Pushmi-Pullyu: Biofuel Incentives Come Together In A Strange Creature

Jim Lane Sometimes, the set-up of the transition from fossil fuels is as pretty and impractical as Dr. Doolittle’s Pushmi-Pullyu. The Digest investigates. As you may have noticed in the stories around the launch of the Great Green Fleet, it is a complex maze of relationships when it comes to a technology benefitting from mandates like the Renewable Fuel Standard and the California’s Low Carbon Fuel Standard and various carbon taxes and tax credits. For example, a renewable fuel does not qualify under the Renewable Fuel Standard if it is to be used in an ocean-going vessel, but...

Amyris: a 5-Minute Guide

Jim Lane Address: 5885 Hollis Street, Emeryville, CA Year founded: 2003 Annual Revenues: $38 billion (DuPont overall for 2011) $1.2 billon (Industrial Biosciences unit for 2011) Company description: Amyris is an integrated renewable chemicals and fuels company founded in 2003 and based in Emeryville, CA, with additional operations in Chicago, IL and Campinas, Brazil. Amyris has over 400 employees, with three-quarters of its employees located in the United States. Amyris subsidiaries include Amyris Brasil Ltda., a wholly-owned Brazilian company through which Amyris conducts its Brazilian operations for the manufacture and...

Hand Sanitizer: Salvation for Ethanol Producers?

by Jim Lane

If you’ve not heard, NuGenTec is looking for Distillers to help supply Ethanol for Hand Sanitizers in California! We have two automated bottling lines waiting for ethanol to produce 8oz and 16oz gel type hand sanitizers, they write. You can learn more here.

And as we reported this morning, Aemetis (AMTX) is one of those companies jumping into the market, even as transport fuel demand falls off, driving fuel ethanol prices into an all-time low range of around $0.70 per gallon.

The shortage is real

If you’ve been trying to buy hand-sanitizer, it’s been hard to find. Here in Digestville, we’ve...

Emissions Standards Driving Algae Aviation Fuel Sourcing…or not

by Debra Fiakas CFA Algae in the River Wate photo via BigStock My post “Algae Takes Flight” featured Algae-Tec (ALGXY: OTC/PK), Lufthansa’s new biofuel partner. Algae-Tec has agreed to operate an algae-based biofuel plant in Europe to supply Lufthansa with jet fuel. Lufthansa is footing the capital costs of the plant, which is to be located in Europe near a carbon source. Algae thrive on carbon so industrial plants and power plants using fossil fuels make the best neighbors. Lufthansa has agreed to purchase a...

FutureFuel Profits Preview

by Debra Fiakas CFA Biodiesel and biochemical producer FutureFuel Corporation (FF: NYSE) will report fourth quarter 2015 financial results after the market close today. No conference call will be held due to low attendance on recent calls. The single published estimate for FutureFuel is for $0.28 in earnings per share on $122.5 million in total sales. Despite an increase in this estimate in the last week, the number still represents a significant decrease in earnings compared to the prior-year period. The Company has missed the consensus estimate in both of the last two quarters and we do not...

Tax On E85 Renewable Fuel Soars

Jim Lane The US passed a dubious and historic milestone this week. The tax rate on E85 renewable fuels now exceeds 100% in some formulations. By comparison, the tax rate on E10 renewable fuel is running at an estimated 41% and the tax rate on straight gasoline is running at an estimated 35%. As Shakespeare observed in Measure by Measure, “some rise by sin, and some by virtue fall”. Now, the idea of a carbon tax is that governments are supposed to collect more tax against high-carbon fuels. Yet, policy in practice works the other way. The less carbon...

Renewable Energy Group Raises $72 Million in Biodiesel IPO

Jim Lane In Iowa, the Renewable Energy Group IPO priced last night, and the company’s shares began trading Thursday on NASDAQ under the REGI symbol. The company sold 7.2 million shares at $10 per share, well below its midpoint target of $14 per share announced last week, with total proceeds of up to $82.8 million if all over-allotments are covered by underwriters. Without over-allotment sales, the offering will raise $72 million. UBS Securities LLC and Piper Jaffray & Co. are acting as joint book-running managers for the offering. Stifel, Nicolaus & Company, Incorporated and Canaccord...

Praj Licenses Gevo’s Isobutanol Technology

Jim Lane In Colorado, Gevo (GEVO) announced that Praj Industries Limited has signed a memorandum of understanding to become a Gevo licensee for producing renewable isobutanol at sugar-based ethanol plants. Under the MOU, Praj will undertake to license up to 250 million gallons of isobutanol capacity for sugar-based ethanol plants over the next ten years. Gevo will market the isobutanol produced by Praj’s sub-licensees. Praj will also contribute process engineering and equipment services to expand isobutanol capacity at Gevo’s plant in Luverne, Minn, as well as to improve yields and optimize energy consumption at the facility. “Praj has...

What I Sold: Dynamotive Energy Systems (OTC:DYMTF)

This entry continues a series on companies I sold as part of a portfolio cleanup prompted by the mess on Wall Street. In the first entry I described what I plan to do with the cash, followed by the reasons why I sold Carmanah Technologies and Pacific Ethanol. UQM Technologies was one I didn't sell. I have not mentioned Dynamotive Energy Systems (DYMTF) before. I have mixed feelings about the company. They use fast pyrolysis to make cellulosic biofuels, which I believe will prove to be one of the more economic pathways to cellulosic biofuels. However, I believe that...

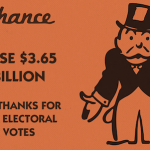

Did Trump’s EPA Cost Corn Growers $3.65 Billion In 2017?

by Jim LaneIn Washington, new evidence has appeared that a Trump Administration shift on US low carbon fuel policy may have cost US corn growers an estimated $3.65 billion.

The mechanism? A secretive effort by Administration officials installed at the US Environmental Protection Agency that destroyed an estimated 1.37 billion gallons of annual demand for low-carbon renewable fuels, in favor of fossil fuels.

Officials at the agency exploited a loophole in US low carbon fuel legislation that allows small oil refineries to gain hardship waivers in cases of severe distress from complying in full with US low carbon fuel laws. Now, evidence...

Bunge: Now Less Sugar

Jim Lane In New York, in the wake of a $37 million Q1 loss in its sugar unit, Bunge CEO Soren Schroder, who took the reins of the company in June, announced yesterday that the trading giant is commencing what he termed a “thoughtful comprehensive review” for its sugar business, including a potential sale of all the assets. The company, which announced a $137 million overall quarterly loss, after posting a Q4 loss of $599 million in June. The Q4 loss included write-downs and charges of $683 million, including a $327 million write-down in its sugar...

Exxon Could Be the Answer to America’s Energy Problems

Bill Paul In the wake of the massive Gulf of Mexico oil spill, it’s clear the U.S. needs to end its crude-oil addiction as much to protect its economy as the environment. To move the future forward, America needs one company in particular to come through on behalf of all Americans. In a cruel twist of fate, that company is ExxonMobil (XOM), which is working on arguably the most important energy-research project in the world today. Namely, a project to replace crude with genetically-modified algae that can be cost-effectively refined using existing refinery equipment. A year...

The Future of Alternative Fuels: Ethanol

Besides a slew of clean car announcements connected to the North American International Auto Show, the alt energy topic that has made media and blog headlines most often over the past week has been alternative fuels. We are thus going to run a 2-part series on alternative fuels this week as follows: ethanol today and coal-to-liquids tomorrow. ETHANOL: INVESTOR FRIEND OR FOE? I’m going to start this post with a statement of opinion: I don’t really like corn-based ethanol (as an investment), I never have, and, as a result, I haven’t followed this space as closely as...

Butamax and Gevo: Bio’s Montagues and Capulets get it on, and on, and on

The 2-Minute Guide to Butamax vs Gevo, and vice-versa

KiOR: “You’ve Cooked The Books”

by Jim Lane

Note. This is Part 3 of our series on the inside true story of KiOR.

In part 1 of our series here, and part 2 here.

Our story so far

KiOR was hanging by a thread as the summer of 2010 commenced. In a few days, the first recorded visitors to Pasadena demo unit, representatives of the Mississippi Development Authority, were expecting to see the demonstration unit in action.

The company was beginning to hurtle towards an IPO. But the fuel yields were low; the fuel was not usable by their initial chosen downstream partner; the catalyst they were using...

Solazyme’s Hybrid Vigor

Jim Lane Solazyme lands monster capacity expansion agreements with Archer Daniels Midland (ADM) and Bunge (BG)– what’s the sector’s hottest company up to now? Wednesday, Solazyme (SZYM) announced two landmark capacity expansion agreements with Bunge and ADM, respectively. The Bunge agreement will expand joint venture-owned oil production capacity at Solazyme Bunge Renewable Oils from the current 100,000 metric tons under construction in Brazil to 300,000 metric tons by 2016 at select Bunge owned and operated processing facilities worldwide. Under the terms of the ADM agreement, Solazyme will initially target the production of 20,000 metric tons of...