Fuel Cell Companies Purchased for Portfolio

I placed several trades for the mutual fund this afternoon to start building a position in some of the fuel cell companies. This sub-sector has been under pressure the last couple of months but seems to be building a nice base of support at the current levels. I feel this entire sub-sector is ready for a nice up move and the stocks have been behaving nicely the last week or so. The one stock I seriously considered not adding was Quantum. The stock has been in a steady decline and there is no sign that it’s going to slow...

Shares of Mechanical Technology and Medis Technology Purchased

I purchased shares of Mechanical Technology Inc (MKTY) and Medis Technologies Ltd. (MDTL) this morning for the mutual fund and also my personal portfolio. Both of these companies are working on the miniaturization of liquid fuel cells so that they can power portable electronic equipment like cell phones and laptop computers. Both companies have also secured contracts from the military to research portable fuel cells for military applications. Both companies announced earnings recently and still show no signs of becoming profitable in the near future. However, they have both made progress on trimming their losses. I feel that...

Alternative Energy and Climate Change Mutual Funds, Part I

Tom Konrad CFA Understanding the costs of green energy mutual funds. It's been a bit over a year since I last looked at the mutual funds in the Clean Energy sector. Each year, I comb through their portfolios for new ideas on where to invest my own funds and those of my green-minded clients, with the added bonus of being able to help readers make better decisions about which fund, if any, is right for them. This year, I looked at the eight mutual funds from AltEnergyStocks' green mutual fund list. In order of fund size,...

Calpine Gets Hammered

Shares of Calpine Corp. (CPN) suffered a greater than 20% loss yesterday and is now down almost another 13% today. All of this was caused by a court ruling stating that they will be unable to use the $395 million in cash they received from the sale of oil and gas fields earlier this year for the purpose of buying natural gas to run its power plants. The dispute stems from the Bank of New York's decision in September when, acting as trustee for Calpine bondholders, it withheld proceeds from Calpine's sale in July of North...

Alternative Energy Exchange Traded Funds (ETFs)

UPDATE 3/4/2011: An up-to-date article on selecting renewable energy ETFs can be found here. For investors looking for diversified exposure to Alternative Energy, Exchange Traded Funds (ETFs) are the best option. I have not found any statistical evidence that actively managed alternative energy mutual funds can beat the market (and hence justify their higher fees,) so lower expense ratios make ETFs compelling. Since last year, the wide variety of Alternative Energy ETFs also makes it possible to even speculate on subsectors. People who expect Solar, Wind, or even Carbon Trading to do better than Alternative Energy...

Is the New Smart Grid ETF GRID All That Smart?

Tom Konrad, CFA First Trust Launched a Grid Infrastructure Exchange Traded Fund (ETF) on November 17th. Although the First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index Fund (Nasdaq: GRID) is labeled a "Smart Grid" ETF to capture popular excitement around smart grid technology, it covers the whole grid infrastructure sector. This broader focus is good for clean energy investors. I've been an advocate of investing in electric transmission and smart gird stocks since early 2007, and for almost a year now, a regular reader has been telling me to create a transmission ETF so he can buy...

The Best Clean and Renewable Energy ETFs

Tom Konrad CFA For short term holders, the Powershares Wilderhill Clean Energy ETF (PBW) is the best If cost is the most important factor, an individual investor without the time or expertise to build a clean energy stock portfolio should choose one of the clean energy Exchange Traded Funds (ETFs). I recently reversed my former stance, and now believe that cost should not be the only factor, because the evidence suggests that, in clean energy at least, the active management available from a mutual fund or an advisor who works with individual stocks can...

The Holdings of the Powershares Global Progressive Transport Portfolio ETF (PTRP)

Tom Konrad, CFA I included the Powershares Global Progressive Transport Portfolio (PTRP) as an investment option instead of three stocks in my Ten Clean Energy Stocks for 2010, as part of a simplified portfolio for small investors wanting to minimize costs by making fewer trades. The other Exchange Traded Fund I used in this way was the First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index Fund (GRID). I took a look at the holdings of the Smart Grid ETF here, and they are not exactly what you would expect from the name. Since it makes sense to know...

Shares in Scottish Power and Endesa Purchased

Scottish Power plc (SPI) is an electrical generation and distribution company primarily focused in the UK. They have two subsidiaries that are based in the US, PacificCorp and PPM Energy. They are currently in the process of trying to sell PacificCorp to Berkshire Hathaway. PPM Energy is a company with extensive wind energy development and generation. Scottish Power also has extensive wind farms in Scotland and Europe. They are also developing off-shore wind power of the Welsh coast. This stock has been moving strong recently and it looks like it is building a base at the $40...

Options on Clean Energy ETFs

In my recent article about Green Energy Exchange Traded Funds (ETFs), I said that there were two main criteria investors should consider when choosing one (the fund's expense ratio, and its investment universe.) This is true for investors who are looking for a single investment in alternative energy, but if you are a more sophisticated investor or speculator, there's another important criterion: Is there a market for exchange traded options on the ETF? I personally love selling (a.k.a. "writing") options. If the stock market is a casino, option sellers are the house. Longtime readers will recall my article last...

Renewable Energy and Cleantech Mutual Funds and ETFs: Does Tax Efficiency Matter?

Alternative Energy and Climate Change Mutual Funds, Part VI Tom Konrad CFA My recent article, In Clean Energy, Active Management Pays, started a bit of a controversy. Rafael Coven, the Index Manager for The Cleantech Index (^CTIUS), which is the index behind the Powershares Cleantech Portfolio (PZD), left a comment on Barrons and sent me an email saying, "Your comparison of funds and ETFs ignores the tax efficiency differences which are very significant." Rafael is right that it's important for many investors to consider taxes before making an investment decision, and that ETFs are often more...

Alternative Energy Funds In The Lead

By Harris Roen Alternative energy MFs and ETFs posted record gains in the past 12 months. Guggenheim Solar (TAN) and Market Vectors Solar Energy (KWT) are the top two performers out of more than 1,500 ETFs. Firsthand Alternative Energy (ALTEX) and Guinness Atkinson Alternative Energy (GAAEX) are in the top ten for over 28,000 mutual funds. Mutual Funds Returns overall have been spectacular for alternative energy MFs. Even the lowest performer is up 27% in the past 12 months. The best performers are those strongly invested in solar, specifically ALTEX and GAAEX,...

As Goes January? What the Pullback in Green Mutual Funds Means

By Harris Roen Alternative energy mutual funds and ETFs have pulled back from some of the fantastic gains seen in 2013. There is a saying in the investment world that “as goes January, so goes the year.” Is it time to bail on this sector, or on stocks in general? Perhaps, but wise long-term alternative energy investors should avoid rash steps at this juncture. Alternative Energy Fund Returns Mutual Funds are down about 4% on average year-to-date, and are basically flat for the past three months. Despite this, alternative energy mutual funds are up 22.7%...

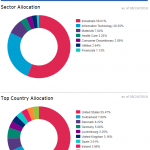

Green Mutual Funds and ETFs Show Signs of Life in 2015

By Harris Roen Alternative Energy Mutual Fund Recovering Alternative energy mutual funds are continuing to recover from a slump which started in fall 2014. Annual returns range greatly, though, from a high of 15.6% for Brown Advisory Sustainable Growth (BIAWX), to a low of -15.8% for Guinness Atkinson Alternative Energy (GAAEX). The large 12-month drop by GAAEX was precipitated by painful losses in some of its top weighted holdings… Alternative Energy ETFs Remain Volitile Green ETFs are showing a wide variety of returns, reflecting the volatility of the renewable energy sector....

Screening For the Best Clean Energy ETF

by Vic Patel

There are over a dozen major Clean Energy ETFs available to investors. But which one is the best one to put your hard earned money into? Best can mean different things to different people based on their investment preferences and risk profile.

In this article, I will provide a more empirical based reason behind why I believe that PZD is the most attractive Clean Energy ETF at the moment. I have based on my analysis of 4 primary factors: liquidity, diversification, recent price action, and last but not least expense ratio.

Liquidity has to be a major consideration in the...

The Bull Market For Alternative Energy Funds Continues

By Harris Roen Robust Alternative Energy Mutual Fund Returns Alternative energy mutual funds remain a strong investment sector, showing extremely robust returns in June. On average, MFs gained 28.1% for the year, and every fund posted double digit returns. Also without exception, all funds are up for the past three months. More importantly, long-term returns for alternative energy mutual funds have greatly improved in the past year. In June 2013, the average three-year return was 3.0%, with three out of 10 funds showing losses. Green ETFs Increase Gains Green ETFs have significantly...