Playing The BC Hydro Clean Power Call

At a time when many people see clouds on the horizon for US wind, one Canadian jurisdiction is moving full-swing ahead with a procurement for renewable power. British Columbia (BC), Canada's westernmost province, announced in June the launch of its Clean Power Call, an initiative aimed at sourcing 5,000 GWh of clean power. The structure of this process is distinctly Canadian and similar to what has occurred in the provinces of Quebec and Ontario. Like a US RPS, the government sets a target for renewable or clean power that the utility meets through procuring the electricity from private...

Shares in Scottish Power and Endesa Purchased

Scottish Power plc (SPI) is an electrical generation and distribution company primarily focused in the UK. They have two subsidiaries that are based in the US, PacificCorp and PPM Energy. They are currently in the process of trying to sell PacificCorp to Berkshire Hathaway. PPM Energy is a company with extensive wind energy development and generation. Scottish Power also has extensive wind farms in Scotland and Europe. They are also developing off-shore wind power of the Welsh coast. This stock has been moving strong recently and it looks like it is building a base at the $40...

China Poised For Significant Expansion In Wind Power Generation

by William Gregozeski, CFA China is the world’s largest producer of electricity, surpassing the United States in 2011, with demand increasing alongside its strong, sustained growth in GDP. Electricity generation in China has increased 9.6% annually, from 2005 to 2013, reaching 5,425.1TWh of electricity. Coal-fired plants currently make up over two-thirds of power generation, which is partly the result of an abundance of coal in China. Despite this growth, the country expects demand to continue to increase at a rapid pace, reaching 7.295TWh of demand in 2020 and 11,595TWh in 2040. However, the growth in electricity...

Crude Oil & Alt Energy: The Non-Relationship That Just Won’t Go Away

Charles Morand The relationship - or lack thereof - between oil prices and the performance of alt energy stocks has been a long-time interest of mine. I discussed it last in late March when I looked at correlations between the daily returns of alt energy and fossil energy ETFs. At the time, I found that only a weak relationship existed between the two and that if someone wanted to make a thematic investment play on Peak Oil, alt energy ETFs were not an ideal way to do so. Seeing as the popular press and countless "experts"...

Investing in German Wind Power

By Jeff Siegel When it comes to understanding the EU, I'm not the brightest star in the sky. And to be honest, after stumbling down a rabbit hole of proposals, directorates, and laws on the European Commission's website, I was even worse shape than before I started. The European Commission is the EU's executive body that represents the interests of the EU as a whole. And just yesterday it made a decision that will result in a huge boost for wind energy in Germany. Germany's 7 Gigawatts are Coming So as many in the renewable energy game know, following...

Google’s Renewed Cleantech Investment Binge

James Montgomery Google Doodle for Earth Day 2006 This week the Internet giant Google revealed that in December it invested $75 million in Pattern Energy's (NASD:PEGI) 182-MW Panhandle 2 wind farm in Carson County, Texas, northeast of Amarillo, expected to be operational by the end of this year. Pattern will hold an 80 percent stake in the project, whose owners also include Google and two institutional tax equity investors, with Morgan Stanley providing construction and equity bridge loans and a letter of credit. Google certainly has displayed a healthy...

Is Composite Technology Corporation Still a Buy?

by Tom Konrad When I asked, Alternative Energy Stocks readers overwhelmingly wanted me to take another look at Composite Technology Corp. (OTC BB:CPTC.OB) I've discussed CPTC several times over the last year, and consider it my most speculative pick in electricity transmission and distribution. True to the nature of a speculative stock with no current earnings which is still trying to establish markets for its products, the stock price has been all over the map. The reader interest is doubtless due to the recent sharp decline since mid January. I personally sold a portion of...

Inverter Stocks: A Backdoor to Solar and Wind Energy

Avoiding the Rush Whenever there is a gold rush, the people who make the real money are seldom the gold miners, but rather the suppliers to the miners that come home with the lion's share of the profits. This is not because there is not an incredible amount of money to be made in mining gold, but because the nature of a gold rush is that too many optimistic miners are encouraged by the early profits of a few to rush to pursue too few opportunities. To many, the rush into solar stocks seems to be just...

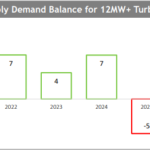

Broadwind Catches a Breeze

by Debra Fiakas CFA Two weeks ago wind tower builder Broadwind Energy (BWEN: Nasdaq) announced $28 million in new orders. Plans are to deliver all the towers within the year, giving a nice boost to the top-line for a company that recorded $170.3 million in sales over the last reported twelve months, well below the same period the year before. In addition to wind towers, the company produces gearing mechanisms used in the oil, gas and mining industries. Unfortunately, demand from these customers has been weak in recent periods. The company has had some difficulty in establishing...

Valuing Finavera’s Deal With Pattern Reveals Buying Opportunity

Tom Konrad Finavera's Wildmare Wind Energy Project is one of three projects in Bristish Columbia to be sold to Pattern Renewable Energy Holdings Canada for C$40M. An earlier sale to of Wildmare Innergex Renewable Energy fell through in September. Photo source: Finavera. On October 1st, following the failed sale of Finavera Wind Energy’s (TSX-V:FVR, OTC:FNVRF) 77 MW Wildmare Wind Energy Project to Innergex Renewable Energy Inc (TSX:INE, OTC: INGXF), Finavera announced that it was in talks with three potential bidders and would review all offers for the company. Finavera...

Eneti and the Jones Act

By Tom Konrad, Ph.D., CFA

About a month ago, an astute reader asked me if Eneti's (NETI) contracted Wind Turbine Installation Vessel (WTIV) would be able to operate in US waters since it will not be compliant with the Jones Act. For those not familiar, the Jones Act requires that all transport of goods between US ports must be done by vessels built in the US, and owned and operated by US citizens.

I looked into it, and concluded that it probably could, since installing wind turbines is not transport, but rather lifting (jack-up, in the parlance), an exemption which is...

American Superconductor: Reading the Tea Leaves

Tom Konrad CFA American Superconductor (NASDAQ:AMSC) dropped 52% since their profit warning on April 6th. Is it a screaming bargain, or does it have farther to fall? Two readers asked me to take a look at American Superconductor Corporation (AMSC) after the company issued a profit warning on April 6th. Although the stock was included in my list Ten Clean Energy Stocks for 2011, (which has produced more buying opportunities than profits so far this year) I did not own the stock in any of my managed portfolios, and so the research had to take...

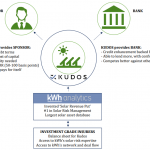

How Weather Risk Transfer Can Help Wind & Solar Development

by Daryl Roberts

The Need To Accelerate Renewables Adoption

Renewables are growing rapidly as a percentage of new electric generation, but are still being assimilated too slowly and still constitute too small of a fraction of total generation, to be able to transition quickly enough to scale into a low carbon economy in time to mitigate climate change.

The issue of providing public support, with subsidies and other reallocation methods, is a politically charged subject. High carbon advocates, for example American Petroleum Institute, argues that support for renewables distorts the market. On the other hand, it has been argued, for example by...

Colorado Voters Approve Amendment 37

Colorado voters have approved an amendment requiring utilities to get part of their electricity from the sun, wind or plant and animal waste. The amendment requires the state's seven largest utilities to get a portion of their retail electricity sales from renewables, beginning with 3 percent in 2007 and climbing to 10 percent by 2015. Four percent of the renewables should be solar sources.

Investing In Offshore Wind Power

Tom Konrad CFA Offshore Wind in the United States Last week, the long-embattled Cape Wind project got a break: Utility NStar(NST) agreed to buy 27.5% of the proposed offshore wind project's output. Together with a previous power purchase agreement with National Grid (NGG), this gives Cape Wind a buyer for 77.5% of the project's total projected output. Jim Gordon, Cape Wind's President speaking at Offshore Wind Power USA in Boston, called the NStar deal the "starting gun" for Cape Wind's financing round. Yet speakers and attendees at Offshore Wind Power USA agreed that the Cape Wind story...

#2 Finavera Renewables (TSX:FVR or FNVRF.PK)

When I first got wind (no pun intended) of Finavera Renewables (TSX:FVR or FNVRF.PK), I did not make too much of it because my view was that commercial exploitation of wave power - which is the banner under which Finavera has decided to promote itself to the investor community - was a few years away at best. Then, upon hearing that the company had managed to get a prototype in the water (PDF document), I decided to do a bit more digging. After all, if the technology worked, the economics of the business model would closely resemble those...