Tag: PBW

Pop Goes the Clean Energy Stock Bubble

by Tom Konrad, Ph.D., CFA

2020 ended with a massive spike in clean energy stock prices. From the end of October, election euphoria drove Invesco WilderHill Clean Energy ETF (PBW) from $63.32 to $136 at the close on February 9th, a 114% gain in 100 days.

Joe Biden is as strong a supporter of clean energy as Donald Trump was a supporter of big fossil fuel companies, but even with control of the presidency and both chambers of congress, there is a limit to what a president can do in a short time. This is especially true when their top priority...

Screening For the Best Clean Energy ETF

by Vic Patel

There are over a dozen major Clean Energy ETFs available to investors. But which one is the best one to put your hard earned money into? Best can mean different things to different people based on their investment preferences and risk profile.

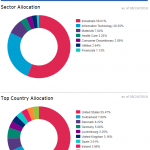

In this article, I will provide a more empirical based reason behind why I believe that PZD is the most attractive Clean Energy ETF at the moment. I have based on my analysis of 4 primary factors: liquidity, diversification, recent price action, and last but not least expense ratio.

Liquidity has to be a major consideration in the...

List of Alternative Energy and Clean Energy ETFs

This list was last updated on 4/27/2022.

ETFs are Exchange-listed funds which pool investor's money for the purpose of making Alternative Energy investments. Exchange Traded Funds (ETFs) track a specified Alternative Energy index. This list also includes closed-end mutual funds and other pooled investments which trade on exchanges.

ALPS Clean Energy ETF (ACES)

ASN Groenprojectenfonds (ASNGF.AS)

Bluefield Solar Income Fund (BSIF.L)

Defiance Next Gen H2 ETF (HDRO)

Evolve Funds Automobile Innovation Index ETF (CARS.TO)

First Trust Global Wind Energy Index (FAN)

First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index Fund (GRID)

First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN)

Foresight Solar Fund Limited (FSFL.L)

Global X Lithium...

Ten Green Energy Gambles for 2010: Update I

Tom Konrad, CFA A quick update of last month's list of speculative puts, to reflect the new options symbols. In January, I put together a list of nine puts and one small energy efficiency stock I expect to do well this year. I normally only do updates on these every quarter, but because of the recent change option symbols, I thought I'd revisit my 10 Green Energy Gambles. The links in the original article have stopped working; this new table shows the current list. Here's the list: with updated option symbols. Security Portfolio...

Oil & Alt Energy Redux

Charles Morand Last week, I conducted an analysis showing the lack of evidence supporting claims that oil and alt energy returns are strongly correlated (claims that sometimes come from outfits as reputable as Bank of America Merrill Lynch). I don't want to belabor this topic but I thought I would post the results of another, similar analysis I conducted following comments I received on how to improve the first one. In a nutshell, the comments suggested I do the following: 1) Look at daily correlations or even smaller periods, as "common knowledge" market...