Ten Clean Energy Stocks For 2014

A list of ten high yield and value clean and alternative energy stocks expected to do well in 2014.

Ten Clean Energy Stocks For 2014: Patience Rewarded

Tom Konrad CFA For both the stock market and the weather, March was more lion than lamb. My broad market benchmark fell 2.2% to end up 1.5% for the quarter. Volatile clean energy stocks were down 4%, to end the quarter up 15.7%. My annual Ten Clean Energy Stocks model portfolio is designed to avoid much of the sector's notorious volatility, and fell only 0.6%, ending the quarter with a 3.9% total return. In dollar terms, the first six (income oriented) picks returned an average...

10 Clean Energy Stocks: Returns Through February/ Poll

by Tom Konrad Ph.D., CFA

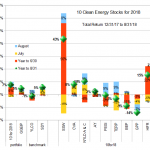

I'm experimenting with how to display the returns of the 10 Clean Energy Stocks model portfolio. My Patreon supporters seem fairly evenly split between the two options show below, so I'm opening the poll up to my broader readership.

You can see the two most popular options below (with real return data through the end of February) and take the poll here.

Comments are welcome as well.

DISCLOSURE: Long all stocks in the model portfolio.

Notes On YieldCos, Future Fuel, and Aspen Aerogels

by Tom Konrad Ph.D., CFA Since I have not had much time to write for AltEnegyStocks, I thought I'd share with readers some notes I wrote for investors in the JPS Green Economy Fund, a hedge fund for which I'm director of Research, regarding our holdings in the third quarter: In the third quarter, we took advantage of the general decline of clean energy "YieldCos" to add two of these owners of wind and solar farms to our portfolio at attractive yields. Pattern Energy Group (PEGI) is an owner of wind farms having long term power purchase agreements...

Two Canadian IPPs For Your Portfolio

Most alternative energy investors are aware of North American wind power's very bright growth prospects. In past articles, we discussed encouraging projections for the US and Canadian (PDF document) wind markets between now and 2015. While onshore European capacity is fast being exhausted, North America is only beginning its foray into wind and some major capex can be expected in this space over the coming years. Besides solid expected growth, another phenomenon is currently impacting the wind industry; consolidation. This is a global movement that is affecting all of the power gen sector, and that has no-doubt been...

Performance Update: 10 Clean Energy Stocks for 2009

I promised I'd do a performance update on my 10 Clean Energy Stocks for 2009 each quarter. Here is the first (although readers got a mini-update in mid February, because I decided I didn't want to use double-shorts.) Company Ticker Change 12/27/08 to 3/27/09 Dividend & Interest The Algonquin Power Income Trust AGQNF.PK +7.14% 5.36% Cree, Inc. CREE +59.96% First Trust Global Wind Energy ETF FAN -10.73% General Electric GE -32.50% 1.94% Johnson Controls JCI -25.97% 0.77% New Flyer...

Ten Clean Energy Stocks For 2018: Second Quarter Earnings

Tom Konrad Ph.D., CFA

July and August saw some mild recovery for the stock market after a difficult first half of 2018. Clean energy income stocks continue to lag the broader market, but my Ten Clean Energy Stocks model portfolio has managed to maintain its lead over its broad market benchmark.

Through August 31st, the model portfolio is up 7.5%, compared to its broad dividend income benchmark SDY, which is up 5.3%. Its clean energy income benchmark YLCO is down 1.2, even after dividend income. The private portfolio I manage, the Green Global Equity Income Portfolio (GGEIP), is slightly behind the...

Our Blue Chip Alternative Energy Stock List

The market has fallen sharply, and Solar stocks have fallen even more following rumors that Congress will pass the Energy Bill without the Production Tax Credit or Investment Tax Credit. Given this volatility and Renewable Energy's reputation for profitless startups, now might seem like an excellent time for a risk adverse investor to abandon the sector altogether. Not so. Even if all tax credits and other incentives for Renewable Energy were to be removed, the underlying drivers of Alternative Energy remain firmly in place: Rising energy prices and decreasing reserves, the need to reduce our Greenhouse gas emissions to avoid...

October Undoes September: Ten Clean Energy Stocks For 2015

Tom Konrad Ph.D., CFA In the two months since my last "monthly" update, clean energy stocks fell precipitously in September and then recovered most of those losses in October, although not for the year. Income focused Yieldcos have been particularly badly hit, but my income heavy Ten Clean Energy Stocks for 2015 model portfolio has done quite well in spite of this. I attribute this resilience to my emphasis on current dividend income, rather than the dividend plus double-digit growth that many Yieldcos were promising before the collapse in their stock prices rendered...

November Update: What Will The Election Bring for Clean Energy Stocks?

11 Clean Energy Stocks for 2012 Tom Konrad CFA October Overview October brought a gentle fall to my Clean Energy model portfolio, and a slightly-less gentle decline for the clean energy sector and the stock market as a whole. Both the unhedged and hedged versions of my model portfolio fell 2.3% for the month, compared to a 4.1% decline for the widely held Powershares Wilderhill Clean Energy ETF (PBW), which I use as a benchmark for the clean energy sector as a whole, and a 4.0%...

Performance Update: 10 Solid Clean Energy Companies to Buy on the Cheap

Unlike my Ten Speculations for 2008, my Solid Clean Energy Companies series will be much more difficult to benchmark. The intent of the series was to list some "stocks to buy when you think we've hit bottom." Since I obviously don't know when you think we've hit bottom (My opinion: not yet), I don't know what prices you'd have paid. Instead, I'll look at what would have happened if you bought only those stocks which dropped 10% since I wrote about them, and you bought them at the close that day, in equal dollar amounts. Here's...

Optionetics Story on Alt E Stocks

Fredric Ruffy from Optionetics.com has written a cautionary article about investing in Alternative Energy stocks. If alternative fuel companies made lots of money, there would be no energy crisis today. Unfortunately, most of these companies don't. You will start to see more and more stories about this sector now that gas prices are starting to cross the $3 per gallon mark and head even higher. As I said in a previous article, this sector is currently in a trading market. While he cautions investors that are looking for the long term viability of this investment, he...

Ten Clean Energy Stocks for 2010: Third Quarter Update

Tom Konrad CFA I like to think that one of the things that distinguishes me from the mass of investment bloggers and newsletter writers is that I write about my mistakes, as well as my great calls. This is not just a service to readers, but a service to myself. Overconfidence and why I write about my mistakes One of the most pernicious cognitive errors common among stock market investors arises from our wish to see ourselves as great investors. One of the ways we accomplish that goal is to selectively and unconsciously self-edit our...

Ten Clean Energy Stocks For 2016: August Earnings

Tom Konrad, Ph.D., CFA My Ten Clean Energy Stocks for 2016 model portfolio continued to coast upward in August after five months of blistering performance since February, while clean energy sector benchmarks and real managed portfolio, the Green Global Equity Income Portfolio (GGEIP), pulled back slightly. The following chart shows the performance of the model portfolio and its sub-portfolios against their benchmarks. The portfolio, its growth and income subportfolios, and GGEIP all remain far ahead of their benchmarks. Second quarter earnings announced this month were neutral or positive for the income...

My Portfolio’s Latest Casualty And Addition

The Casualty Last Monday, I discussed how I had recently reviewed Railpower Tech with a view to potentially adding to my position on grounds that: (a) the company had a fair amount of cash in the bank, which reduced the need to go to capital markets for financing for a while; and (b) that it was getting badly battered by general market conditions, potentially offering an attractive entry point. Although my portfolio has taken a beating in recent weeks, I remain ready to take small positions in stocks if I feel they are being unfairly bashed, including in...

Ten Clean Energy Stocks For 2015: Marching Ahead

Tom Konrad CFA My Ten Clean Energy Stocks for 2015 model portfolio added a second month to its winning streak, with a 6.1% gain for the month and a 5.7% gain for the year, despite a continued drag by the strong dollar. If measured in terms of the companies' local currencies, the portfolio would have been up 7.5% for the month and 10.5% for the quarter or year to date. For comparison, the broad universe of US small cap stocks rose 1.5% for the month and 4.0% for quarter, as measured...