Tag: Hannon Armstrong Sustainable Infrastructure (HASI)

List of Energy Efficiency Stocks

Energy efficiency stocks are publicly traded companies using a wide range of technologies to deliver the same energy services using less energy in the built environment. This includes efficient lighting such as LED lighting stocks, insulation, efficient motors, efficient appliances and appliance replacement services, sensor and control technologies, the internet of things, efficient power conversion and generation, and energy efficient design, construction, and retrofits.

See the list of efficient vehicle stocks and alternative transportation stocks for companies reducing energy used in transportation.

This list was last updated on 7/20/2022.

Acuity Brands(NYSE:AYI)

AIXTRON SE (AIXA.DE)

Ameresco, Inc. (AMRC)

Appliance Recycling Centers of American (ARCI)

Aspen Aerogels, Inc....

List of Environmental Markets Stocks

This post was last updated on 4/27/2022.

Environmental market stocks are publicly traded companies whose business involves the trading of commodities designed to represent an environmental attribute, such as renewable electricity, the environmental benefits of renewable energy (Renewable Energy Credits ), Carbon Offsets and other types of environmental offsets.

Carbon emission trading implemented

Carbon emission trading scheduled

Carbon tax implemented

Carbon tax scheduled

Carbon emission trading or carbon tax under consideration

By Tbap , via Wikimedia Commons

Crius Energy Trust (KWH-UN.TO, CRIUF)

GlyEco, Inc. (GLYE)

Hannon Armstrong Sustainable Infrastructure (HASI)

Just Energy Group Inc. (JE)

KraneShares Global Carbon ETF (KRBN)

Trading Emissions PLC (TRE.L)

If you know of...

Hannon Armstrong Declines to Raise Dividend, Sets 3 Year Guidance

Investors did not like Hannon Armstrong's (NYSE:HASI) fourth quarter earnings announcement last night. While core earnings were a little weaker than expected, that is not what has the stock trading down 11% today. What shocked investors is the fact that the company did not raise the dividend this year for the first time since the REIT went public, and it gave 3 year guidance which likely disappointed many investors.

Last month, I wrote,

I expect that Hannon Armstrong will continue to be a well run and conservative business in 2018, and that management will raise the dividend at the lower end...

See You Later, Hannon Armstrong

by Tom Konrad Ph.D., CFA

Sustainable infrastructure financier Hannon Armstrong (NYSE:HASI) is not in my Ten Clean Energy Stocks model portfolio for the first year since its IPO in 2013. I still love the company and its business model, but I have become concerned about its short term prospects.

Dividend Disappointment?

In my last update on the 2017 portfolio, I wrote,

“Sustainable infrastructure and clean energy financier Hannon Armstrong reported earnings on November 1st. The headline numbers were lower than expected, but for a very good reason. The company has spent the last few months locking in low interest rates by refinancing its...

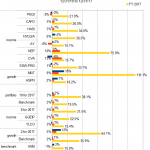

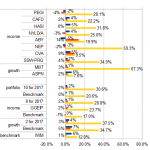

Ten Clean Energy Stocks For 2017: Fall Forward

Tom Konrad Ph.D., CFA

Yieldco Buyouts

A Canadian Yieldco Invasion sent clean energy stocks running up in October and November. My Ten Clean Energy Stocks model portfolio benefited from the purchase of 25% of Yieldco Atlantica Yield (NASD:ABY) by Canadian utility and renewable power generation conglomerate Algonquin Power and Utilities (TSX:AQN or OTC AQUNF), which was one of my Ten Clean Energy Stocks for 2009.

Rumors had circulated that the Atlantica stake would be purchased by Brookfield (NYSE:BAM) and its Yieldco Brookfield Renewable (NYSE:BEP). If there were discussions, Brookfield must have decided that it had enough on its plate with the recently...

Green Asset-Backed Bond From Hannon Armstrong Has Measured GHG Savings

by the Climate Bonds Team Hannon Armstrong’s (HASI) second green ABS, $118.6m, will save 0.39 tons of GHG annually per $1,000! ($100.5m, 4.28%, 19 yr, A and $18.1m, 5.00%, 19 yr, BBB) Hannon Armstrong (NYSE:HASI) closed its second green ABS bond (Sustainable Yield Bond) following its inaugural issuance in December 2013. The ABS was a private placement split into two tranches with different credit ratings (from Kroll Bond Credit Rating Agency): $100.5m with a rating of A and 4.28% interest rate, and $18.1m with a rating of BBB and 5.00% interest rate. Both tranches have a 19-year tenor....

Power REIT: Light At The End Of The Tunnel?

Tom Konrad CFA

It Could Have Been The First Yieldco

Light at the End of the Tunnel photo via BigStock

I first became interested in Power REIT (NYSE MKT:PW) in 2012 because of the company's plans to become what would have been the first US-listed "yieldco," i.e. a clean energy power producer paying a high level of reliable dividends to investors. The company was an infrastructure Real Estate Investment Trust (REIT) with a single asset: its subsidiary, Pittsburgh & West Virginia Railway (P&WV) which owned 122 miles of track leased to Norfolk Southern Corp. (NYSE:NSC), which had in turn subleased the track...

Hannon Armstrong’s Strong Q2 Keeps It In My Top Picks

By Jeff Siegel Hannon Armstrong (NYSE:HASI), one of my top picks for 2014, just made me very happy. Yesterday, the company announced its Q2 Core Earnings of $4.7 million or $0.22 per share. On a GAAP basis, the Company recorded net income of $2.9 million. Here are some other highlights. . . Raised approximately $70 million in April, 2014 in a follow-on offering. Increased the flexibility and expanded the capacity of its existing credit facility by $200 million. Completed more than $200 million worth of transactions, including the acquisition of a $107 million portfolio of land...

No Longer Just Growth: Investing in Renewable Energies for Yield

by Robert Muir Given the determined investor quest for yield as the Federal Reserve maintains the benchmark Federal Funds rate at zero, and the resurgence of attention being paid to alternative energy generation, mainly solar, and to a lesser extent wind and hydro, it’s no wonder Yield Co’s have gained so much investor interest lately. In the near to mid-term, the enthusiasm may be justified. Supported by Power Purchase Agreements, energy infrastructure financing and leasing contracts, and electricity transmission and distribution concessions, all with credit-worthy counter-parties, Yield Co’s are designed specifically to pay out a large portion of...

Obama’s Next $2 Billion For Energy Efficiency: How To Take The Money And Run

By Jeff Siegel It's all about the money. I don't care how you slice it when it comes to investing, personal politics are irrelevant. This has long been how I've approached wealth creation, and it works quite well. Even as I denounced the continued reliance on outdated and economically inferior energy and transportation systems (i.e. the internal combustion engine and tar sands production), I make no apologies for profiting from new opportunities in fossil fuels. My gains in shale over the past few years alone are reason enough to stick to this strategy. Of course, when I'm given...

Can’t Put Solar On Your House? Four Ways To Invest In Solar Leases

Tom Konrad CFA Disclosure: I and my clients have long positions in HASI. I have sold NYLD $40 and $45 calls short. The secret sauce for bringing residential solar into the mainstream is the solar lease. With the simple value proposition of little or no money down and cost savings from day one, a homeowner does not have to be an environmentalist or green to be interested in the green of a solar lease. He or she simply needs to live in a state where the combination of annual sunshine and state incentives provide the economics to make solar...

Toyota’s Asset Backed Green Bond: This Is Big

Sean Kidney Toyota Motor Corp. (NYSE:TM) will close mid-next week on what will be the world’s first green bond backed by auto loans – electric vehicle and hybrid car loans to be specific. And what a kickstart for that market, at $1.75 billion. According to a report in International Financing Review (IFR), the bond will be in multiple tranches, each at a different ratings level: A2 tranche, A3 and A4 (Moody’s ratings). First thing to know: they told the media a week ago it would be a US$774.675 million bond. Rumour has it that initial investor interest...

Christmas Climate Bond From Hannon Armstrong

Sean Kidney Out Monday: a very interesting bond from US listed sustainable infrastructure investor, Hannon Armstrong Sustainable Infrastructure (NYSE:HASI): a $100 million asset-backed securitization of cash flows from over 100 individual wind, solar and energy efficiency installations, all with investment grade obligors. They’re calling them “Sustainable Yield Bonds”; Climate Bonds for us. Coupon is 2.79%. This first bond was privately placed - but they’re planning lots more. Hannon Armstrong have taken the high ground on emissions and built in quantitative annual reporting of greenhouse gas emission reductions, measured in metric tons per $1,000 of par value. The assets...

Hannon Armstrong Yeild On Track For 7% in Q4 With More To Come

Tom Konrad CFA After the close on Thursday, November 7th, Hannon Armstrong Sustainable Infrastructure Capital (NYSE:HASI) declared third quarter earnings. Results were in-line with my, and other analysts’ expectations: Earnings per share (EPS) of 14 cents, and a declared dividend of 14 cents as well. This more than doubled the second quarter’s 7 cent EPS and 6 cent dividend. Note: I have a large long position in HASI. HASI remains on track to reach managements’ dividend target of “over 7% of the $12.50 IPO price” (22 cents a quarter,) and provided some additional guidance for future dividends....

Solar REITs Unlikely to Win Favorable IRS Ruling

by David K. Burton In early 2013, many in the solar industry appeared to be thinking that the IRS’s blessing of a solar REIT would be provided within weeks. It is now the middle of 2013, and it appears the thinking from a few months ago was at best irrational exuberance. Three events have triggered a change in perspective on solar REITs. First, Hannon Armstrong’s (NYSE:HASI) private letter ruling request as to its REIT status is now public. Prior to the ruling being made public, the industry scuttlebutt was that the ruling would bless rooftop solar as REIT...