Ten Green Energy Gambles for 2010: Update I

Tom Konrad, CFA A quick update of last month's list of speculative puts, to reflect the new options symbols. In January, I put together a list of nine puts and one small energy efficiency stock I expect to do well this year. I normally only do updates on these every quarter, but because of the recent change option symbols, I thought I'd revisit my 10 Green Energy Gambles. The links in the original article have stopped working; this new table shows the current list. Here's the list: with updated option symbols. Security Portfolio...

Ten Clean Energy Stocks for 2012: 10% more than other top-10 lists

Tom Konrad. CFA A "bonus" stock pick this year. Also, notes on New Flyer Industries and Finavera Wind Energy. Maybe it was because Seeking Alpha did not carry my annual list of 10 Clean Energy Stocks for 2012 this year, but no one seems to have noticed that there were actually 11 stocks in the list. Call it the Spinal Tap of top-ten lists. If anyone did notice the extra pick, they didn't leave a comment. What happened was that I have two number 8 stocks, but there is enough text...

The Pros Pick 14 Cleantech Stocks for 2014

Tom Konrad CFA Over the last few weeks, I’ve brought you articles about the top Cleantech stock picks for 2014 from my panel of Cleantech money manager. This article puts them all in one place. Disclosure: I am long MIXT, ACCEL, SBS, and HASI. Originally, there were twelve picks. Then, a mis-communication with Rafael Coven, Managing Director at the Cleantech Group, and manager of the index which underlies the Powershares Cleantech ETF (NYSE:PZD) had me listing two more stocks he likes. Through a happy coincidence, that brings the total picks...

11 Clean Energy Stocks for 2012: Quick Update

Tom Konrad CFA Experimenting with more frequent updates In the past, I genrally only wrote about my annual list of ten clean energy stocks on a quarterly basis, but when I wrote last month to apolgize for inadvertently slipping in an extra stock, and in the process wrote a few notes on a couple of the stocks with news, a couple readers wrote to say they liked the more frequent updates. So let it be written, so let it be done. Leave a comment if you think it's something I should continue doing,...

High Income Green Investing For Small Investors

Tom Konrad Ph.D., CFA Until recently, green income investing was an oxymoron. Most companies people think of as green (think Tesla Motors (TSLA) or First Solar (FSLR)) are relatively new companies that are investing all of their profits (such as they are) back into the business. Meanwhile traditional income sectors like utilities, oil and gas, and coal mining are deeply tied into fossil fuels. Real Estate Income Trusts (REITs) are the sole exception. A REIT is as green as the property it owns, and a few such companies are real leaders in sustainable buildings......

Veolia Cleaning Up Balance Sheet

Tom Konrad CFA On Thursday, Veolia Environnement (NYSE:VE) closed a deal to sell its solid waste business for $1.9 billion. This is part of its ongoing effort to reduce debt and cost of operations by selling assets worth $6.14 billion, which the company expects to complete by the end of 2013. Last year, Veolia took the first step in this program by selling its UK water business, also for $1.9 billion. I’ve long been attracted to Veolia for its green credentials and high dividend yield. The company paid a euro 0.70 ($0.85) dividend in 2012,...

Shares in Energy Conversion Devices Purchased

Energy Conversion Devices Inc (ENER) opened up trading this morning with a gap down to the $33 level. For the last hour it has been steadily rising up from this point. As I said in my earlier post, I have been looking for a good entry point in this company and feel that the near term support of $33 is an ideal area to place an order. The stock has been on a run for several months and it is always hard to take a new position in a stock that has already seen dramatic increases...

My Portfolio’s Latest Casualty And Addition

The Casualty Last Monday, I discussed how I had recently reviewed Railpower Tech with a view to potentially adding to my position on grounds that: (a) the company had a fair amount of cash in the bank, which reduced the need to go to capital markets for financing for a while; and (b) that it was getting badly battered by general market conditions, potentially offering an attractive entry point. Although my portfolio has taken a beating in recent weeks, I remain ready to take small positions in stocks if I feel they are being unfairly bashed, including in...

10 Clean Energy Stocks Performance Chart

Here's the performance through August for the 10 Clean Energy Stocks for 2021 model portfolio... The market has turned down a bit since then but the relative performance has not changed significantly. The model portfolio is still well ahead of its benchmarks., both clean energy (RNRG) and broad market (SDY).I don't know if this recent downturn is just a blip, or the start of the possible larger decline I've been worrying about. But I'm prepared if it's the latter.

DISCLOSURE: Long positions all the stocks in the model portfolio.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of...

Ten Green Energy Gambles for 2010: Q2 Update

Tom Konrad CFA My speculative green gambles still have chips, but the mild decline of the stock market so far this year is not enough to make them really pay off, yet. In January, I brought readers a collection of nine bearish puts on non-green companies and ETFs and one tiny energy efficiency company with a chance of taking off big before the end of the year. They considered of bets against three fossil energy companies, four travel and leisure stocks, a Mexico ETF , a Trucking company (JB Hunt ), and a long bet on Power...

Ten Clean Energy Stocks For 2014: September Update and Thoughts on the Finavera Deal

Tom Konrad CFA Clean energy stocks and the market in general rebounded strongly in August. My broad market benchmark of small cap stocks, IWM, rose 4.5%, returning to positive territory up 1.7% for the year. My clean energy benchmark PBW also jumped back into the black with an 11.1% gain for the month and 10.8% for the year to date. The less volatile defensive stocks in my 10 Clean Energy Stocks for 2014 model portfolio rose 1.9%. For the year to...

Clean Energy Tracking Portfolio Update: Oops!

My Quick Clean Energy Tracking Portfolio has solidly outperformed its benchmark... was it bad design? Tom Konrad, Ph.D. On February 27, I used the top holdings of the (then six) clean energy mutual funds to design a tracking portfolio intended to replicate the performance of those funds at much lower cost. If my methodology was sound, the tracking portfolio should produce returns within the range of returns of the mutual funds on which it was based. If all went well, the returns would be at the upper end of that range because of the way I chose to emphasize...

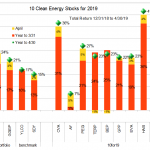

Ten Clean Energy Stocks For 2019: April Ascent

In April, my 10 clean energy stocks model portfolio continued to power ahead, despite the concerns about market valuation I expressed last month. As I said at the time "me being nervous about the market is not much of an indicator that stocks are going to fall" at least in the short term. So I continue to trim winning positions and increase my allocation to cash as stocks advance.

Both the model portfolio and the Green Global Equity Income Portfolio (GGEIP) were up 4.5% and 3.6% respectively in April. This was solidly ahead of their clean energy income benchmark YLCO...

The Four Best Peak Oil Investments

Tom Konrad CFA The best four stocks I've found in my six month quest to find the best peak oil investments. I apologize for being a tease. Since March, I've been writing this series I've called "The Best Peak Oil Investments," but in many cases what I've actually done is to warn readers to stay away from particular sectors. This bait-and-switch was compounded for my syndicated readers at Seeking Alpha when their editors decided to re-title the early articles in this series "Peak Oil Investments I'm Putting My Money On." If you've stuck...

Performance Update: 10 Clean Energy Stocks for 2009

I promised I'd do a performance update on my 10 Clean Energy Stocks for 2009 each quarter. Here is the first (although readers got a mini-update in mid February, because I decided I didn't want to use double-shorts.) Company Ticker Change 12/27/08 to 3/27/09 Dividend & Interest The Algonquin Power Income Trust AGQNF.PK +7.14% 5.36% Cree, Inc. CREE +59.96% First Trust Global Wind Energy ETF FAN -10.73% General Electric GE -32.50% 1.94% Johnson Controls JCI -25.97% 0.77% New Flyer...

Ten Clean Energy Stocks For 2015: Riding The Storm

Tom Konrad CFA The first half of 2015 saw a mild advance in the broad market, but concerns about rising interest rates and the ongoing Greek debt drama sent income stocks, clean energy, and most non-US currencies down decisively. My Ten Clean Energy Stocks for 2015 model portfolio has heavy exposure to not only clean energy, but income stocks (6 out of 10) and foreign stocks (4 out of 10.) Despite this the stormy market for all three, the portfolio delivered admirably. The model portfolio ended the second quarter up 9.7%, compared to its broad market...