10 Clean Energy Stocks for 2022-2023: The List

By Tom Konrad, Ph.D., CFA

With the launch of my (green dividend income focused) hedge fund early this year, I had to take a hiatus from publishing my annual list of 10 Clean Energy Stocks that I feel will do well in the coming year. Since my duty to clients takes precedence over readers, I could not tell people about stocks I liked before buying them for the fund.

As we complete the first half of the year, the fund is now largely invested, although I am still keeping some buying power back in anticipation that the overall market could easily...

Shares of Capstone Rising

Shares of Capstone Turbine Corp (CPTC) are rising sharply this morning with high volume and gapped up with a gain of over 35% this morning. There is currently no news to cause this increase today and I will be digging deeper to find out what is going on. This is good news for the stock and also the portfolio. My holdings are now up over 50% in about 10 days. If you were thinking of buying the stock now, you should wait till some news confirms this move. Update at 12:15 EST: The only news I can...

June Bloom: Ten Clean Energy Stocks For 2014, Q2 Update

Tom Konrad CFA After two weak months, June brought a strong recovery to clean energy stocks and the market in general. The broad market benchmark IWM put on 7.2%, reversing its previous loss for the year to enter the 4th of July holiday up 4.7%. My clean energy benchmark PBW shot up 8.6%, for year to date gains of 9.9%. Meanwhile my relatively conservative 10 Clean Energy Stocks for 2014 model portfolio rose 3.6%, retaining its lead on the broad market with a 7% gain so far this year, but falling...

Five Alternative Energy Stocks For 2014

By Jeff Siegel There's no doubt about it: 2013 was a fantastic year for alternative energy investors. The big story this year was Tesla (NASDAQ: TSLA). A company that we began touting years before the company even went public, Tesla soared this year, taking the stock from $34.71 in January to a high of $194.50 a share in September. Folks, a 460% gain from an electric car company in just nine months would've been laughable in 2013. Today, it's the one of the most hyped stories in the world of finance... And if you listened to me...

Ten Clean and Green Energy Stocks for 2011

Tom Konrad, CFA My annual mini-portfolio of clean energy stocks which I expect to outperform in 2011. This is my fourth annual list of renewable energy and energy efficiency stocks since I began the series in January 2008. The Purpose of this List For myself, these lists serve as a record of my thinking on the market which I can look back on and learn from over the following year. When I publish the list, I state my reasons for selecting each stock, and then track the portfolio's performance over the following year in...

Ten Clean Energy Stocks For 2019: What Caution Looks Like

by Tom Konrad Ph.D., CFA

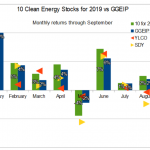

So far, my worries about stock market valuation and political turmoil have not turned into the stock market downturn I've been warning readers to prepare for. In fact, September has been a particularly sunny month for both clean energy stocks and the stock market in general.My broad income stock benchmark SDY was up 3.9% and the energy income stock benchmark YLCO rose 2.7% for the month, more than reversing August's declines. My 10 Clean Energy Stocks model portfolio accelerated upward by 5.3%, as did my real-money managed strategy, the Green Global Equity Income Portfolio(GGEIP), which...

May Dividends Rise: Ten Clean Energy Stocks For 2015

Tom Konrad CFA My Ten Clean Energy Stocks for 2015 model portfolio had a good May, despite headwinds from the strengthening dollar and declines in clean energy stocks in general. As a whole, the model portfolio rose 2.2% for the month, the same as my broad market benchmark. In general, clean energy stocks did worse, with the Powershares Wilderhill Clean Energy ETF (PBW) down 1.9% for the month. The portfolios clean energy benchmark, which blends PBW with the more income oriented Utility ETF, JXI, was flat. For the year to date, the portfolio is up 7.4%, ahead...

October Undoes September: Ten Clean Energy Stocks For 2015

Tom Konrad Ph.D., CFA In the two months since my last "monthly" update, clean energy stocks fell precipitously in September and then recovered most of those losses in October, although not for the year. Income focused Yieldcos have been particularly badly hit, but my income heavy Ten Clean Energy Stocks for 2015 model portfolio has done quite well in spite of this. I attribute this resilience to my emphasis on current dividend income, rather than the dividend plus double-digit growth that many Yieldcos were promising before the collapse in their stock prices rendered...

Covanta and Green Plains Partners Don’t Let A Crisis Go To Waste

by Tom Konrad, Ph.D., CFA

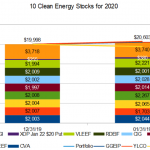

Last week, two of the stocks in my Ten Clean Energy Stocks model portfolio cut their dividends. Covanta Holding Corp (CVA) dropped its quarterly payout from $0.25 to $0.08 (a 68% cut) while Green Plains Partners (GPP) slashed its quarterly distribution from $0.475 to $0.12, a drop of 74.75%.

Before reducing their dividends, both companies had payout ratios near 100%, meaning that substantially all of their free cash flow was going to pay dividends. In general, companies are very reluctant to cut their dividends because it is a signal that their management thinks they cannot grow...

Our Blue Chip Alternative Energy Stock List

The market has fallen sharply, and Solar stocks have fallen even more following rumors that Congress will pass the Energy Bill without the Production Tax Credit or Investment Tax Credit. Given this volatility and Renewable Energy's reputation for profitless startups, now might seem like an excellent time for a risk adverse investor to abandon the sector altogether. Not so. Even if all tax credits and other incentives for Renewable Energy were to be removed, the underlying drivers of Alternative Energy remain firmly in place: Rising energy prices and decreasing reserves, the need to reduce our Greenhouse gas emissions to avoid...

Atlantica Q1, Buying Hannon Armstrong

By Tom Konrad, Ph.D., CFA

Here are two more updates from last week on Patreon. Also, I realize I neglected to publish the monthly performance chart for my 10 Clean Energy Stocks model portfolio here at the start of the month, so here it is as well:

Atlantica Sustainable Infrastructure Earnings

(published May 11th)

Atlantica Sustainable Infrastructure (AY) released its first quarter earnings announcement and financial statements on May 6th.

Atlantica is one of the higher yielding Yieldcos, 5.3% at the new quarterly dividend rate of $0.43 and a $32.50 stock price. The dividend is safe, since most of Atlantica's debt is fixed rate,...

In a Buying Mood

Several key indicators I follow have put me back into a buying mood. But sadly I will be spending most of my day in meetings and will not have much time to follow through on any purchases. I wanted to post a quick update about the stocks I'm following. I will be averaging down on some of my current holdings this week and also looking to add some new stocks to the portfolio. Here is my short list of new stocks I'm taking a close look at to add to the portfolio: Capstone Turbine Corp (CPTC)...

Ten Clean Energy Stocks for 2011: Year In Review

Tom Konrad CFA My clean energy portfolio outperformed again in 2011, but it was a Pyrrhic victory. Without a doubt, 2011 was a horrible year for Clean Energy stocks, nearly as bad as 2008. The difference was that, in 2008, the entire stock market was crushed, while this year, the broad market ended with only modest declines compared to clean energy stocks. Based on 2010 and 2011 closing prices, the broad market (as measured by the performance of the Russell 2000 index), was down 10%, while clean energy stocks were down 52%, as...

10 Clean Energy Stocks for 2011: Q2 Update

Tom Konrad CFA Some investors buy clean energy stocks because it's the right thing to do, others because we know that the diminishing availability and increasing environmental impacts of traditional fuels will eventually force society to adopt more sustainable solutions. Cartoonist Scott Adams says we're all wrong, and we should invest in companies we hate. Although Adams' column is meant to amuse, rather than as investment advice, it's funny because he touches on two very important truths about investing. Although a few investors can outperform the market over the long run, the vast majority can't,...

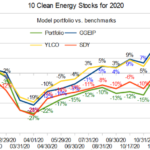

Year in Review: 10 Clean Energy Stocks for 2020

by Tom Konrad, Ph.D., CFA

Looking Back

At the end of 2019, I was worried about overvaluation.

I wrote that my main goal for the 10 Clean Energy Stocks for 2020 list was “to find stocks which will be resilient in the event of a US bear market.” We certainly had a bear market in 2020, although it was nothing like the kind of bear market I had been anticipating. The bear market was precipitated by the coronavirus pandemic, rather than overvaluation.

While I can claim to have anticipated the 2020 bear market, if not its nature, I was surprised by two other...

Divestment v Coronavirus: Ten Clean Energy Stocks for 2020 January Update

by Tom Konrad, Ph.D., CFA

January 2020- where do I start? A year of market-shaking news in a month.

The Brink of War

The month started off with a literal bang when Trump decided that a good way to distract the public from his impeachment trial would be to try to start a war with Iran by assassinating one of Iran's top military leaders, Qassem Suleimani. A week later, the world and markets heaved a collective sigh of relief when Iran decided that their honor had been satisfied with two missile strikes on US bases. While Trump reported no casualties, Iran's Foreign...