List of Ethanol Stoccks

This Post was updated on 8/16/21.

Ethanol stocks are publicly traded companies whose business involves producing ethanol alcohol (C2H5OH) made from biomass for use as a fuel in gasoline blends. Common feedstocks include corn and sugar cane. Ethanol is the most widely produced and used biofuel, and all ethanol stocks are also biofuel stocks.

Aemetis, Inc. (AMTX)

Andersons Inc (ANDE)

Archer Daniels Midland (ADM)

Bluefire Renewables (BFRE)

Cosan Ltd (CZZ)

Green Plains Partners LP (GPP)

Green Plains Renewable Energy (GPRE)

MGP Ingredients (MGPI)

Pacific Ethanol (PEIX)

Raízen S.A. (RAIZ4.SA)

REX American Resources Corp. (REX)

SunOpta (STKL)

If you know of any ethanol stock that is not listed here and should be, please let us know...

Advantage Biodiesel

By Tom Konrad, Ph.D., CFA

Because of rising fertilizer prices, farmers are planting more soybeans than corn. Soybeans are a legume, meaning that they can fix their own nitrogen in the soil, meaning that they need less nitrogen fertilizer, the price of which is spiking due to rising natural gas prices. Corn, in contrast, needs more nitrogen than most other crops.

High gas prices are rising because of Putin’s war on Ukraine, which is also preventing Ukrainian farmers from planting this year’s wheat crop, while sanctions are likely to disrupt wheat supplies from Russia as well.

Corn and (to a lesser extent,...

Ethanol and Biodiesel: Production Cost and Profitability

For a number of years, this (now old and outdated, but) very useful chart has been in circulation in energy circles, mapping the supply of energy to the world by looking not at prices, but at production costs. For one thing, it goes a long way to explaining why the price of oil can tumble so quickly when there is a fall off in demand, and explains why OPEC is troubled by unconventional oil in a way it is not so bothered by other energy sources such as renewable fuels. Renewables not only have been traditionally at the...

Novozymes Ignites Yeast Wars

Novozymes (Copenhagen:NZYM-B; OTC:NVZMY) moved into yeast this week with a new organism, Innova Drive.

It’s saccharomyces cerevisae — the workhouse yeast that has been powering wine fermentation since the days of Noah and the Ark. But here’s a new strain engineered to cut fermentation times up to two hours, and yield boosts of up to two percent.

A 2% yield increase and a 5% faster rate of production — let’s illustrate it — would mean something like 7.1 million gallons per year of more ethanol from the same standard 100 million gallon nameplate plant. Retailing at up to $10 million dollars, per year (yes,...

A Disappointing Supreme Court Biofuel Decision. Why It’s Not Over Yet

By Jim Lane

The case

Last week’s decision stems from a May 2018 challenge brought against EPA in the U.S. Court of Appeals for the Tenth Circuit by the Renewable Fuels Association, the National Corn Growers Association, National Farmers Union, and the American Coalition for Ethanol, working together as the Biofuels Coalition. The petitioners argued that the small refinery exemptions were granted in direct contradiction to the statutory text and purpose of the RFS and challenged three waivers the EPA issued to refineries owned by HollyFrontier Corp. and CVR Energy Inc.’s Wynnewood Refining Co.

The case is HollyFrontier Cheyenne Refining, LLC v....

10 Clean Energy Stocks for 2020: Updates on GPP, HASI, CVA

by Tom Konrad, Ph.D., CFA

Market Decline

Last week I warned "The risks in today's stock market outweigh the possibility of future potential gains." Looks like we're seeing those risks manifest in short order. The last couple days' decline have me looking at a few stocks to start adding to my positions again, especially MiX Telematics (MIXT) discussed on June 2nd and Green Plain Partners (GPP), discussed below.

Note that this pullback could easily be very early days of a much larger market decline. We might even see the market fall far enough to test the March lows... any of my buying...

Covanta and Green Plains Partners Don’t Let A Crisis Go To Waste

by Tom Konrad, Ph.D., CFA

Last week, two of the stocks in my Ten Clean Energy Stocks model portfolio cut their dividends. Covanta Holding Corp (CVA) dropped its quarterly payout from $0.25 to $0.08 (a 68% cut) while Green Plains Partners (GPP) slashed its quarterly distribution from $0.475 to $0.12, a drop of 74.75%.

Before reducing their dividends, both companies had payout ratios near 100%, meaning that substantially all of their free cash flow was going to pay dividends. In general, companies are very reluctant to cut their dividends because it is a signal that their management thinks they cannot grow...

North American Outlook on Biofuels Challenges and Opportunities

Challenges and Opportunities in Biofuels

By Steve Hartig, Former VP of Technology Development at ICM

The North American biofuels market can be split into three main segments all of which have major dynamics. What I would like to do is give a high-level overview of what I see as some of both the challenges and opportunities across these.

Ethanol which is a produced from corn and sorghum in about 200 plants mainly across the Midwest and blended at about 10% with gas. Majors such as POET, Green Plains, Flint Hills, Valero, ADM and Cargill do a bit more than half of the 16...

Corn Fractionation Improving Ethanol Production

Ethanol and isobutanol producer Gevo, Inc. (GEVO: Nasdaq) is installing equipment in its Luverne, Minnesota plant to improve efficiency in corn processing. The company is leasing a proprietary corn fractionation or slicing process developed Shockwave, LLC based in DesMoines, Iowa. The new equipment is intended to increase by-product output, including feed protein products and food-grade corn oil. With sales of more valuable by-products Gevo expects to improve overall profit margins. Shareholders can expect to see results after the first quarter 2019, when the equipment installation is expected to be complete.

Shockwave keeps a low profile with no corporate website and no one to answer phone calls. However,...

Hand Sanitizer: Salvation for Ethanol Producers?

by Jim Lane

If you’ve not heard, NuGenTec is looking for Distillers to help supply Ethanol for Hand Sanitizers in California! We have two automated bottling lines waiting for ethanol to produce 8oz and 16oz gel type hand sanitizers, they write. You can learn more here.

And as we reported this morning, Aemetis (AMTX) is one of those companies jumping into the market, even as transport fuel demand falls off, driving fuel ethanol prices into an all-time low range of around $0.70 per gallon.

The shortage is real

If you’ve been trying to buy hand-sanitizer, it’s been hard to find. Here in Digestville, we’ve...

A Modest Proposal: Cellulosic Beef

The Future is Cellulosic It is now widely accepted that the future of ethanol is cellulosic: Rather than distilling corn for ethanol to fuel our cars, accepted wisdom is now that we will be able to replace a large fraction of our current fuel consumption with ethanol distilled from agricultural and forestry waste, as well as dedicated energy crops, such as switchgrass and hybrid poplar. Cellulosic ethanol also has the potential to alleviate the greatest stumbling block of corn ethanol as a potential replacement of gasoline: that there is simply not enough of it. Corn ethanol will only be...

Fortunately, Unfortunately: The Spring Saga of American Ethanol

by Jim Lane

The ethanol signals from Washington DC are more inexplicably mixed than cocktails with names like Sex on the Beach. Let’s parse through the wigwagging over the future of American biofuels supply and demand — ethanol and otherwise.

Fortunately: Trump backs year-round E15 ethanol blends

In Washington, President Trump endorsed year-round E15 ethanol availability as an emerging compromise between oil refiners and US farm sector.

The Renewable Fuel Standard is a federal program that requires transportation fuel sold in the United States to contain a minimum volume of renewable fuels. The RFS originated in a bi-partisan Congress with the Energy Policy Act...

Biofuel Industry Reacts To EPA New Renewable Fuel Standard

Yay or Nay for EPA? RFS Volumes out for 2020, Biodiesel for 2021 – What’s the reaction from industry?

by Jim Lane

What’s the reaction from industry? Coal for Christmas?

Should Santa bring coal for EPA’s stocking this year? Do the biofuels and agriculture industries think the EPA just put coal in their stocking? Is it thumbs up or thumbs down from biofuel industry advocates on last week’s U.S. Environmental Protection Agency renewable fuel volumes? What about the exempted volumes?

The Ruling – Rotten or Respectable?

First, a bit on the EPA ruling that establishes the required renewable volumes under the Renewable Fuel Standard (RFS) program for...

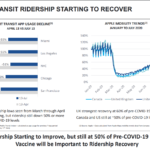

Earnings Roundup: Covanta, NFI Group, Green Plains Partners

by Tom Konrad, Ph.D., CFA

Earnings Season Continues

Below are three more updates on second quarter earnings which I've been sharing with my Patreon supporters. If you'd like to support my writing and see those thoughts in a more timely manner, consider becoming a patron. becoming a patron.

For everyone else, I'm reprinting those thoughts below.

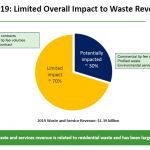

Covanta Earnings

(published August 2nd)

Waste to energy company Covanta Holding Corp (CVA) saw most of its business recovering towards the end of the second quarter. Management is reluctant to predict if the positive trend will continue into the third quarter and for the rest of the year, but...

EPA Reneges on Trump’s Biofuels Deal

by Jim Lane

“EPA Reneges on Trump’s Biofuels Deal”, said the Iowa Renewable Fuels Association in reacting to the US Environmental Protection Agency’s new plans for fulfilling federal renewable fuel requirements. EPA released a proposed supplemental rule for the Renewable Fuel Standard today, and the bioeconomy is up in arms, and the outrage is centered in farm country, once a Trump bastion of support.

“IRFA members continue to stand by President Trump’s strong biofuels deal announced on Oct. 4, which was worked out with our elected champions and provided the necessary certainty that 15 billion gallons would mean 15 billion gallons, even after...

ADM Separates Ethanol Business

Prelude to a spin-off?

by Jim Lane

The Archer Daniels Midland Company (ADM) is breaking news of breaking off their ethanol unit…and a tumbling 40% decline in profit.

In Chicago, Archer Daniels Midland Company reported their financial results for the quarter ended March 31, 2019, but most interesting to us, they are looking at separating their ethanol business with the option of spinning it off completely. They are also taking other actions to restructure and deal with challenges they say include weather issues and trade pressures.

ADM announced a “series of measures to continue to underpin long-term-value creation” which included:

“First, to meet growing customer...