Clean Energy Tracking Portfolio Update: Oops!

My Quick Clean Energy Tracking Portfolio has solidly outperformed its benchmark... was it bad design? Tom Konrad, Ph.D. On February 27, I used the top holdings of the (then six) clean energy mutual funds to design a tracking portfolio intended to replicate the performance of those funds at much lower cost. If my methodology was sound, the tracking portfolio should produce returns within the range of returns of the mutual funds on which it was based. If all went well, the returns would be at the upper end of that range because of the way I chose to emphasize...

Change Winds Blow for Renewable Energy Income Trusts

Renewable energy is still very much in its infancy, which means that companies in the space are either profitless or high-multiple startups, or divisions of much larger companies (GE Wind (NYSE:GE), or utilities such as FPL Group (NYSE:FPL) and Xcel (NYSE:XEL) which get much of their power from conventional generation.) This presents a dilemma for investors who understand the compelling drivers for the sector, but whose risk tolerance or financial needs indicate an income-based investing strategy. Canadian Income Trusts in Renewable Energy A few Canadian Income Trusts have historically gone some way towards filling this niche....

Ten Clean Energy Stocks For 2014: Out With The Old

Tom Konrad CFA Plummeting oil prices, global economic weakness, and the Republicans' win in the US midterms have delivered a triple-whammy to clean energy stocks over the last few months. Many of the stock declines are justified more by headlines than fundamentals. My 10 Clean Energy Stocks for 2014 model portfolio has suffered, especially the riskier growth stocks. The strong dollar has been a further drag on the six foreign stocks. Since the last update at the start of October, the model portfolio is down 4.6%, for a loss since its December 27th,...

Ten Clean Energy Stocks For 2015: Marching Ahead

Tom Konrad CFA My Ten Clean Energy Stocks for 2015 model portfolio added a second month to its winning streak, with a 6.1% gain for the month and a 5.7% gain for the year, despite a continued drag by the strong dollar. If measured in terms of the companies' local currencies, the portfolio would have been up 7.5% for the month and 10.5% for the quarter or year to date. For comparison, the broad universe of US small cap stocks rose 1.5% for the month and 4.0% for quarter, as measured...

Ten Green Gambles for 2010: Q3 Update

Tom Konrad CFA To my surprise, the market came back in the 3rd Quarter, and my portfolio of put options designed to hedge a market decline is predictably down. However, my benchmark (a put against the Dow Jones Industrials has performed even worse than my picks.) I don't have a lot to say about the performance of my Ten Green Gambles for 2010 so far this year. These gambles were a bet on a market decline in 2010. Since we're now into the 4th quarter and the market is still...

Ten Clean Energy Stocks For 2015: Riding The Storm

Tom Konrad CFA The first half of 2015 saw a mild advance in the broad market, but concerns about rising interest rates and the ongoing Greek debt drama sent income stocks, clean energy, and most non-US currencies down decisively. My Ten Clean Energy Stocks for 2015 model portfolio has heavy exposure to not only clean energy, but income stocks (6 out of 10) and foreign stocks (4 out of 10.) Despite this the stormy market for all three, the portfolio delivered admirably. The model portfolio ended the second quarter up 9.7%, compared to its broad market...

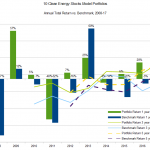

Ten Clean Energy Stocks For 2018

Tom Konrad Ph.D., CFA

Ten Years of "10 Clean Energy Stocks." A 38% total return in 2017 is the one to beat.

I started blogging about investing in clean energy stocks in 2005. At the time, I had just started an independent investment advisory practice, and thought blogging was a good way to impress people with my knowledge of clean energy. I don't know how many people I impressed, but the clients were hardly pounding down the door.

What I did learn, however, was that I loved writing about clean energy from the perspective of a stock investor. Because I was...

Ten Clean Energy Stocks For 2016: August Earnings

Tom Konrad, Ph.D., CFA My Ten Clean Energy Stocks for 2016 model portfolio continued to coast upward in August after five months of blistering performance since February, while clean energy sector benchmarks and real managed portfolio, the Green Global Equity Income Portfolio (GGEIP), pulled back slightly. The following chart shows the performance of the model portfolio and its sub-portfolios against their benchmarks. The portfolio, its growth and income subportfolios, and GGEIP all remain far ahead of their benchmarks. Second quarter earnings announced this month were neutral or positive for the income...

Portfolio For A GHG-Regulated World

Investment opportunities connected to climate change and greenhouse gas (GHG) regulation are a popular topic of discussion on this blog. Most of the time, however, the companies we discuss are relatively small, often unknown to most investors and overall pretty speculative. Yesterday, I came across an interesting article on Seeking Alpha entitled "Investing In a Greenhouse Gas-Regulated World" - the title says it all. The article looks at the question of investing in a GHG-constrained world from a conventional portfolio management perspective, and therefore argues for a low weighting in pure-play cleantech or carbon finance stocks, and...

Election Jitters Spell Opportunity: Ten Clean Energy Stocks For 2016

Tom Konrad, Ph.D., CFA This October saw falling leaves and falling stocks. Then came the first week of November with its election jitters and stripped the trees of the rest of their leaves like a fifty mile an hour wind sending stocks flying as well. While Donald Trump's unpredictable performance has the whole stock market rattled (at least when it looks like he might win), his anti-environment and pro fossil fuel rhetoric have had stocks in the sector quaking like the leaves on an aspen. Although all its benchmarks were decidedly in the red for October...

Ten Clean Energy Stocks For 2015: A Fine February

Tom Konrad CFA After a rough start to the year, My Ten Clean Energy Stocks for 2015 posted a strong recovery in February. For the month, the model portfolio rose 7.9% in local currency terms and, 8.3% in dollar terms. For comparison the broad universe of US small cap stocks rose 5.9% (as measured by IWM, the Russell 2000 index ETF), and the most widely held clean energy ETF, PBW, shot up 11.6%. This year I split the model portfolio into two sub-portfolios of six income stocks (NYSE:HASI, NYSE:BGC, TSX:...

Ten Clean Energy Stocks For 2015: Income Comes In First; Growth Shrinks

Tom Konrad Ph.D., CFA 2015 was a very tough year for energy stocks, especially income oriented energy stocks such as (mostly fossil fuel) MLPs and (mostly clean energy) Yieldcos. Not only did oil and gas prices drop dramatically, but most other commodities did as well. Low commodity prices hurt commodity producers, but also commodity recyclers and efficiency companies that help reduce the consumption. Against this backdrop, I'm happy that my Ten Clean Energy Stocks for 2015 model portfolio ended the year in the black, with a 5.8%...

November Update: What Will The Election Bring for Clean Energy Stocks?

11 Clean Energy Stocks for 2012 Tom Konrad CFA October Overview October brought a gentle fall to my Clean Energy model portfolio, and a slightly-less gentle decline for the clean energy sector and the stock market as a whole. Both the unhedged and hedged versions of my model portfolio fell 2.3% for the month, compared to a 4.1% decline for the widely held Powershares Wilderhill Clean Energy ETF (PBW), which I use as a benchmark for the clean energy sector as a whole, and a 4.0%...

Three Green Money Managers; Six Green Stocks for 2013

Tom Konrad When I asked my panel of green money managers their predictions for trends 2013, I got enough material for four articles: On where the cleantech sector is heading in 2013, as well as on Solar, Smart Grid, and LED technology. I also asked them for stock picks, some of which I included in the previous articles. Several had opinions about EnerNOC (NASD:ENOC), which I wrote about here, and two picked LED stocks Veeco Instruments (NASD:VECO) and Universal Display Corp. (NASD:PANL), which I discussed here. Since I just published my annual model portfolio of...

10 Clean Energy Stocks For 2018 Preview

Like last year, I will be offering paying readers a preview of my Ten Clean Energy Stocks for 2018 list. I plan to publish the final article after market close on January 1st. If you would like to see a draft version mailed on December 29th (a full trading day before the final publication) please PayPal $10 to me at with a note that it's for the 10 for 2018 preview. The draft will contain the full list, but may not have a complete stock discussion for each stock. I plan to finish the article over the next couple days.

Note...

Growth Stocks Shrivel; Income Stocks Grow

Ten Clean Energy Stocks For 2014: June Update Tom Konrad CFA While the major market indexes were hitting new highs in May, small capitalization stocks and clean energy stocks (most of which are small cap) continued to lag. The broad market benchmark IWM gained just 0.2% and is down 2.3% for the year, while my clean energy benchmark PBW fell 3.2% cutting its gains for the year to a slim 1.2%. Meanwhile my 10 Clean Energy Stocks for 2014 model portfolio managed to eke out a 0.3% gain. ...