Veolia Cleaning Up Balance Sheet

Tom Konrad CFA On Thursday, Veolia Environnement (NYSE:VE) closed a deal to sell its solid waste business for $1.9 billion. This is part of its ongoing effort to reduce debt and cost of operations by selling assets worth $6.14 billion, which the company expects to complete by the end of 2013. Last year, Veolia took the first step in this program by selling its UK water business, also for $1.9 billion. I’ve long been attracted to Veolia for its green credentials and high dividend yield. The company paid a euro 0.70 ($0.85) dividend in 2012,...

Four Picks and Shovels Stocks

by Tom Konrad, Ph.D., CFA

The last three months of 2020 brought an explosion in clean energy stock prices.

Solar stocks (as measured by the Invesco Solar ETF (TAN), nearly tripled. So did the Invesco Wilderhill Clean Energy ETF (PBW), which includes a broader spectrum of companies. Wind stock rose 61%, and even the relatively sedate Yieldcos were up 32%. The stars of the last half of 2020 was undoubtedly Tesla (TSLA, up 246%) and other electric vehicle stocks.

Money Flows Out of Fossil Fuels and Into Clean Energy

I believe that the cause of the current rise in stock prices is largely...

Ten Clean Energy Stocks For 2018: Stormy Winter

Tom Konrad Ph.D., CFA

While the broad market has been turbulent for the start of 2018, clean energy stocks have fared worse than most. The Trump administration's anti-environmental efforts had little effect on clean energy stocks in 2017 (it was a banner year for this model portfolio). So far, this year has been quite different. Last year, investors seemed unfazed by the chaos in Washington, but with the single "win" of the Republican tax give-away to corporations, investors now seem to think that Trump may indeed be able to deliver on his polluter-funded agenda.

Income-oriented stocks have also been taking a...

Buying Lime and Finavera (11 Clean Energy Stocks for 2012)

Tom Konrad CFA Portfolio performance March was a volatile month for clean energy, with many of my picks reporting earnings. My 11 picks were down 4% on average since my last update (March 1st to April 5th), compared to a 9% decline in the Powershares Wilderhill Clean Energy Index (PBW), while the broad Russell 2000 index was flat. The hedged portfolio (see the original article for details) lost 5%. For the year to date, the portfolio has put in a strong performance, and is up 15%. PBW and the Russell 2000 are up only 3%...

Ten Clean Energy Stocks for 2013: First Half Review

Tom Konrad CFA I missed my regular monthly update on my Ten Clean Energy Stocks for 2013 model portfolio last month, and a lot has happened to the individual companies since. Because of this, I will split this semiannual update in two parts. This part will look at the performance of the portfolio as a whole, and the reasons it's lagging its benchmarks. The next part will look at the news driving the performance of specific stocks. Since the last update on May 5th, my portfolio has advanced 3.0% for a 10.5% return for the first...

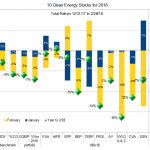

Ten Green Energy Gambles for 2010: Update I

Tom Konrad, CFA A quick update of last month's list of speculative puts, to reflect the new options symbols. In January, I put together a list of nine puts and one small energy efficiency stock I expect to do well this year. I normally only do updates on these every quarter, but because of the recent change option symbols, I thought I'd revisit my 10 Green Energy Gambles. The links in the original article have stopped working; this new table shows the current list. Here's the list: with updated option symbols. Security Portfolio...

Ten Clean Energy Stocks For 2014: Out With The Old

Tom Konrad CFA Plummeting oil prices, global economic weakness, and the Republicans' win in the US midterms have delivered a triple-whammy to clean energy stocks over the last few months. Many of the stock declines are justified more by headlines than fundamentals. My 10 Clean Energy Stocks for 2014 model portfolio has suffered, especially the riskier growth stocks. The strong dollar has been a further drag on the six foreign stocks. Since the last update at the start of October, the model portfolio is down 4.6%, for a loss since its December 27th,...

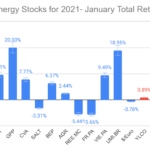

January Performance: 10 Clean Energy Stocks for 2021

You can find the original list here. I'll be doing commentary on individual stocks as there is news. The first of these is on MiX Telematics (MIXT) earnings, first published for my Patreon subscribers on January 28th and copied below. A note on Scorpio Bulkers (SALT) from February first will be published here tomorrow.

MiX Earnings

MiX Telematics (MIXT) reported earnings this morning . The numbers showed improvement over the previous quarter, but a decline over the previous year due to the covid crisis which was exacerbated by the strengthening dollar.

The results were pretty much what I expected when I added...

10 Clean Energy Stocks Performance Chart

Here's the performance through August for the 10 Clean Energy Stocks for 2021 model portfolio... The market has turned down a bit since then but the relative performance has not changed significantly. The model portfolio is still well ahead of its benchmarks., both clean energy (RNRG) and broad market (SDY).I don't know if this recent downturn is just a blip, or the start of the possible larger decline I've been worrying about. But I'm prepared if it's the latter.

DISCLOSURE: Long positions all the stocks in the model portfolio.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of...

Shares of IDA Corp. Purchased

The fears of Rita have fallen away and the market is finally moving to the upside again this morning. I have been watching IdaTech (IDA) for purchase for a couple of weeks and I had previously mentioned I have been looking for a good entry point on this stock. IDAcorp is an Idaho power utility with electrical generation using Hydro, Natural Gas, and Coal. They also own IDATech which manufactures fuel cell solutions. I'm waiting on this one until the technical picture of the chart improves. I would be a buyer if we can either get...

Ten Clean Energy Stocks For 2019

by Tom Konrad Ph.D., CFA

Looking forward to 2019, I'm more optimistic than I have been since the start of 2016, in the wake of the popping of the YieldCo Bubble in late 2015.

The bear market that started in late 2018 seems like it's far from over, but I expect in early 2019 will see it enter a less chaotic phase. After the wild declines and swings of late 2018, I expect investors will begin the new year with an eye to safety more than growth. This means that the clean energy income stocks which are my focus should outperform...

Performance Update: 10 Solid Clean Energy Companies to Buy on the Cheap

Unlike my Ten Speculations for 2008, my Solid Clean Energy Companies series will be much more difficult to benchmark. The intent of the series was to list some "stocks to buy when you think we've hit bottom." Since I obviously don't know when you think we've hit bottom (My opinion: not yet), I don't know what prices you'd have paid. Instead, I'll look at what would have happened if you bought only those stocks which dropped 10% since I wrote about them, and you bought them at the close that day, in equal dollar amounts. Here's...

The Pros Pick 14 Cleantech Stocks for 2014

Tom Konrad CFA Over the last few weeks, I’ve brought you articles about the top Cleantech stock picks for 2014 from my panel of Cleantech money manager. This article puts them all in one place. Disclosure: I am long MIXT, ACCEL, SBS, and HASI. Originally, there were twelve picks. Then, a mis-communication with Rafael Coven, Managing Director at the Cleantech Group, and manager of the index which underlies the Powershares Cleantech ETF (NYSE:PZD) had me listing two more stocks he likes. Through a happy coincidence, that brings the total picks...

Ten Clean Energy Stocks for 2013: January Update

Tom Konrad CFA Clip art by Philip Martin January has been a great month for clean energy stocks, and the stock market as a whole. My clean energy benchmark, the Powershares Wilderhill Clean Energy Index (PBW), returned 10.9%, while the broad universe of small cap stocks which I benchmark with the iShares Russell 2000 Index ETF (IWM) is up a lesser but still impressive 9.5%. My ten clean energy picks for 2013 (introduced here), are up a...

Shares of Capstone Rising

Shares of Capstone Turbine Corp (CPTC) are rising sharply this morning with high volume and gapped up with a gain of over 35% this morning. There is currently no news to cause this increase today and I will be digging deeper to find out what is going on. This is good news for the stock and also the portfolio. My holdings are now up over 50% in about 10 days. If you were thinking of buying the stock now, you should wait till some news confirms this move. Update at 12:15 EST: The only news I can...

Dipping a Toe in the Golden Stuff

And I'm not talking about gold, but I liked the play on this title. Last December, I wrote about a report that claimed that solar stocks were the best play on the cleantech revolution. In that article, I analyzed the two solar ETFs: the Claymore/Mac Global Solar Index ETF (TAN) and the Market Vectors/Van Eck Global Solar Energy ETF (KWT). At the end of the article, I said I had an open buy order on TAN. That buy order expired unfilled in January as the suckers rally progressed, but TAN then dropped to the...