Europe’s New Renewable Energy Directive

by Helena Tavares Kennedy

You may have heard that the European Parliament voted in favor of the RED II (Renewable Energy Directive) proposal in January. Probably the most notable (or at least covered in the news the most) was their decision to remove biodiesel made from palm oil from its list of biofuels that can count towards the EU’s renewables target from 2021.

It also voted that “biomass fuels consumed in transport, if produced from food or feed crops, shall be no more than the contribution from those to the gross final consumption of energy from renewable energy sources in 2017 in that Member...

Solazyme, Gevo, Amyris earnings, outlook: the 5-Minute version

Jim Lane As Solazyme, Gevo and Amyris report on results for Q2, update forward guidance – what does the data reveal about demand, supply of advanced biofuels and co-products? We digest down analyst reports, company comments into a 5-minute summary of “news you can use”. In California and Colorado, the newswires have been working overtime this week in advanced biofuels, as several industry titans reported their latest quarterlies and subjected themselves to public scrutiny, which sometimes resembles the Puritan practice of mounting minor offenders in the public stocks and pelting them with rotten eggs and tomatoes. But it...

Biobased and Biofuel Investments: A System

Jim Lane A Biofuels and Biobased investment primer: An 18-combination, 8-character system for classifying bio investments Here’s our investment primer on how to size up the risks and the rewards and tune them to meet your goals. And, a system for organizing opportunities. So, you’re thinking about investing in bio? Here’s the good news – you’re not alone. Here’s the bad news – you’re not alone. There are retail, private equity, hedge fund, sovereign wealth, strategic, grower, VC and institutional investors snooping around too, and making active investments. For one thing, carbon’s making a comeback as the...

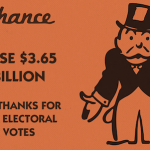

Did Trump’s EPA Cost Corn Growers $3.65 Billion In 2017?

by Jim LaneIn Washington, new evidence has appeared that a Trump Administration shift on US low carbon fuel policy may have cost US corn growers an estimated $3.65 billion.

The mechanism? A secretive effort by Administration officials installed at the US Environmental Protection Agency that destroyed an estimated 1.37 billion gallons of annual demand for low-carbon renewable fuels, in favor of fossil fuels.

Officials at the agency exploited a loophole in US low carbon fuel legislation that allows small oil refineries to gain hardship waivers in cases of severe distress from complying in full with US low carbon fuel laws. Now, evidence...

Gevo’s Glow

Specialty chemicals developer Gevo, Inc. (GEVO: Nasdaq) is celebrating a string of market wins for its renewable chemicals and fuels. Since its beginning thirteen years ago this month, Gevo has been doggedly perfecting its synthetic biology and chemical technologies and turning it into products that are in demand by consumers and industry. Last week shareholders were treated to an announcement by the U.S. Environmental Protection Agency (EPA) raising the amount of isobutanol for on-road use to 16% blend level from 12.5%. As a producer of renewable isobutanol Gevo will be a direct beneficiary of the EPA action. Following directly on the heels of that news,...

Green Plains Primes The Pump

by Debra Fiakas CFA Ethanol producer Green Plains Renewable Energy, Inc. (GPRE: Nasdaq) announced today plans to build a fuel terminal point in Beaumont, Texas. The terminal will be located at a facility owned by Green Plains’ partner in the venture, Jefferson Gulf Coast Energy Partners. It will be helpful to have a friend in the project that is expected to cost $55 million to complete just ethanol storage and throughput capacity. Planned storage capacity is equivalent to 500,000 barrels, with the potential to expand to 1.0 million barrels. Capacity to handle biofuels or other...

Cellulosic Electricity: Stock Analysts v. Venture Capitalists

Romm v. Kholsa In a persuasive series of articles, entitled "Pragmatists vs. Environmentalists" (Parts I, II, and III) on Gristmill, Vinod Khosla provides the reasoning behind his "dissing" of plug-in hybrids, which drew the ire of Joeseph Romm. Neither seems to think the argument is settled, and Joeseph Romm returns fire here. As someone who knows as much about investing as Joe Romm and has written as much about Climate Change and Energy Policy as Vinod Khosla, I feel the need to jump into the debate and settle the matter. (Will either of them will notice?)...

Dyadic International (DYAI.PK), A Stock To Avoid

Tom Konrad, Ph.D., CFA Dyadic International hopes to use proprietary gene discovery to revolutionize cellulosic biofuel and pharmaceuticals. Investors should stay away. Dyadic International (DYAI.PK) says they are applying their "proprietary enabling biotechnologies for multi-billion dollar markets in industrial enzymes, biofuels and biotherapeutics." A very exciting prospect, and just the sort of thing I've long warned investors to avoid. In short, they are a company with gigantic claims and not a lot of track record to back them up. Why I Care (I don't, really) In our survey of readers, one respondent asked that I write more about stocks...

Advanced Biofuels: I Love You, You’re Perfect, Now Scale

Jim Lane Codexis (CDXS) and Mascoma show that low-cost sugar is the key, as advanced biofuels moves from R&D into industrial era. There used to be a restaurant in lower Manhattan called Exterminator Chili. Decorated in Elvis garb, it served world-class chili for the enlightened chow hound, in three grades of heat: residential (hot), commercial (blistering), and industrial (melt steel in your mouth). The proprietors would have understood little about advanced biofuels and nothing about the importance therein of low-cost sugars. But they did understand that the bigger the scale, the hotter you were. And that the highest...

The 6 Hottest Ways to Alleviate Food vs Fuel

Jim Lane With the US drought, food vs fuel has returned as an issue. What alternatives are scientists, entrepreneurs developing to take us beyond the old debate? With the US drought, food vs fuel has returned as an issue. What alternatives are scientists, entrepreneurs developing to take us beyond the old debate? In the past week we published a report that the chairman of Nestle, Peter Brabeck-Lemathe, has called anew for a ban on making biofuels from feedstocks that can also be used in food production. The backdrop for Brabeck’s comments is the US drought, which...

Renewable Energy Group Acquires LS9

Jim Lane A stunner at NBB. Renewable Energy Group (REGI) deploys its balance sheet and takes aim at renewable chemicals as it acquires the storied LS9. In Iowa, Renewable Energy Group (REGI) announced it has acquired LS9 for a purchase price of up to $61.5 million, consisting of up front and earnout payments, in stock and cash. Most of the LS9 team, including the entire R&D leadership group, will join the newly named REG Life Sciences, LLC, which will operate out of LS9’s headquarters in South San Francisco, CA. Under the terms of the agreement between REG...

The API Bushwhacks Ethanol

Jim Lane Who’s right, in the fight of their lives over E15 ethanol blending? Whose data’s a Looney Tune, whose is from the real-world? Yesterday the American Petroleum Institute, in an apparent impression of Yosemite Sam, held a press conference in DC to highlight a new report from the Coordinating Research Council on E15 ethanol blends. The report is here. The API: Blast your scuppers, now I gotcha, ya’ flea-ridden riff-raff! Use of the ethanol gasoline blend E15 may endanger fuel systems in millions of 2001 and newer vehicles,...

Milestone for Gas-to-Liquids Fuel Plant

Syntroleum Corp (SYNM) commemorated the successful production of more than 140,000 gallons of ultra-clean fuels at its gas-to-liquid (GTL) fuels plant at Port of Catoosa, Oklahoma. The plant also manufactured 60,000 gallons of additional products, such as syncrude. Gathered to mark the occasion were representatives from Syntroleum, the U.S. Department of Energy (DOE), Marathon Oil Company and Integrated Concepts and Research Corporation (ICRC).

Fly the Bio Skies: 10 Milestones in the Summer of Aviation Biofuels

Jim Lane Algae powered plane photo via BigStock We look back on a big summer for biofuels development: There have been many recent algae biofuel developments, the drought, and the policy fight over the Renewable Fuel Standard. But in many respects, its been a summer about aviation biofuels – starting with the demonstration of the US Navy’s Green Strike Group and continuing to announcements of projects right through the summer. The story has internationalized, the technologies are broadening, and more and more blue-chip players are making...

Aemetis: Indian Breakthrough, California Expansion

Aemetis, Inc. (AMTX: NasdaqCM) just announced sales of biodiesel to gas stations in India. The sales follow on the heels of a significant ruling in November 2018, by the Bombay High Court to remove restrictions on biodiesel that had barred direct to consumer sales by biofuel manufacturers. The breakthrough into the India market is significant for the company, which has been operating a 50-million gallon integrated chemicals and fuels facility in Kakinada, India for several years.

Demand for renewable fuels has been strongest among fast growing economies like India, where decision makers fear dependence upon imported fossil fuels. India produces only about 1% of global...

BlueFire Renewables: Solid and Liquid

Jim Lane You just can’t beat the financing of renewable fuels for all-out zaniness. Tragicomedy, anyone? Consider the case of BlueFire Renewables (BFRE). Sometimes, the financing of renewable fuels can start to sound a little like an Abbott & Costello routine. The planned BlueFire plant Allow us to summarize. You can finance a liquid renewable fuel as long as the market is solid, especially if you are making solids, and the market for solids is liquid, and your liquidity is solid. Adding solids to...