Portfolio For A GHG-Regulated World

Investment opportunities connected to climate change and greenhouse gas (GHG) regulation are a popular topic of discussion on this blog. Most of the time, however, the companies we discuss are relatively small, often unknown to most investors and overall pretty speculative. Yesterday, I came across an interesting article on Seeking Alpha entitled "Investing In a Greenhouse Gas-Regulated World" - the title says it all. The article looks at the question of investing in a GHG-constrained world from a conventional portfolio management perspective, and therefore argues for a low weighting in pure-play cleantech or carbon finance stocks, and...

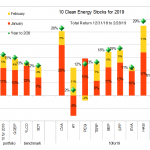

Ten Clean Energy Stocks For 2018: Wrap Up

by Tom Konrad Ph.D., CFA

Almost every major index fell in 2018. My Ten Clean Energy Stocks model portfolio and the Green Global Equity Income Portfolio (GGEIP), the real-money portfolio that I manage were not exceptions. Still, I'm satisfied with their performance: the model portfolio lost only 1.3 percent for the year, while GGEIP was down 2.6 percent. That's well ahead of most indexes, including my benchmarks YLCO (down 7.8 percent) and SDY (down 4.1%.) These benchmarks are intended to reflect the performance of clean energy dividend stocks and general of dividend stocks, respectively. Non-income oriented indexes such as the...

10 Clean Energy Stocks for 2020: May Update Part 1

by Tom Konrad, Ph.D., CFA

For the last few monthly updates, I've been focusing on the big picture, and have neglected to say anything about many of the 10 Clean Energy Stocks for 2020 since I looked at how the pandemic would likely affect each stock in March.

This month, I'm trying to rectify the oversight, and have been posting updates on individual stocks for my Patreon supporters since Friday. Below is a collection of the updates I've published so far. I am to keep posting one a day until I've gotten to all of them, after which I plan to...

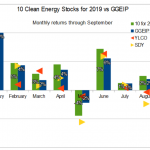

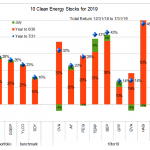

Ten Clean Energy Stocks For 2019: What Caution Looks Like

by Tom Konrad Ph.D., CFA

So far, my worries about stock market valuation and political turmoil have not turned into the stock market downturn I've been warning readers to prepare for. In fact, September has been a particularly sunny month for both clean energy stocks and the stock market in general.My broad income stock benchmark SDY was up 3.9% and the energy income stock benchmark YLCO rose 2.7% for the month, more than reversing August's declines. My 10 Clean Energy Stocks model portfolio accelerated upward by 5.3%, as did my real-money managed strategy, the Green Global Equity Income Portfolio(GGEIP), which...

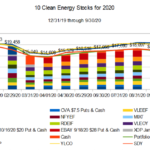

10 Clean Energy Stocks for 2020: Updated Model Portfolio

by Tom Konrad, Ph.D., CFA

After a couple down market days, all the limit orders I listed on Monday have executed.

Here is the current portfolio:

Position

Shares

Position

Shares

CVA

135

CIG

587

CVA Mar21 $7.50 Put

-2

RDEIF

100

VLEEF

57

VEOEF

75

GPP

276

EBAY Jan ‘21 $8 Put

-1

NFYEF

98

Cash

$4415

MIXT

274

Coming Up:

Third quarter earnings season is starting… I plan to write short notes on earnings as they come out for my Patreon supporters, which will be compiled into longer articles on AltEnergyStocks.com a few days later.

Also, I’m doing a talk on how to divest from fossil fuels with the founder of divestor.org this coming Monday at 8:30 pm ET for the Climate and Health subgroup of Citizens Climate Lobby ...

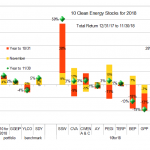

Ten Clean Energy Stocks For 2018: Quick November Update

by Tom Konrad Ph.D., CFA

At the start of November, I abandoned my short-term bearish stance on the market, writing "I’m not confident that the correction is over, but we seem to be heading into a temporary lull, and so I’m going to abandon cash as my top pick for November." This turned out to be a good call, with my Ten Clean Energy Stocks model portfolio up 4.3% for the month, slightly behind its broad dividend income benchmark, SDY, which was up 4.9%. Its clean energy income benchmark YLCO gained 1.6%, as did the private portfolio I manage, the...

10 Clean Energy Stocks For 2020 May Update: Red Eléctrica, Ebay, NFI Group

by Tom Konrad, Ph.D., CFA

Market Outlook

The continuing market rebound in the face of a worsening epidemic in the US (outside of the initially hardest hit states) widespread protests against lack of police accountability, and a President who thinks the right response to mostly peaceful protests is to call in the military continues to befuddle me.

The risks in today's stock market outweigh the possibility of future potential gains. Although I was buying aggressively in March, I've shifted back to a more cautious stance, and am mostly starting to sell covered calls on my positions with the greatest gains. I generally...

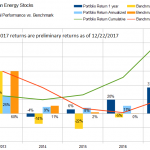

Ten Clean Energy Stocks For 2017: Taking Profits

By Tom Konrad Ph.D., CFA

2017 is turning into a second banner year in a row for my “Ten Clean Energy Stocks” model portfolio. I expected at best to make high single digit returns after the impressive 20% (while my benchmark fell 4%). Instead, the portfolio produced a 36.8% total return while its benchmark is up 19.5% with only four trading days left in the year.

Such returns are obviously cause for celebration, and also for profit taking. I plan to replace at least five of this year's list with new stocks in the 2018 (tenth annual) “Clean Energy Stocks” model...

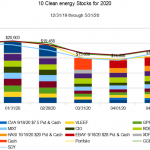

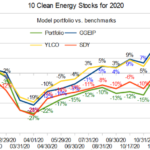

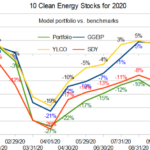

Year in Review: 10 Clean Energy Stocks for 2020

by Tom Konrad, Ph.D., CFA

Looking Back

At the end of 2019, I was worried about overvaluation.

I wrote that my main goal for the 10 Clean Energy Stocks for 2020 list was “to find stocks which will be resilient in the event of a US bear market.” We certainly had a bear market in 2020, although it was nothing like the kind of bear market I had been anticipating. The bear market was precipitated by the coronavirus pandemic, rather than overvaluation.

While I can claim to have anticipated the 2020 bear market, if not its nature, I was surprised by two other...

10 Clean Energy Stocks for 2020: Spooked in October, but Trading Anyway

by Tom Konrad, Ph.D., CFA

Two of the cash covered puts in the 10 Clean Energy Stocks for 2020 model portfolio have now expired, and I am left with a difficult decision as to what to replace them with.

As I discussed last month, I feel the market is overvalued given the economic impact of the pandemic and little prospect of fiscal stimulus before January. Yes, the market is not the whole economy, and large tech firms and high income workers and the wealthy are doing great while people on the bottom half of the income ladder are being crushed. With...

Ten Clean Energy Stocks For 2017: Summer Harvest

Tom Konrad Ph.D., CFA

Colossal Fossil Failure

With a president actively hostile towards renewable energy and focused on promoting fossil fuels, it would be easy to think that clean energy stocks would underperform their fossil cousins. The exact opposite has been true. Despite the administrations' efforts and tweets bragging about new highs for the Dow, energy funds are down over 10% for the year. For example, the Energy Select Sector SPDR (XLE), largely composed of oil and gas companies, is down 13% for the year. The tiny coal sector did better, with the VanEck Vectors Coal ETF up 18%.

Even so, Trump's...

Fuel Cell Companies Purchased for Portfolio

I placed several trades for the mutual fund this afternoon to start building a position in some of the fuel cell companies. This sub-sector has been under pressure the last couple of months but seems to be building a nice base of support at the current levels. I feel this entire sub-sector is ready for a nice up move and the stocks have been behaving nicely the last week or so. The one stock I seriously considered not adding was Quantum. The stock has been in a steady decline and there is no sign that it’s going to slow...

Ten Clean Energy Stocks For 2019: Marginally Hotter

by Tom Konrad Ph.D., CFA

July 2019 was “marginally” the warmest month on record. Meanwhile, the stock market was also inching to new highs, and the real, sweltering evidence of climate change continues to let clean energy income stocks turn in a blistering performance.

While my broad income stock benchmark SDY was up 16.0% through the end of July (0.9% for the month), my clean energy income stock benchmark YLCO is up 23.4% through July (0.4% for the month,) My 10 Clean Energy Stocks model portfolio is up 28.3% (1.3%) and my real-money managed strategy, GGEIP, is up 26.4% (1.2%) for...

Valeo February Update (Ten Clean Energy Stocks)

I'm trying something different and doing quick updates on individual stocks in my 10 Clean Energy Stocks model portfolio as I have time to write. The portfolio as a whole has been accelerating with the instant torque of an electric vehicle this year (details here.) I thought I'd start with the company that's newest to my readers,

Valeo SA (FR.PA, VLEEF)

12/31/18 Price: €25.21/$28.20. Annual Dividend: €1.25. Expected 2019 dividend: €1.25. 03/4/19 price: €29.13/$33.00. YTD gain: 15.5% Euro/ 12.8% USD.

I added this stock to the portfolio because it has great technology and and improving market share, but weak industry growth and overoptimistic management projections in 2018...

Ten Clean Energy Stocks For 2017: First Quarter Earnings

Tom Konrad Ph.D., CFA In the two months since the last update, most of the stocks in my Ten Clean Energy Stocks model portfolio have reported first quarter earnings. There were few surprises, and those were mostly pleasant ones, allowing the model portfolio to add to its gains, and pull a little farther ahead of its benchmark. For the year to the end of May, the model portfolio is up 13.8%, 2% ahead of its benchmark. The benchmark is an 80/20 blend of the clean energy income...

Performance Update: Sell and Short Recommendations

Investors are getting bearish these days, which comes as a surprise to me, since I'm used to being in the minority. I was a bear when I first took the leap from mutual funds and started trading stocks in 1999, and am a bear still. I wish I'd turned bullish for a couple of years at what I consider to be the large bear market recovery of 2003-2006, but I didn't. However, since I was (and still am) bullish on commodities since around the same time frame, I can't complain about my returns over the period. This spring, I...