Ten Clean Energy Stocks for 2020: Trades

by Tom Konrad Ph.D., CFA

Four weeks ago, I predicted that the 12% market correction we had seen would turn into a true bear market. Bear markets are often defined as a decline of more than 20% for the major market indexes, but I find it more useful to focus on long term changes in investor sentiment.

What I did not predict was just how severe the effect of the coronovirus shutdown would be on the economy. I thought we would need the combined of the effect of the shutdown and investors re-assessing their risk tolerance to bring us into full...

Performance Update: 10 Solid Clean Energy Companies to Buy on the Cheap

Unlike my Ten Speculations for 2008, my Solid Clean Energy Companies series will be much more difficult to benchmark. The intent of the series was to list some "stocks to buy when you think we've hit bottom." Since I obviously don't know when you think we've hit bottom (My opinion: not yet), I don't know what prices you'd have paid. Instead, I'll look at what would have happened if you bought only those stocks which dropped 10% since I wrote about them, and you bought them at the close that day, in equal dollar amounts. Here's...

10 Clean Energy Stocks for 2011: Q2 Update

Tom Konrad CFA Some investors buy clean energy stocks because it's the right thing to do, others because we know that the diminishing availability and increasing environmental impacts of traditional fuels will eventually force society to adopt more sustainable solutions. Cartoonist Scott Adams says we're all wrong, and we should invest in companies we hate. Although Adams' column is meant to amuse, rather than as investment advice, it's funny because he touches on two very important truths about investing. Although a few investors can outperform the market over the long run, the vast majority can't,...

Restarting 10 Clean Energy Stocks Series

By Tom Konrad, Ph.D., CFA

With the launch of my (green dividend income focused) hedge fund early this year, I had to take a hiatus from publishing my annual list of 10 Clean Energy Stocks that I feel will do well in the coming year. Since my duty to clients takes precedence over readers, I could not tell people about stocks I liked before buying them for the fund.

As we complete the first half of the year, the fund is now largely invested, although I am still keeping some buying power back in anticipation that the overall market could easily...

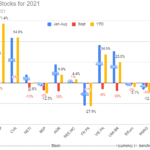

January Performance: 10 Clean Energy Stocks for 2021

You can find the original list here. I'll be doing commentary on individual stocks as there is news. The first of these is on MiX Telematics (MIXT) earnings, first published for my Patreon subscribers on January 28th and copied below. A note on Scorpio Bulkers (SALT) from February first will be published here tomorrow.

MiX Earnings

MiX Telematics (MIXT) reported earnings this morning . The numbers showed improvement over the previous quarter, but a decline over the previous year due to the covid crisis which was exacerbated by the strengthening dollar.

The results were pretty much what I expected when I added...

Notes On YieldCos, Future Fuel, and Aspen Aerogels

by Tom Konrad Ph.D., CFA Since I have not had much time to write for AltEnegyStocks, I thought I'd share with readers some notes I wrote for investors in the JPS Green Economy Fund, a hedge fund for which I'm director of Research, regarding our holdings in the third quarter: In the third quarter, we took advantage of the general decline of clean energy "YieldCos" to add two of these owners of wind and solar farms to our portfolio at attractive yields. Pattern Energy Group (PEGI) is an owner of wind farms having long term power purchase agreements...

11 Clean Energy Stocks for 2012: August Update

Tom Konrad CFA July Overview July was a good month for my Clean Energy model portfolio. Since the last update, these 11 stocks are up an average of 3.3%, with a year to date return total return a tiny loss of -0.5%. While it's never pleasant to be down for the year, it's helpful to compare this performance to that of the most widely held clean energy ETF, the Powershares Wilderhill Clean Energy ETF (PBW), which was down 8.7% for the month, and down 21% year to date. All in all, it has been a miserable year...

10 Clean Energy Stocks for 2022-2023: The List

By Tom Konrad, Ph.D., CFA

With the launch of my (green dividend income focused) hedge fund early this year, I had to take a hiatus from publishing my annual list of 10 Clean Energy Stocks that I feel will do well in the coming year. Since my duty to clients takes precedence over readers, I could not tell people about stocks I liked before buying them for the fund.

As we complete the first half of the year, the fund is now largely invested, although I am still keeping some buying power back in anticipation that the overall market could easily...

Fuel Cell Companies Purchased for Portfolio

I placed several trades for the mutual fund this afternoon to start building a position in some of the fuel cell companies. This sub-sector has been under pressure the last couple of months but seems to be building a nice base of support at the current levels. I feel this entire sub-sector is ready for a nice up move and the stocks have been behaving nicely the last week or so. The one stock I seriously considered not adding was Quantum. The stock has been in a steady decline and there is no sign that it’s going to slow...

Ten Clean Energy Stocks For 2015: Income Comes In First; Growth Shrinks

Tom Konrad Ph.D., CFA 2015 was a very tough year for energy stocks, especially income oriented energy stocks such as (mostly fossil fuel) MLPs and (mostly clean energy) Yieldcos. Not only did oil and gas prices drop dramatically, but most other commodities did as well. Low commodity prices hurt commodity producers, but also commodity recyclers and efficiency companies that help reduce the consumption. Against this backdrop, I'm happy that my Ten Clean Energy Stocks for 2015 model portfolio ended the year in the black, with a 5.8%...

A Better Way to Play Green Stocks?

Tom Konrad, Ph.D., CFA My Quick Clean Energy Tracking Portfolio continues to outperform all benchmarks and expectations... is it luck, or did I stumble onto a better way to invest in green energy stocks? I continue to be stunned at how the portfolio which I intended as an easy way to duplicate green energy mutual fund performance at much lower cost continues to blow those green mutual funds out of the water. I last published an update on this portfolio at the end of May, and was shocked to find that it had beaten the funds it was...

Ten Clean Energy Stocks for 2013: Lessons Learned

Tom Konrad CFA As we come into the final stretch of 2013, my annual model portfolio of Ten Clean Energy Stocks for 2013 looks certain to break its five year winning streak of beating its industry benchmark. As of December 6th, the model portfolio's total return has been 19.0%, compared to a sunny 56.1% for my benchmark, the Powershares Wilderhill Clean Energy (PBW). The broad market, as represented by the Russell 2000, also resoundingly beat my model portfolio, and is up 37.5%. My six alternative picks fared even worse than...

Ten Green Energy Gambles for 2010: Update I

Tom Konrad, CFA A quick update of last month's list of speculative puts, to reflect the new options symbols. In January, I put together a list of nine puts and one small energy efficiency stock I expect to do well this year. I normally only do updates on these every quarter, but because of the recent change option symbols, I thought I'd revisit my 10 Green Energy Gambles. The links in the original article have stopped working; this new table shows the current list. Here's the list: with updated option symbols. Security Portfolio...

Will McConnell Kill The Bull Market?

By Tom Konrad, Ph.D., CFA

The risks of playing politics

The American news media often tries too hard to be “balanced” when talking about politics.

Depending on which news sources you rely on, you may be hearing that “congress” is having trouble passing bills to fund the government and raise the debt ceiling. More partisan sources will be blaming it on the Democrats or the Republicans, depending on their political bent.

I generally consider myself an independent who cares deeply about the environment and competent government. Since the rise of Donald Trump, the Republicans have shifted from being the party of big business...

Q3 Performance Update: 10 Green Energy Stocks for 2009

My annual green energy stock picks continue to hold up, but the Obama Effect for clean energy seems to have been lost in the summer's healthcare debate. Tom Konrad, Ph.D., CFA For the first 9 months of 2009, my ten green energy stocks for 2009 are up 23.4% vs. the S&P 500, and up 20.4% over my clean energy benchmark, the iShares S&P Global Clean Energy Index (ICLN). For the third quarter, that amounts to a loss of 1% relative to the S&P 500, and a gain of 7% relative to ICLN. In my second quarter update, I...

10 Clean Energy Stocks for 2021: November. Notes on MIXT, GPP, EVA

By Tom Konrad, Ph.D., CFA

Monthly Performance

Returns for the Ten Clean Energy Stocks for 2021 model portfolio are shown below. It was a good month for clean energy stocks as well as the broader stock market, with the portfolio up 4% for a 20% total return through the end of October. Its clean energy benchmark (RNRG) was up more (8%) but is still down 6% for the year. Its broad market benchmark (SDY) rose 5% and has caught up with the model portfolio at a 20% return year to date.

Earnings

Third quarter earnings season has started. Below are some notes I’ve...