Portfolio For A GHG-Regulated World

Investment opportunities connected to climate change and greenhouse gas (GHG) regulation are a popular topic of discussion on this blog. Most of the time, however, the companies we discuss are relatively small, often unknown to most investors and overall pretty speculative. Yesterday, I came across an interesting article on Seeking Alpha entitled "Investing In a Greenhouse Gas-Regulated World" - the title says it all. The article looks at the question of investing in a GHG-constrained world from a conventional portfolio management perspective, and therefore argues for a low weighting in pure-play cleantech or carbon finance stocks, and...

High Conviction Paired Trade – Short Tesla Motors And Buy Exide Technologies

John Petersen Short sellers are the bane of every securities lawyer who represents small public companies. In over thirty years of practice I've never advocated a short sale because I hate the idea of profiting from someone else's misery. Based on recent quarterly reports filed by my short-list of pure play energy storage companies, which includes Tesla Motors (TSLA) as an honorary member, I'm compelled to break with tradition and suggest a paired trade that involves a short sale of Tesla coupled with a long purchase of Exide Technologies (XIDE). The following table summarizes the year-to-date and...

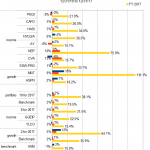

How Did These 7 Green Money Managers Do in 2013?

Tom Konrad CFA Outlook 2013 photo via BigStock Last December, I asked my panel of managers of green funds and portfolios to predict the major trends of 2013, and pick their top stock for the year to come. I wrote a series of articles based on their responses, which I’ll reference below. I plan to ask them the same questions this year, but first I will check on how they’ve done so far. The Managers Not everyone on my panel responded to all the questions, but here are the...

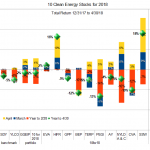

Ten Clean Energy Stocks for 2013

Tom Konrad CFA Every year since 2008, I've published a list of ten (or eleven in 2012) clean energy stocks I expect to do well over the coming year. The list is intended as a model portfolio which could be used by a small investor looking to avoid the relatively high costs of clean energy mutual funds, most of which have expense ratios around 2%, in addition to the trading costs they incur with fairly high turnover ratios. My list also reflects my belief that the best returns and least risk in clean...

December Update: 11 Clean Energy Stocks for 2012

Tom Konrad CFA What the Election Brought to Energy Stocks Obama's reelection did not bring on a new bull market for Clean Energy stocks, as some had hoped. My Clean Energy model portfolio was flat (+0.4%) for the month, while the widely held Powershares Wilderhill Clean Energy ETF (PBW) fell 1.6%. In contrast, the broad market, as measured by the Russell 2000 ETF, (IWM) rose 1.1%. If Obama's re-election had a strong effect on any energy sector, it was coal stocks: the Market Vectors Coal ETF (KOL) was down 8.5% over the same...

Veolia Cleaning Up Balance Sheet

Tom Konrad CFA On Thursday, Veolia Environnement (NYSE:VE) closed a deal to sell its solid waste business for $1.9 billion. This is part of its ongoing effort to reduce debt and cost of operations by selling assets worth $6.14 billion, which the company expects to complete by the end of 2013. Last year, Veolia took the first step in this program by selling its UK water business, also for $1.9 billion. I’ve long been attracted to Veolia for its green credentials and high dividend yield. The company paid a euro 0.70 ($0.85) dividend in 2012,...

Earnings Season For Ten Clean Energy Stocks

Tom Konrad CFA The third quarter earnings season has been quite eventful for my Ten Clean Energy Stocks for 2013 and six alternative picks model portfolios, so much so that writing about them has taken a back seat to keeping up with the announcements. There were a number of earnings disappointments and earnings announcements which were in line with my expectations but the market treated like disappointments. These resulted in an overall decline of 2.5% for the portfolio since the last update, even as my industry benchmarks, the Powershares Wilderhill Clean Energy (PBW) and my...

Trade Like It’s 2008

Tom Konrad CFA Three stocks I sold recently, and why. Three years later, I'm still kicking myself that the severity of the 2008 financial crisis and stock market collapse took me by surprise. Not that I wasn't in good company. If a majority of investors had been prepared for the crisis, it would never have happened in the first place: The overpriced CDOs and other securities which were a large part of the cause would never have become overpriced. But making excuses for past mistakes is not useful. Learning from them...

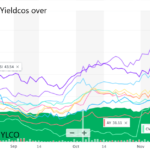

The Yieldco Virtuous Cycle

by Tom Konrad, Ph.D., CFA

Readers who followed my coverage of the Yieldco bubble in 2015 know the Yieldco Virtuous Cycle.

A Yieldco’s stock price rises

It issues new shares, and invests the money in renewable energy projects.

Because the stock price is high, it is able to buy more project cash flow by issuing fewer shares than it has in the past.

Cash flow available for distribution (CAFD) per share increases, despite the increasing number of shares outstanding.

Yieldco management sets a target for continued rapid annual distribution growth, which can be met either by further share issuance (if...

See You Later, Hannon Armstrong

by Tom Konrad Ph.D., CFA

Sustainable infrastructure financier Hannon Armstrong (NYSE:HASI) is not in my Ten Clean Energy Stocks model portfolio for the first year since its IPO in 2013. I still love the company and its business model, but I have become concerned about its short term prospects.

Dividend Disappointment?

In my last update on the 2017 portfolio, I wrote,

“Sustainable infrastructure and clean energy financier Hannon Armstrong reported earnings on November 1st. The headline numbers were lower than expected, but for a very good reason. The company has spent the last few months locking in low interest rates by refinancing its...

10 Clean Energy Stocks for 2022-2023: The List

By Tom Konrad, Ph.D., CFA

With the launch of my (green dividend income focused) hedge fund early this year, I had to take a hiatus from publishing my annual list of 10 Clean Energy Stocks that I feel will do well in the coming year. Since my duty to clients takes precedence over readers, I could not tell people about stocks I liked before buying them for the fund.

As we complete the first half of the year, the fund is now largely invested, although I am still keeping some buying power back in anticipation that the overall market could easily...

Ten Clean Energy Stocks For 2018: Oddballs Spring Back

After a stormy winter for the broad market and clean energy stocks, including my picks, March and April brought relative calm. Better yet, my model portfolio has rebounded from its February lows, although its benchmarks (SDY for the broad market of income stocks and YLCO for clean energy income stocks) have mostly been treading water.

The gains were led by two of my less conventional clean energy picks, Seaspan (SSW) and InfraREIT (HIFR). Seaspan owns (mostly very efficient) container-ships, which most people would not associate with clean energy, but which I include because they they are much less energy intensive...

Ten Clean Energy Stocks For 2014: May Update

Tom Konrad CFA April showers fell on both the broad market and clean energy stocks last month, but my picks weathered the storm relatively well. My clean energy benchmark (PBW) was down 5.9% since the last update, and my broad market benchmark (IWM) fell 1.7%. Meanwhile 10 Clean Energy Stocks for 2014 model portfolio also fell 1.7%. For the year so far, the clean energy benchmark is up 4.5%, having given back most of its large February gains, while the broad market is down 2.5%. My model portfolio is up 2.2%, having...

Ten Clean Energy Stocks for 2010: Q1 Update

Tom Konrad, CFA Three months have passed since I published my annual clean energy mini-portfolio. So far, these stocks have beaten the Powershares Wilderhill Clean Energy Index (PBW) handily, but they trail the broader market. This is the third year in a row I've published a list of ten stocks for the year ahead at the end of December. In 2008 my list trailed the broader stock market but beat the clean energy index, and last year it outperformed both. So far, this year looks more like 2008 than 2009. In addition to the portfolio of ten...

Clean Energy Tracking Portfolio Update: Oops!

My Quick Clean Energy Tracking Portfolio has solidly outperformed its benchmark... was it bad design? Tom Konrad, Ph.D. On February 27, I used the top holdings of the (then six) clean energy mutual funds to design a tracking portfolio intended to replicate the performance of those funds at much lower cost. If my methodology was sound, the tracking portfolio should produce returns within the range of returns of the mutual funds on which it was based. If all went well, the returns would be at the upper end of that range because of the way I chose to emphasize...

10 Clean Energy Stocks For 2018 Preview

Like last year, I will be offering paying readers a preview of my Ten Clean Energy Stocks for 2018 list. I plan to publish the final article after market close on January 1st. If you would like to see a draft version mailed on December 29th (a full trading day before the final publication) please PayPal $10 to me at with a note that it's for the 10 for 2018 preview. The draft will contain the full list, but may not have a complete stock discussion for each stock. I plan to finish the article over the next couple days.

Note...