Tag: GPRE

Earnings Roundup: Covanta, NFI Group, Green Plains Partners

by Tom Konrad, Ph.D., CFA

Earnings Season Continues

Below are three more updates on second quarter earnings which I've been sharing with my Patreon supporters. If you'd like to support my writing and see those thoughts in a more timely manner, consider becoming a patron. becoming a patron.

For everyone else, I'm reprinting those thoughts below.

Covanta Earnings

(published August 2nd)

Waste to energy company Covanta Holding Corp (CVA) saw most of its business recovering towards the end of the second quarter. Management is reluctant to predict if the positive trend will continue into the third quarter and for the rest of the year, but...

Covanta and Green Plains Partners Don’t Let A Crisis Go To Waste

by Tom Konrad, Ph.D., CFA

Last week, two of the stocks in my Ten Clean Energy Stocks model portfolio cut their dividends. Covanta Holding Corp (CVA) dropped its quarterly payout from $0.25 to $0.08 (a 68% cut) while Green Plains Partners (GPP) slashed its quarterly distribution from $0.475 to $0.12, a drop of 74.75%.

Before reducing their dividends, both companies had payout ratios near 100%, meaning that substantially all of their free cash flow was going to pay dividends. In general, companies are very reluctant to cut their dividends because it is a signal that their management thinks they cannot grow...

Hand Sanitizer: Salvation for Ethanol Producers?

by Jim Lane

If you’ve not heard, NuGenTec is looking for Distillers to help supply Ethanol for Hand Sanitizers in California! We have two automated bottling lines waiting for ethanol to produce 8oz and 16oz gel type hand sanitizers, they write. You can learn more here.

And as we reported this morning, Aemetis (AMTX) is one of those companies jumping into the market, even as transport fuel demand falls off, driving fuel ethanol prices into an all-time low range of around $0.70 per gallon.

The shortage is real

If you’ve been trying to buy hand-sanitizer, it’s been hard to find. Here in Digestville, we’ve...

Ten Clean Energy Stocks for 2020: Navigating the Storm

by Tom Konrad, Ph.D., CFA

This monthly update for my Ten Clean Energy Stocks model portfolio is in two parts. I published my thoughts on the current market turmoil on March 2nd. You can find them here. I'm not even going to get into the Fed slashing interest rates like they were a furniture warehouse going out of business on March 3rd except to say that apparently they are more afraid of the effects of covid-19 on the economy than they are of appearing to panic.

You can see overall performance for January and February in the following chart. Not that...

Green Plains’ Cattle Drive

As quickly as the ethanol producer jumped into the cattle business, Green Plains (GPRE: Nasdaq) has sold off half of its Green Plains Cattle Company to a group of investment funds for $77 million. Operating at six locations in Colorado, Kansas, Texas and Missouri, the company has the capacity to feed 355,000 head of cattle each year. The cattle business contributed $271 million to total revenue in the most recently reported quarter ending June 2019, delivering a modest operating profit near $7.3 million.

There has been considerable stress in the feed cattle industry. The number of cattle in feedlots is down compared to last year, an unusual development...

Living Endangeredly- Q2 Biobased Earnings Roundup

by Jim Lane

In hand we now have the latest earnings reports from what you might call the 8 Pathfinders – eight publicly traded stocks whose second quarter results offer insights into the health and performance of the advanced bioeconomy as 2019 heads towards its closing crescendos.

Our 8 Pathfinders – In the world of global renewable diesel at scale, Neste (Neste.HE); pure-play enzymes, Novozymes (NVMB); In pharma and synbio, Codexis (CDXS); as a hybrid play in advanced fuels, Aemetis (AMTX); in advanced marine and jet fuels, Gevo (GEVO); for biodiesel and hydrocarbons, Renewable Energy Group (REGI); in advanced began foods,...

Trump Takes Down Ethanol in Pincer Move

by Debra Fiakas, CFA

The Trump Administration is using tariffs on China goods as a trade war tactic to pressure China into relenting to U.S. trade policy demands. Unfortunately, the fallout has been heavy and widespread. Farmers have taken the heaviest hits as China has dropped orders for corn and soybeans. Ethanol producers have been ensnared in the trade war skirmish as well and in recent weeks have been caught an uncomfortable ‘pincer-like’ squeeze by the Trump Administration.

Trump’s Environmental Protection Agency has continued its practice of granting waivers to oil and gas refiners, eliminating the requirement to blend biofuel with the refiners’ petroleum...

ADM Separates Ethanol Business

Prelude to a spin-off?

by Jim Lane

The Archer Daniels Midland Company (ADM) is breaking news of breaking off their ethanol unit…and a tumbling 40% decline in profit.

In Chicago, Archer Daniels Midland Company reported their financial results for the quarter ended March 31, 2019, but most interesting to us, they are looking at separating their ethanol business with the option of spinning it off completely. They are also taking other actions to restructure and deal with challenges they say include weather issues and trade pressures.

ADM announced a “series of measures to continue to underpin long-term-value creation” which included:

“First, to meet growing customer...

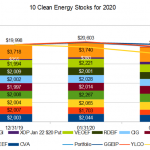

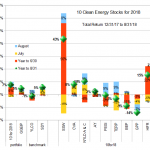

Ten Clean Energy Stocks For 2018: Second Quarter Earnings

Tom Konrad Ph.D., CFA

July and August saw some mild recovery for the stock market after a difficult first half of 2018. Clean energy income stocks continue to lag the broader market, but my Ten Clean Energy Stocks model portfolio has managed to maintain its lead over its broad market benchmark.

Through August 31st, the model portfolio is up 7.5%, compared to its broad dividend income benchmark SDY, which is up 5.3%. Its clean energy income benchmark YLCO is down 1.2, even after dividend income. The private portfolio I manage, the Green Global Equity Income Portfolio (GGEIP), is slightly behind the...

More Than Ethanol at Green Plains

Last week ethanol producer Green Plains (GPRE: Nasdaq) reported financial results for the quarter ending June 2018. As expected the company reported a net loss, but actual results were far better than expected. The news gave traders a reason to celebrate with bids that led to a gap higher at the opening on the first day of trading following the announcement. Cooler heads came into the market as the day wore on and the stock closed below the open on heavy volume. Nonetheless, the stock finished the week higher and appears prepared to challenge lines of volume-related price resistance in the trading sessions ahead.

There may...

A Simple Fix To Farmer’s Tariff Woes?

by Jim Lane

As most know by now, the US and China have fired opening salvos in a trade war, with the US targeting a range of commodities including steel and aluminum, and China retaliating with, to date, stiff tariffs on a range of agricultural products, but primarily hitting soybeans and corn because of the volume of trade in those agricultural goods. Overall, China imports $24 billion of agricultural goods from the US and is a leading export market for the US.

The trade wars prompted North Dakota farmer Kevin Skunes, president of the National Corn Growers Association, to state:

“Farmers are...

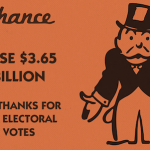

Did Trump’s EPA Cost Corn Growers $3.65 Billion In 2017?

by Jim LaneIn Washington, new evidence has appeared that a Trump Administration shift on US low carbon fuel policy may have cost US corn growers an estimated $3.65 billion.

The mechanism? A secretive effort by Administration officials installed at the US Environmental Protection Agency that destroyed an estimated 1.37 billion gallons of annual demand for low-carbon renewable fuels, in favor of fossil fuels.

Officials at the agency exploited a loophole in US low carbon fuel legislation that allows small oil refineries to gain hardship waivers in cases of severe distress from complying in full with US low carbon fuel laws. Now, evidence...

EPA Administrator Scott Pruitt Resigns

by Jim Lane

In Washington, EPA Administrator Scott Pruitt has resigned.

US President Donald Trump announced the exit on Twitter, commenting, “President Donald Trump announced Pruitt’s exit, saying on Twitter “I have accepted the resignation of Scott Pruitt as the Administrator of the Environmental Protection Agency. Within the Agency Scott has done an outstanding job, and I will always be thankful to him for this.”

Deputy Administrator Andrew Wheeler becomes acting administrator.

The Digest’s Take

Elsewhere in the media, it is widely reported that Pruitt was undone by a growing number of controversies and investigations relating to his conduct as EPA Administrator, particularly relating...

List of Ethanol Stoccks

This Post was updated on 8/16/21.

Ethanol stocks are publicly traded companies whose business involves producing ethanol alcohol (C2H5OH) made from biomass for use as a fuel in gasoline blends. Common feedstocks include corn and sugar cane. Ethanol is the most widely produced and used biofuel, and all ethanol stocks are also biofuel stocks.

Aemetis, Inc. (AMTX)

Andersons Inc (ANDE)

Archer Daniels Midland (ADM)

Bluefire Renewables (BFRE)

Cosan Ltd (CZZ)

Green Plains Partners LP (GPP)

Green Plains Renewable Energy (GPRE)

MGP Ingredients (MGPI)

Pacific Ethanol (PEIX)

Raízen S.A. (RAIZ4.SA)

REX American Resources Corp. (REX)

SunOpta (STKL)

If you know of any ethanol stock that is not listed here and should be, please let us know...

Novozymes Ignites Yeast Wars

Novozymes (Copenhagen:NZYM-B; OTC:NVZMY) moved into yeast this week with a new organism, Innova Drive.

It’s saccharomyces cerevisae — the workhouse yeast that has been powering wine fermentation since the days of Noah and the Ark. But here’s a new strain engineered to cut fermentation times up to two hours, and yield boosts of up to two percent.

A 2% yield increase and a 5% faster rate of production — let’s illustrate it — would mean something like 7.1 million gallons per year of more ethanol from the same standard 100 million gallon nameplate plant. Retailing at up to $10 million dollars, per year (yes,...

Green Plains to Adopt Syngenta’s Enogen Corn Ethanol Tech Across Fleet

by Jim LaneGood news arrives from Minnesota that Syngenta has partnered with Green Plains (GPRE) to expand its use of Enogen corn enzyme technology across GPRE’s 1.5 billion gallon production platform.

The Enogen backstory

Enogen corn enzyme technology is an in-seed innovation available exclusively from Syngenta and features the first biotech corn output trait designed specifically to enhance ethanol production. Using modern biotechnology to deliver best-in-class alpha amylase enzyme directly in the grain, Enogen corn eliminates the need to add liquid alpha amylase and creates a win-win-win scenario by adding value for ethanol plants, corn growers and rural communities.

We reported in January that Syngenta had reached...