Alternative Energy Will Outperform The Market, With Storage Stocks Leading the Way

The public relations firm Waggener Edstrom released a survey of investors and analysts yesterday seeking opinions on what was in store for alternative energy for 2009 (link to the survey at the end of this article). Of the 81 respondents, 47 were institutional investors, 26 were brokerage analysts, five were from independent research firms and three were classified as "Other industry participants". Overall, 58% of respondents were from the buy side, 32% from the sell side and the remainder from "Other". Here are a few tidbits that caught my attention. Storage: The Next Boom? Overall, 50% of respondents expect...

The Alternative Energy Revolution – Summary of Industry Sectors

Last week I was speaking to Jim Atkinson of Guinness Atkinson Funds (or GA Funds) (see Disclosure below). Jim sent me document or research paper called, "The Alternative Energy Revolution" which was written in April 2006. The document is usually accompanied by a prospectus for the GA Alternative Energy Fund. Today, I am not commenting on the fund itself but will summarize some of the information I found important in "The Alternative Energy Revolution" paper. A link to the document itself follows my summary. Please note, I am simply presenting the information and numbers in the document. ...

Stock Picking For Green Investors (Presentation)

Here is a short presentation on stock picking for green investors by AltEnergyStocks Editor Tom Konrad CFA, Ph.D., with a couple stock picks. I gave this presentation as part of a workshop on divestment from fossil fuels and investment in green stocks at the third annual Climate Solutions Summit. The Divestment part is here.

What’s In Store For Cleantech Stocks?

Tom Konrad Ph.D., CFA talks with four investors about the rocky year ahead for the stock market and the likely impact of the market correction. Note: This article was first published on GreenTechMedia on January 21st. With the markets in free fall since the start of the year, many investors are rightfully worried about their portfolios' rapid declines. Although one of the biggest drivers of recent declines has been the fall in fossil fuel (especially oil) prices, clean energy investors have been far from immune. Is it time for clean energy investors to run...

Will 2010 Be the Year of Cleantech Revenues, IPOs and, Maybe, Even Profits?

David Gold As a “gearhead” (engineer) I must admit I truly enjoy looking at all the cool technologies being developed by cleantech companies. The promise of cleantech hinges, in part, on these innovations. So it is not surprising that so much focus in the blogosphere and the press is given to the funding and development of these new technologies. Much like the dot-com buzz in the mid-90s, today we celebrate the amazing innovations that are taking seed. But for cleantech to avoid the fate of synfuels of the ‘70s or that of many of the early...

Will Rare Earths Cripple the Green Economy? Part 3

Eamon Keane This is Part Three of a three part series based on a rare earth elements (REE) review which is available for download at slideshare, where references can be viewed. Part 1 is an introduction to REEs. Part 2 analyzes REE consumption and refining and Part 3 looks at how REEs might affect the green economy. There have been several forecasts made for future demand. Approximate data was derived from Byron Capital Market’s own estimate and the data contained in Oakdene Hollins’ May 2010 report “Lanthanide Resources and Alternatives” for others . Figure...

Minimizing a Key Threat: State of the Union Address 2012

Garvin Jabusch Americans, rightly, prefer specifics and plans, as opposed to rhetorical vision and platitudes, from their president in their State of the Union addresses. We couldn't agree more, so here are our thoughts about President Obama's 2012 address, with respect to our area, the next economy and investing therein. President Barack Obama delivers the 2012 State of the Union Address (Image source: whitehouse.gov) Two years ago, President Obama in his State of the Union Address said, "The nation that leads the clean energy economy will lead the global economy and America must be that...

Investing in Climate Change…Again And Again

I caught this one a little late, but thought it might still be useful. The Globe & Mail, Canada's main national newspaper, is running, in its investment section, a segment on investing in climate change. I didn't find all of it useful, but there are some interesting nuggets of information that are worth sharing. More specifically, I enjoyed the piece on cleantech ETFs called "Go clean, invest green". It discusses The PowerShares WilderHill Clean Energy Portfolio , the PowerShares WilderHill Progressive Energy Portfolio , the PowerShares Cleantech Portfolio and the Claymore/LGA Green ETF . ...

Green New Deal Roadmap – Accelerating Renewable Energy Infrastructure Development

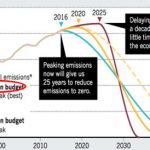

Investment in renewable energy is rising, but clearly needs to grow faster to meet the goals for an expedited transition away from carbon infrastructure if we are to avoid dangerous climate change, given that now even the Trump administration forecasts a 7°C increase by 2100, which would be catastrophic.

The Paris Agreement determined that in order to keep warming below 2°C, the global economy would need to be restricted to a 600 gigaton carbon “budget”, and completely decarbonize by 2040.

Emissions must be cut by 70% in the Paris-congruent Remap case, and 90% of those cuts in energy-related CO2 emissions can...

Financing Clean Energy: Perspectives

Tom Konrad, Ph.D. I recently moderated a panel on Financing Renewable Energy for the Colorado CFA Society. I took down choice quotes, with the plan of using them on Alt Energy Stocks' new twitter feed. I ended up with enough material for a short article. My panelists were Garvin Jabusch, COO of Green Alpha Advisors, a green-focused investment advisory firm in Boulder; David Gold, a partner at Access Venture Partners, and manager of their Cleantech investments, and Brian Greenman, of Greenman Financial Advisors, who does project development and finance for community wind developers. The broad range of perspectives seemed...

Will Rare Earths Cripple the Green Economy? Part 1

Eamon Keane Rare Earth Elements Eamon Keane This is Part One of a three part series based on a rare earth elements (REE) review which is available for download at slideshare, where references can be viewed. Part 1 is an introduction to REEs. Part 2 analyzes REE consumption and refining and Part 3 looks at how REEs might affect the green economy. Rare earths captured the popular imagination a year or two ago. Since then a bonfire of reports, presentations and analyses have been published, with many generating more consulting fees...

Renewable Energy Stocks By Dollars Per Watt

Tom Konrad CFA Disclosure: I and my clients own HASI and BEP. I have short call positions in NYLD and PEGI, and short put positions in PEGI. Dollars per watt ($/W) is a lousy measure of the economics of solar, but it persists. Most likely, it persists because it seems familiar. We can pay $4 for a watt of solar, or $4 for a Iced Hazelnut Macchiato at Starbucks. Unfortunately, while the analogy may seem apt, this is a lot like knowing you’re getting a Macchiato without knowing if it’s a Tall, Grande, or Venti. The actual energy production from a...

Watt’s Watt?

Watts are standard, but the way we talk and write about them is not.

Money Is Flowing Into Alt Energy Again, But We Are Not Out Of The...

Charles MorandIt seems as though the darkest clouds are finally dissipating over alt energy's financing horizon. Over the past few weeks, money has started flowing into the sector again, as evidenced by a number of recent deal announcements: On June 9, I reported on the upcoming IPO for Magma Energy Corp., a geothermal exploration company. The IPO's size will be upped from an initial C$50 MM to C$100 MM, a sign of increased market appetite SunPower Corp. raised $418 MM in early May through a share and debt offering, and recently announced it had reached a $100...

Cleantech Stimulus Still Not Stimulating

David Gold The stimulus bill along with the $31B cleantech element focused on grants and loan guarantees through the Department of Energy was passed into law over 18 months ago. About a year ago I wrote about how the cleantech stimulus was not very stimulating to our economy. I suggested at that time that the goals of stimulus and of long-term investment are largely incompatible, and the evidence is bearing that out. At the time, I felt like a bit of an outcast for having such a critical view and yet being an ardent supporter of clean technologies...

The Buffett Shareholder Letter & Alt Energy

It is fair to say that most people continue to equate the terms "alternative" and "energy" with expensive, unreliable and plain unpractical. This naturally leads a majority of people to view alternative energy investing as a high-risk play on some unproven technology with an uncertain probability of success. This is a perception we've tried to dispel on several occasions, whether we were talking about blue chip alt energy stocks, dividend alt energy stocks or utility alt energy stocks. It's also fair to say that most people don't typically associate value investing and, by extension, ...