Last week I wrote a post about the future of ethanol. In it, I promised a sister piece on the future of coal-to-liquids (CTL). This comes a bit later than initially promised…I apologize to those who had been holding their breaths. I already wrote a post discussing the future of CTL not very long ago. I’m thus not going to repeat myself here, but rather supplement that post with some new info. CTL In The News As stated at the outset of the ethanol article, what drove me to write a series of posts on alternative fuels is that big news items on both ethanol and CTL abounded (relatively speaking) during the first week of January. Firstly, a very insightful piece on China’s CTL industry appeared in Technology Review in early January (I would recommend this if you have about 10 minutes to spare, it’s very interesting). This was followed, a short while later, by news that 2 US Senators were trying to revive a piece of legislation aimed at boosting production capacity and providing investment tax credits for CTL in the US. The 2 Senators are also apparently keen on forming a “Senate Coal-to-Liquid Fuel Caucus��?. This could be the first step to some helpful pork being funneled to that industry, which, admittedly, hasn’t been shown much political love since shortly after the oil shock of the late 1970s. Finally, a few days ago, news came out that a DKRW unit involved in one of the first large-scale CTL projects in the US, Medicine Bow, had found a buyer for 100% of its synthetic fuel output, due to start flowing in late 2010. This project will have an initial capacity of 10,000 bpd, with a potential of up to 35,000 bpd after expansion. (BTW, If you want to browse a good database of CTL news, I would recommend the Green Car Congress’) CTL Growth There are currently no great short-term plays on CTL in the US, for the plain and simple reason that there is no CTL production to speak of in America today. The first significant CTL production is not scheduled to occur until around 2011. The EIA estimates that CTL production should reach 5.7 billion gallons by 2030. Compare that, for instance, to the ethanol industry, with 4 billion gallons of output in 2005 and a projected 14.6 billion gallons in 2030. Investing in CTL Potentially, CTL has all the hallmarks of a great transition fuel: coal abounds, the technology to produce CTL has been around for a few decades, it can be made into a very clean-burning alternative to gasoline, and if oil does not dip below the upper 40s/lower 50s for an extended period of time, CTL can compete. However, as discussed above, there may not be a good way to play this in the US for a few more years. That is why you should take a good hard look at China, because CTL is already happening there, and it will be big time in the foreseeable future. The great thing is, you can invest in a US-listed company with great exposure to the Chinese CTL market: Sasol [NYSE:SSL]. Sasol is currently involved in one of China’s most ambitious CTL projects.  Sure, the company’s share price has been correcting along with the price of oil over the past few weeks, and it could continue to do so in the short run. But there are certainly other things to consider. The Gold Stock Bull made the case for Sasol based on its exposure to CTL technology just before Christmas. Need anything more recent? Some 20,000 Motley Fool CAPS participants were very bullish on Sasol today. Although Rentech [NYSE:RTK] and Syntroleum [NASDAQ:SYNM] are 2 interesting companies to keep an eye on, Sasol may be on the verge of doing great things for its investors. I don’t think CTL is a panacea, especially not in the long run. However, it will occupy a growing niche in the transportation fuel mix of several large energy consumers like the US, China and India, at least until the feedstock (i.e. coal) starts to run low. The good thing about CTL from a retail investor standpoint is that there hasn’t yet been too much unfounded excitement around it, which is a problem that often plagues alt energy stocks. This could, however, change soon. The value investor might thus be able to scoop up a some good prospects, but my sense is that the window is closing. DISCLOSURE: I don’t have a position in any of the stocks discussed above. DISCLAIMER: I am not a registered investment advisor. The information and trades that I provide here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here. Digg This

Sure, the company’s share price has been correcting along with the price of oil over the past few weeks, and it could continue to do so in the short run. But there are certainly other things to consider. The Gold Stock Bull made the case for Sasol based on its exposure to CTL technology just before Christmas. Need anything more recent? Some 20,000 Motley Fool CAPS participants were very bullish on Sasol today. Although Rentech [NYSE:RTK] and Syntroleum [NASDAQ:SYNM] are 2 interesting companies to keep an eye on, Sasol may be on the verge of doing great things for its investors. I don’t think CTL is a panacea, especially not in the long run. However, it will occupy a growing niche in the transportation fuel mix of several large energy consumers like the US, China and India, at least until the feedstock (i.e. coal) starts to run low. The good thing about CTL from a retail investor standpoint is that there hasn’t yet been too much unfounded excitement around it, which is a problem that often plagues alt energy stocks. This could, however, change soon. The value investor might thus be able to scoop up a some good prospects, but my sense is that the window is closing. DISCLOSURE: I don’t have a position in any of the stocks discussed above. DISCLAIMER: I am not a registered investment advisor. The information and trades that I provide here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here. Digg This

Agreed, this is going to be niche fuels technology -not a total replacement technology purely because of the primary energy requirements. By the way of niche, that’s still potentially hundreds ‘000’s tonnes of liquid fuel products per anum.

Compared to other forms of Alt-Energy-Tech I do think the price of oil is more important here, since the final product is compared like-with-like with the refined-oil-equivalent, unless you can give it “value added status” somehow…

Seems to me that alot of effort remains on the initial GTL. Rather than the slightly more complicated CTL or BTL.

Salsol and Shell are certainly involved in this – the Salsol involvement is a legacy of pre-apatite South Africa incidentally. It will be interesting to see how this can further economic development in SA – and the rest of the world.

I still think further energy efficiency and reduced primary energy requirements – are a must.

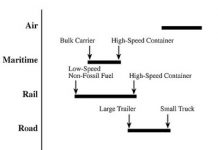

Technology-wise for those not familiar would be:

1. New Catalysis

2. Better reactor engineering & design

3. Improved yields/selectivity of reactions

3. Others… alternative chemistry? (if possible? and as yet unknown but can be worked on…)

NB* this a very basic non-exhaustive list!

TES, Thermal Energy Storage can eliminate the need for new coal fired power plants in Texas. About half the existing power plants are only used in the heat of the day in summer to generate electricity for air conditioning.

TES solves this air conditioning problem.

Charge a fee for all new construction that does not have a flat peak load profile. Use this money to fund retrofit of existing residences to TES. TES systems are now available for residential systems

Yes Yes – I was on James Fraser’s Energy Blog yesterday and TES came up and it sounds intriguing.

I wonder if you could couple a similar system to wind? For smoothing out the supply-demand conflicts issue?. Are they feasible on large scales?

I’d be interested in learning more on TES – and even more advanced storage-release systems … that can store ever larger amounts of renewable-derived energy, when it outstrips demand – and releases it when demand outstrips renewable supply…

a company that trades in canada in this field could one day amount to something big look at todays headline.

West Hawk Announces Deal With Lu’an Mining Group

http://www.stockhouse.ca/pfolio_v2.asp?page=displaynews&portid=220572&viewid=2&newsid=4242946&symbol=V.WHD&fromalert=1