Should “Green” Funds Invest in Fossil Fuels?

Marc Gunther Bill McKibben’s groundbreaking Rolling Stone story (Global Warming’s Terrifying New Math) and 350.org’s “Do the Math” divestment campaign raise important and difficult questions about fossil fuels. One that is starting to roil the world of socially-responsibly investing is this: How should mutual funds that strive to be “green” or “sustainable” or “socially responsible” deal with the fossil fuel companies in their portfolios? Should they divest, as McKibben argues? That was the topic of a column I wrote last week for the Guardian Sustainable Business, which generated some noteworthy responses. It’s part of the British newspaper...

Investing In Renewable Energy 101

UPDATE 3/4/2011: An up-to date article on selecting green mutual funds and ETFs can be found here. Why Invest in Renewable Energy? Given all the attention that renewable energy is getting in the news over the last couple years, investing in renewable energy has become a hot topic. People are drawn to renewable energy for one of several reasons: To fight Global Warming To prepare for Peak Oil. To improve Energy Security and local economies. To cash in on the above trends. The beauty of investing in renewable energy companies is that these goals are not...

An Actively Managed Green ETF: HECO

Tom Konrad CFA Deepwater Horizon Oil slick, as seen by NASA satellite, May 24, 2010 For a growing number of people, ecological responsibility means more than just recycling and changing our light bulbs. Many have started to ask, “How much good does saving a few hundred gallons of gas with a hybrid car do, when the mutual funds in your 401k own companies that are allowing 6.6 million barrels of oil to spill into the Gulf of Mexico, or fund misinformation about climate change?” For most, the answer...

Do You Need To Invest In Oil To Benefit From Expensive Oil?

Two months ago, Tom told us how he'd dipped a toe into the black stuff (i.e. bought the OIL etf) on grounds that current supply destruction related to the depressed price of crude oil would eventually lead to the same kind of supply-demand crunch that led oil to spike during the 2004 to mid-2008 period. If you need evidence that the current price of crude is wreaking havoc in the world of oil & gas exploration, look no further than Alberta and its oil sands. The oil sands contain the second largest oil reserves in the world after...

List of Alternative Energy and Clean Energy ETFs

This list was last updated on 4/27/2022.

ETFs are Exchange-listed funds which pool investor's money for the purpose of making Alternative Energy investments. Exchange Traded Funds (ETFs) track a specified Alternative Energy index. This list also includes closed-end mutual funds and other pooled investments which trade on exchanges.

ALPS Clean Energy ETF (ACES)

ASN Groenprojectenfonds (ASNGF.AS)

Bluefield Solar Income Fund (BSIF.L)

Defiance Next Gen H2 ETF (HDRO)

Evolve Funds Automobile Innovation Index ETF (CARS.TO)

First Trust Global Wind Energy Index (FAN)

First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index Fund (GRID)

First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN)

Foresight Solar Fund Limited (FSFL.L)

Global X Lithium...

A Buying Opportunity for Alternative Energy Mutual Funds and ETFs?

By Harris Roen Alternative Energy Mutual Funds Trade Down for the Year Alternative energy mutual funds have taken a hit, down 6.5% on average over the past 12 months. Just three of the 15 mutual funds we track are up for the year. The largest gainer, Brown Advisory Sustainable Growth Inv (BIAWX), is only up an anemic 6.2%. Much of the difficulty is due to a drop in solar stocks over the past 12 months. For example, if you look at the top weighted holdings of Guinness Atkinson Alternative Energy (GAAEX), nine out of 15...

Alternative Energy Funds: 2014 Review

By Harris Roen Mutual Funds (MFs) Falling fossil fuel prices have hampered 2014 returns for alternative energy mutual funds. Returns are slightly down on average for the past three-month, with a third of funds showing losses. Monthly gains fared worse, with only 2 out of 14 funds in the black. One-year returns are flat on average, and range from a high of 8.3% for Gabelli SRI Green AAA (SRIGX), to a low of -14.3% for Guinness Atkinson Alternative Energy (GAAEX)… Exchange Traded Funds (ETFs) Alternative energy ETFs had a wide range of returns for 2014,...

Shares of Capstone Rising

Shares of Capstone Turbine Corp (CPTC) are rising sharply this morning with high volume and gapped up with a gain of over 35% this morning. There is currently no news to cause this increase today and I will be digging deeper to find out what is going on. This is good news for the stock and also the portfolio. My holdings are now up over 50% in about 10 days. If you were thinking of buying the stock now, you should wait till some news confirms this move. Update at 12:15 EST: The only news I can...

UltraPromises Fall Short

When I first came across ProShares' UltraShort ETFs, I thought they were a brilliant idea. They seem to promise a multitude of advantages for investors: The ability to hedge market or sector exposure without having to go short. (Going short requires a margin account, and US law prohibits the use of margin in most retirement accounts.) They should have a better risk profile than shorting. With an UltraShort, you can't lose more than your initial investment. With true shorting, the potential losses are unlimited. As the underlying index rises, each percentage gain creates a smaller dollar fall, while...

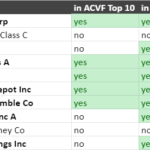

Step By Step Fossil Fuel Divesting With Mutual Funds

by Tom Konrad Ph.D., CFA

A large and growing number of individual investors are showing an interest in divesting from fossil fuels. Where in the past I have been asked to give a talk on divestment once every year or two, I’ve spoken on the subject three times so far in 2020. (Here is a recording of a presentation I did for my college alumni association.)

The response to these talks has been overwhelmingly positive, but I’m left with the impression that a lot of the less financially sophisticated attendees are still not sure where to start. For most of these...

Alternative Energy and Climate Change Mutual Funds, Part III

Tom Konrad CFA Past performance of green energy mutual funds. In part I of this series, I looked at the full costs of alternative energy and climate change mutual funds. I concluded that they were quite expensive, ranging from over 2% per year, to almost 6%. In a stock market that has historically produced returns of about 10.5% per year, but has been flat for the last decade, even 2.5% in expenses per year would have resuted in a substantial loss of value. In order to make up for the drag on returns, these mutual funds will...

Alternative Energy Outperforms All Other Sectors in September

By Harris Roen Alternative energy MFs racked up extremely robust gains in the past year. Returns range from a low of 16%, to a high of 64% for a mutual fund that is heavy into solar investments. ETFs also did well, but returns are much more variable. They range from a loss of 34% for a carbon ETF, to more than doubling of a solar ETF. Mutual Funds Returns remain excellent for alternative energy MFs overall, with average mutual fund up 32.3% for the year. Not a single fund posted a loss in...

Are ESG Funds All That Different?

by Jan Schalkwijk, CFA

ESG investing is all the rage these days. That is, investing that includes the non-traditional environmental, social, and governance factors in the investment process. Its appeal to the broader investment industry is twofold:

1) The writing is on the wall: as wealth is passed down to younger generations who in the aggregate care more about values alignment, the asset management industry does not want to lose the assets and the fees they generate.

2) Thematic investing is popular and ESG is one of the hottest themes. Wall Street is not going to miss out. Much like crypto...

Renewable Energy and Cleantech Mutual Funds and ETFs: Does Tax Efficiency Matter?

Alternative Energy and Climate Change Mutual Funds, Part VI Tom Konrad CFA My recent article, In Clean Energy, Active Management Pays, started a bit of a controversy. Rafael Coven, the Index Manager for The Cleantech Index (^CTIUS), which is the index behind the Powershares Cleantech Portfolio (PZD), left a comment on Barrons and sent me an email saying, "Your comparison of funds and ETFs ignores the tax efficiency differences which are very significant." Rafael is right that it's important for many investors to consider taxes before making an investment decision, and that ETFs are often more...

Strong Returns Continue for Alternative Energy Mutual Funds and ETFs

By Harris Roen Alternative Energy Mutual Fund Returns Alternative energy mutual funds have posted extremely strong returns across the board. Gains have shown a wide breadth, with all MFs up for the last 12-month and 3-month periods. In the past year, all funds are up double digits. A new fund has been added to our tracking system, Calvert Green Bond A (CGAFX). This fund started trading in November 2013, and is the first green open end bond fund designed for retail investors. CGAFX focuses at least 80% of its assets on “…opportunities related to climate change...

529 Plans Without The Fossil Fuels

by Tom Konrad Ph.D., CFA

The most popular way we have to save for our children's future education is destroying their future.

A 529 savings plan is a tax-advantaged savings plan designed to help pay for education. There are also prepaid tuition plans set up under the section 529 tax rules, but this article is focused on 529 savings plans, and will be what I mean by “529 plans” for the rest of the article.

The money in 529 plans can be used for college as well as K-12 education, apprenticeship programs, and paying off some student debt. Savings plans grow...