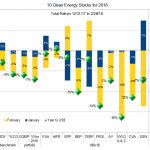

Ten Years of "10 Clean Energy Stocks." A 38% total return in 2017 is the one to beat.

I started blogging about investing in clean energy stocks in 2005. At the time, I had just started an independent investment advisory practice, and thought blogging was a good way to impress people with my knowledge of clean energy. I don't know how many people I impressed, but the clients were hardly pounding down the door.

What I did learn, however, was that I loved writing about clean energy from the perspective of a stock investor. Because I was...

10 Clean Energy Stocks for 2022-2023: The List

By Tom Konrad, Ph.D., CFA

With the launch of my (green dividend income focused) hedge fund early this year, I had to take a hiatus from publishing my annual list of 10 Clean Energy Stocks that I feel will do well in the coming year. Since my duty to clients takes precedence over readers, I could not tell people about stocks I liked before buying them for the fund.

As we complete the first half of the year, the fund is now largely invested, although I am still keeping some buying power back in anticipation that the overall market could easily...

Ten Clean Energy Stocks of 2022/3 – July Returns

Here are the numbers. I hope to write some market commentary to go with them soon.

Disclosure: Long all the stocks in the 10 Clean Energy Stocks model portfolio.

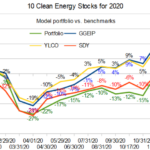

Ten Clean Energy Stocks for 2020

by Tom Konrad, Ph.D., CFA

If it's tough to follow a winner, 2020 is going to be an especially tough year for my Ten Clean Energy Stocks model portfolio.

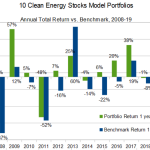

I've been publishing lists of ten clean energy stocks that I think will do well in the year to come since 2008. With a 46 percent total return, the 2019 list has had its best year since 2009, when it managed a 57 percent return by catching the rebound off the 2008 crash. This year's returns were also achieved in the context of full- to over-valuation of most of the clean energy...

10 Clean Energy Stocks for 2021: November. Notes on MIXT, GPP, EVA

By Tom Konrad, Ph.D., CFA

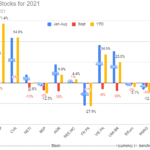

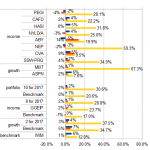

Monthly Performance

Returns for the Ten Clean Energy Stocks for 2021 model portfolio are shown below. It was a good month for clean energy stocks as well as the broader stock market, with the portfolio up 4% for a 20% total return through the end of October. Its clean energy benchmark (RNRG) was up more (8%) but is still down 6% for the year. Its broad market benchmark (SDY) rose 5% and has caught up with the model portfolio at a 20% return year to date.

Earnings

Third quarter earnings season has started. Below are some notes I’ve...

10 Clean Energy Stocks for 2021: Wrap Up

By Tom Konrad, Ph.D., CFA

The Ten Clean Energy Stocks for 2021 model portfolio had a decent year. With a 13.2% total return, it handily beat its clean energy income stock benchmark, the Global X Renewable Energy Producers ETF (RNRG, formerly YLCO), which fell 12.1%. It did not, however, compare as well to the wider universe of income stocks, which had an excellent year, with its benchmark SDY up 27.2%.

The poor performance of clean energy stocks in 2021 was largely due to the bursting of a clean energy bubble which formed in the second half of 2020 fueled by speculation...

Restarting 10 Clean Energy Stocks Series

By Tom Konrad, Ph.D., CFA

With the launch of my (green dividend income focused) hedge fund early this year, I had to take a hiatus from publishing my annual list of 10 Clean Energy Stocks that I feel will do well in the coming year. Since my duty to clients takes precedence over readers, I could not tell people about stocks I liked before buying them for the fund.

As we complete the first half of the year, the fund is now largely invested, although I am still keeping some buying power back in anticipation that the overall market could easily...

Ten Clean Energy Stocks For 2019

by Tom Konrad Ph.D., CFA

Looking forward to 2019, I'm more optimistic than I have been since the start of 2016, in the wake of the popping of the YieldCo Bubble in late 2015.

The bear market that started in late 2018 seems like it's far from over, but I expect in early 2019 will see it enter a less chaotic phase. After the wild declines and swings of late 2018, I expect investors will begin the new year with an eye to safety more than growth. This means that the clean energy income stocks which are my focus should outperform...

Ten Clean Energy Stocks for 2021: The List

by Tom Konrad, Ph.D., CFA

An annual tradition, here is my Ten Clean Energy Stocks for 2021, which is also the new model portfolio for the year, with equal dollar values of each stock using closing prices on 12/29/2020.

Returning Stocks

Mix Telematics (MIXT)

Green Plains Partners (GPP)

Covanta Holding (CVA)

Red Electrica (REE.MC, RDEIF, RDEIY)

Valeo, SA (FR.PA, VLEEF, VLEEY)

Veolia (VIE.PA, VEOEF, VEOEY)

New Stocks

Scorpio Bulkers, Inc. (SALT) - Dry bulk shipper converting to offshore wind construction. Thanks to Thad Curtz for bringing my attention to this one.

Brookfield Renewable Energy Partners (BEP) - A leading clean energy Yieldco...

Will McConnell Kill The Bull Market?

By Tom Konrad, Ph.D., CFA

The risks of playing politics

The American news media often tries too hard to be “balanced” when talking about politics.

Depending on which news sources you rely on, you may be hearing that “congress” is having trouble passing bills to fund the government and raise the debt ceiling. More partisan sources will be blaming it on the Democrats or the Republicans, depending on their political bent.

I generally consider myself an independent who cares deeply about the environment and competent government. Since the rise of Donald Trump, the Republicans have shifted from being the party of big business...

Ten Clean Energy Stocks For 2018: Stormy Winter

Tom Konrad Ph.D., CFA

While the broad market has been turbulent for the start of 2018, clean energy stocks have fared worse than most. The Trump administration's anti-environmental efforts had little effect on clean energy stocks in 2017 (it was a banner year for this model portfolio). So far, this year has been quite different. Last year, investors seemed unfazed by the chaos in Washington, but with the single "win" of the Republican tax give-away to corporations, investors now seem to think that Trump may indeed be able to deliver on his polluter-funded agenda.

Income-oriented stocks have also been taking a...

10 Clean Energy Stocks Performance Chart

Here's the performance through August for the 10 Clean Energy Stocks for 2021 model portfolio... The market has turned down a bit since then but the relative performance has not changed significantly. The model portfolio is still well ahead of its benchmarks., both clean energy (RNRG) and broad market (SDY).I don't know if this recent downturn is just a blip, or the start of the possible larger decline I've been worrying about. But I'm prepared if it's the latter.

DISCLOSURE: Long positions all the stocks in the model portfolio.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of...

10 Clean Energy Stocks for 2021: Diversification

by Tom Konrad, Ph.D., CFA

Rounding out the discussion of the stocks in my 10 Clean Energy Stocks for 2021 list are the two that don’t fit either of the themes I highlighted for 2021: Picks and Shovels or a Possible Yieldco Boom. Both help with diversification, both in terms of their industry and geography.

MiX Telematics (MIXT) was retained from the Ten Clean Energy Stocks for 2020 list because I expect its prospects to improve rapidly as the world comes out of covid lockdowns. The global vehicle telematics provider has a large number of its customers among mass transit, logistics,...

Ten Clean Energy Stocks For 2017: Fall Forward

Tom Konrad Ph.D., CFA

Yieldco Buyouts

A Canadian Yieldco Invasion sent clean energy stocks running up in October and November. My Ten Clean Energy Stocks model portfolio benefited from the purchase of 25% of Yieldco Atlantica Yield (NASD:ABY) by Canadian utility and renewable power generation conglomerate Algonquin Power and Utilities (TSX:AQN or OTC AQUNF), which was one of my Ten Clean Energy Stocks for 2009.

Rumors had circulated that the Atlantica stake would be purchased by Brookfield (NYSE:BAM) and its Yieldco Brookfield Renewable (NYSE:BEP). If there were discussions, Brookfield must have decided that it had enough on its plate with the recently...

Ten Clean Energy Stocks For 2017: Finessing Trump

Tom Konrad Ph.D., CFA The History of the "10 Clean Energy Stocks" Model Portfolios 2017 will be the ninth year I publish a list of ten clean energy stocks I expect to do well in the coming year. This series has evolved from a simple, off-the-cuff list in 2008, to a full blown model portfolio, with predetermined benchmarks and (mostly) monthly updates on performance and significant news for the 10 stocks. While there is much overlap between the model portfolio and my own holdings (both personal and in the Green Global Equity Income Portfolio (GGEIP),...

Earnings Roundup: Metals Prices Boost Covanta and Umicore

By Tom Konrad, Ph.D., CFA

You don’t have to own mining companies to benefit from rising metals prices.

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. Waste to energy operator Covanta and specialty metals recycler Umicore are both benefiting from skyrocketing metals prices.

Just as renewable energy and energy efficiency stocks have long shown that investors don’t have to own fossil fuel companies to benefit from rising prices of fossil fuels, recyclers like Covanta and Umicore are showing that you don’t have to own environmentally damaging mining companies to benefit from rising...