Six More Clean Energy Stocks for 2013

Tom Konrad CFA This article is intended as a companion piece to Ten Clean Energy Stocks for 2012. In the past, I've generally avoided illiquid stocks like Lime Energy (NASD:LIME) and PFB Corporation (TSX:PFB, OTC:PFBOF) which are included in this year's list. The reason is simple: it's hard for all but the smallest investors to buy such stocks without significantly moving the price. This year, I've instead chosen to publish a short list of alternative picks which readers can substitute for stocks they consider too illiquid or otherwise risky for their portfolio. Another advantage...

The Pros’ Clean Energy Picks: Solar Dominates, Emerging Markets Drag

I check in with professional green money managers Shawn Kravetz, Garvin Jabush, Jan Schalkwijk, and Rafael Coven to see how their fourteen top picks for 2014 are doing.

10 Clean Energy Stocks for 2020: Updated Model Portfolio

by Tom Konrad, Ph.D., CFA

After a couple down market days, all the limit orders I listed on Monday have executed.

Here is the current portfolio:

Position

Shares

Position

Shares

CVA

135

CIG

587

CVA Mar21 $7.50 Put

-2

RDEIF

100

VLEEF

57

VEOEF

75

GPP

276

EBAY Jan ‘21 $8 Put

-1

NFYEF

98

Cash

$4415

MIXT

274

Coming Up:

Third quarter earnings season is starting… I plan to write short notes on earnings as they come out for my Patreon supporters, which will be compiled into longer articles on AltEnergyStocks.com a few days later.

Also, I’m doing a talk on how to divest from fossil fuels with the founder of divestor.org this coming Monday at 8:30 pm ET for the Climate and Health subgroup of Citizens Climate Lobby ...

Energy Conversion Devices (NASDAQ:ENER): Jefferies Vs. Cramer

Two different opinions on Energy Conversion Devices came out last Thursday (Jan. 11). Analyst Jeffrey W. Bencik at Jefferies & Co said that ENER was one his top 2 picks in the solar industry for '07, opining that despite continued volatility this should be a rewarding year for ENER investors. He believes that attention will "shift from company specific performance to a top down focus on the evolution of solar incentive schemes." Jim Cramer, on Thursday's Mad Money, said he could not, "in good conscience, recommend that stock with oil at $51, going to $49. So,...

Ten Clean Energy Stocks For 2014: September Swoon

Tom Konrad CFA Worries including the conflict with ISIL, Ebola, and economic slow-down in Europe, sent the stock market down in the month to October 3rd, with small cap stocks and clean energy stocks falling even farther than the large cap S&P 500. My 10 Clean Energy Stocks for 2014 model portfolio weathered the storm relatively well because of its emphasis on defensive and income stocks. Since the last update, the model portfolio was down 4.8%,...

Shares of IDA Corp. Purchased

The fears of Rita have fallen away and the market is finally moving to the upside again this morning. I have been watching IdaTech (IDA) for purchase for a couple of weeks and I had previously mentioned I have been looking for a good entry point on this stock. IDAcorp is an Idaho power utility with electrical generation using Hydro, Natural Gas, and Coal. They also own IDATech which manufactures fuel cell solutions. I'm waiting on this one until the technical picture of the chart improves. I would be a buyer if we can either get...

Q3 Performance Update: Ten Green Energy Gambles for 2009

Tom Konrad, CFA I never thought 2009 would be a good year for risky stocks, but my readers asked for them anyway. The market's strong third quarter have paid off for risk-takers who gambled on my 10 Green Energy Gambles for 2009. I started out the year by providing readers with a portfolio of ten relatively conservative plays on green energy. That portfolio was representative of how I planned to approach the market this year, and has produced stronger returns and less volatility when compared to both green energy stocks and the market as a whole. Many of my...

January Performance: 10 Clean Energy Stocks for 2021

You can find the original list here. I'll be doing commentary on individual stocks as there is news. The first of these is on MiX Telematics (MIXT) earnings, first published for my Patreon subscribers on January 28th and copied below. A note on Scorpio Bulkers (SALT) from February first will be published here tomorrow.

MiX Earnings

MiX Telematics (MIXT) reported earnings this morning . The numbers showed improvement over the previous quarter, but a decline over the previous year due to the covid crisis which was exacerbated by the strengthening dollar.

The results were pretty much what I expected when I added...

10 Clean Energy Stocks for 2020: June Update

by Tom Konrad, Ph.D., CFA

The coronavirus pandemic no longer has the United States by its financial center throat, the New York City area, but is instead is now gnawing ravenously at its arms and legs. In June, the stock market seems to be just starting to get a clue that this is also a bad thing, leading to a month of volatility and general consolidation.

Europe, in a display of relative competence, has been much more effective than the US at getting the pandemic beast under control, and so investors looking for safe havens might do well to look there. ...

Ten Clean Energy Stocks for 2010

Tom Konrad, CFA A mini-portfolio of stocks that not only are green, but should outperform the market in an environment of increasing concern about climate change and peak oil. This is the third annual list of green stocks I have published. In 2008, it was a list of ten speculative alternative energy companies (in three parts) that I thought might catch public notice that year. As we all now know, 2008 was a horrible year for speculative stocks, and my stocks were no exception, losing an average of 55% that year, although that still ended up being better than...

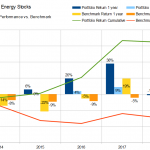

Ten Clean Energy Stocks For 2018: Wrap Up

by Tom Konrad Ph.D., CFA

Almost every major index fell in 2018. My Ten Clean Energy Stocks model portfolio and the Green Global Equity Income Portfolio (GGEIP), the real-money portfolio that I manage were not exceptions. Still, I'm satisfied with their performance: the model portfolio lost only 1.3 percent for the year, while GGEIP was down 2.6 percent. That's well ahead of most indexes, including my benchmarks YLCO (down 7.8 percent) and SDY (down 4.1%.) These benchmarks are intended to reflect the performance of clean energy dividend stocks and general of dividend stocks, respectively. Non-income oriented indexes such as the...

Two Canadian IPPs For Your Portfolio

Most alternative energy investors are aware of North American wind power's very bright growth prospects. In past articles, we discussed encouraging projections for the US and Canadian (PDF document) wind markets between now and 2015. While onshore European capacity is fast being exhausted, North America is only beginning its foray into wind and some major capex can be expected in this space over the coming years. Besides solid expected growth, another phenomenon is currently impacting the wind industry; consolidation. This is a global movement that is affecting all of the power gen sector, and that has no-doubt been...

Ten Clean Energy Stocks for 2013: January Update

Tom Konrad CFA Clip art by Philip Martin January has been a great month for clean energy stocks, and the stock market as a whole. My clean energy benchmark, the Powershares Wilderhill Clean Energy Index (PBW), returned 10.9%, while the broad universe of small cap stocks which I benchmark with the iShares Russell 2000 Index ETF (IWM) is up a lesser but still impressive 9.5%. My ten clean energy picks for 2013 (introduced here), are up a...

The Pros Pick Two (Correction:Four) Offbeat Cleantech Stocks for 2014

Tom Konrad CFA Green 2014 image via BigStock Among the dozen stocks picked by my panel of professional green money managers for 2014, most followed three themes: Solar stocks, IT stocks, and income stocks. Two didn’t, and they are included here. This Cash-Rich Water Company Could Produce a Big Dividend The first is a Japanese water utility, picked by Rafael Coven, the Managing Director at the Cleantech Group, and manager of the Cleantech index (^CTIUS) which underlies the Powershares Cleantech ETF (NYSE:PZD.) Coven likes...

Shares of Capstone Rising

Shares of Capstone Turbine Corp (CPTC) are rising sharply this morning with high volume and gapped up with a gain of over 35% this morning. There is currently no news to cause this increase today and I will be digging deeper to find out what is going on. This is good news for the stock and also the portfolio. My holdings are now up over 50% in about 10 days. If you were thinking of buying the stock now, you should wait till some news confirms this move. Update at 12:15 EST: The only news I can...

Ten Clean Energy Stocks For 2014

A list of ten high yield and value clean and alternative energy stocks expected to do well in 2014.