by Debra Fiakas CFA

Keep the applause down! Contain your enthusiasm for yet another biomass- or gas-to-liquids company. Over the past several weeks I have written about a number of privately-held developers of one technology or another intended to produce a drop-in renewable fuel from biomass or natural gas. There are more, In this post we check in on Velocys (VCL: London), which stands out from the rest as a public company. No matter that it’s technology looks like that of the very next renewable fuel company, it is accessible to minority investors.

Until recently Velocys was known as Oxford Catalyst Group, a name that perhaps better describes the technology behind the company. Velocys has developed a small-scale modular plant that can be deployed in remote locations where stranded natural gas or waste biomass can be found. Velocys uses the conventional steam reforming and Fischer Tropsch processes, but has added a twist it calls ‘microchannel reactors’ where it deploys a proprietary catalytic effect. The microchannels, with reduced dimensions, intensify the chemical reactions and deliver greater efficiencies than conventional Fischer Tropsh and steam reforming processes.

The company recorded the first commercial sales of its microchannel reactors in the year 2013. An important market for Velocys is the oil and gas industry, needs to capture and upgrade stranded gases rather than burning them off in the oil field. Primus Green Energy, which was discussed in the July 15th post “Primus Wants to Clean up Fossil Fuels” and is also targeting this market with its version of steam reforming.

The company has some interesting partnerships to help penetrate commercial markets: waste handler Waste Management (WM: NYSE) and power generator Pinto Energy. Velocys has a joint venture with Waste Management in Oklahoma, where the company expects to locate a plant next to one of Waste Management landfills. Final permits have been submitted and approvals are expected in 2014.

Just as this article was being prepared, Velocys announced its intention to acquire its partner Pinto Energy in a gas-to-liquids project near the Port of Ashtabula in Ohio. The project is expected to receive final permits yet in 2014 and then convert natural gas from the Marcellus shale region to liquid gas. Velocys claims Pinto Energy has a string of similar projects in its pipeline. If that is the case there should be a nice step up in value after the all-stock deal is completed.

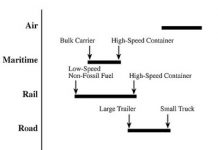

Velocys shares traded down on news of the Pinto Energy acquisition. Perhaps investors would rather see the company report its first profits. Still investors, even those who have not considered a London Exchange listed company, should take note of VLS.L. There is some concern about the benefits of switching to natural gas from an environmental standpoint. Make no mistake about it, natural gas is still a fossil fuel. However, compared to coal it has some merits. What is more gas-to-liquids could serve as a valuable interim fuel source for U.S. transportation transitions away foreign oil and gas to electric or another more environmentally friendly fuel source. What is more, Velocys technology does help clean up one of the dirtier elements of the oil and gas industry – burning off waste gases into the atmosphere.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

I think Velocys’s offer is too expensive for most of the market. The kinds of products that it is going to produce (such and nap and waxes) don’t have any really value outside the OECD and by doing EPC in Houston, it is going to be in the $ 150,000/bbl/day category.

That’s just too darn expensive for most of the world.

Better is to go through a simple DME approach