What has Changed in the Alternative Energy Investment Landscape?

Is the time right to invest in alternative energy? We’ve seen a lot of this before in the 1970s and 1980s. Solar and biomass hot, big regulatory pushes, and then companies and investors lost a lot of money when things changed. We’re still a bit skeptical. We’re also all about not getting pulled in to each and every overpriced hype (read, the ethanol race) – but fundamentals are fundamentals. And they’re hard to ignore and pretty darn impressive. We think the real question today is not “are alternatives a good investment?��?, but “which ones have legs and make a...

Graftech Manages the Heat of Competition

by Debra Fiakas CFA Products like Graftech's ultra-thin heat spreader help customers manage the heat. Investors think restructuring will help Graftech do the same. Feeling the heat of competition, graphite materials supplier Graftech International Ltd. (GTI: Nasdaq) has initiated a restructuring of sorts. The company’s two highest cost graphite electrode plants will be closed. Those are located in Brazil and South Africa. A machine shop in Russia will also be shuttered. Locks will go on the doors in these locations by the end of...

Investing in Climate Change…Again And Again

I caught this one a little late, but thought it might still be useful. The Globe & Mail, Canada's main national newspaper, is running, in its investment section, a segment on investing in climate change. I didn't find all of it useful, but there are some interesting nuggets of information that are worth sharing. More specifically, I enjoyed the piece on cleantech ETFs called "Go clean, invest green". It discusses The PowerShares WilderHill Clean Energy Portfolio , the PowerShares WilderHill Progressive Energy Portfolio , the PowerShares Cleantech Portfolio and the Claymore/LGA Green ETF . ...

Energy in the Great Depression

Energy in the Great Depression Eamon Keane With the focus on the size of the ECB's balance sheet and eurozone bond auctions, it can be difficult to see the big picture of where this is going. Concerns about oil and climate change have taken a backseat to the foreboding sense of doom. To see the implications for energy it requires a look at the direction of the financial system. In recent times every 40 years or so there has been an upheaval in the monetary system, as Philip Coggan explains in his excellent...

The Energy Balance of Snake Oil

It's no secret that money is flooding into the alternative energy sector, but not all of this money comes from sophisticated, investors. Unsophisticated investment is a lighting rod for the scam artists. Because there is both an urgent need to deal with the the problems posed by global warming, energy security, and resource depletion, and the new money is rapidly accelerating the advance of technology in renewable energy, new innovations are very plausible. There are many ways to lose money in alternative energy, even without being taken by a scam. The current emotional...

How to Invest in Clean Energy Webinar

Eventbrite sign-up: https://www.eventbrite.com/e/how-to-divest-from-fossil-fuels-and-invest-in-clean-energy-tickets-591429470467?keep_tld=1

Cash in on the efficient transit and transmission building booms

This week's Fortune contains an article titled Cash in on the Rebuilding Boom in which the author, Katie Benner picks several companies she feels will benefit from upgrading the United States' aging infrastructure. She picked Granite Construction (NYSE: GVA), for their road, bridge, and mass transit construction business, Greenbrier (NYSE: GBX) for their railcar leasing operations, General Cable (NYSE: BGC) for their wire and cable business, and Wesco (NYSE: WCC) for their business distributing electrical supplies and equipment. I agree that our nation's infrastructure is in need of a massive upgrade and repair. However, given my expectation of continued...

Inevitable Shifts and Indispensable Technologies

Next Economy Inflection, Pt. III Garvin Jabusch Back at the New Year, I thought it’d be fun to write up a short recap of some of the evidence that, finally, the world is waking up to the real need to get our economies on a footing that can allow it to persist indefinitely. In that post I wrote of those observations that “these are just the first few recent ‘tipping point’-like stories to come to mind. I've read dozens more examples recently, and I feel the fact that I can no longer be aware of all the evidence...

6 Reasons Why Stock Markets Are No Longer Fit For Purpose

A new investment architecture is set to emerge By John Fullerton and Tim MacDonald Stock markets are not as portrayed on TV, the nerve center of capitalism. Stock markets are nothing more than tools to facilitate the exchange of stock certificates that represent contractual rights that have little to do with real ownership. Today’s stock markets are primarily about speculating on the future prices of stock certificates; they are largely disconnected from real investment or what goes on in the real economy of goods and services. It’s time for real investors such as pension funds and endowments to...

Earnings Season – Alternative Energy Stocks to Watch

By Harris Roen Some 44 companies active in alternative energy have reported earnings in January 2013. Results have been all over the map, so it is important for alternative energy investors to know where to be cautious, and where the best potential profits are to be found. Below is a summary of selected earnings results from alternative energy companies that the Roen Financial Report tracks. Date Linear Technology Corporation (LLTC) More Info 1/15 Earnings came in on target for this integrated circuit company, but EPS were down 16%...

T. Boone Pickens on Larry King Live Thursday

In the past 24 hours, there have been a flurry of opinions coming out on what a commanding Obama victory would mean for people's portfolios. Alt energy investors certainly have reasons to be cautiously optimistic. T Boone Pickens, the famous Texas oilman turned clean energy cheerleader, and his Pickens Plan, are likely to have some influence on where President-elect Obama goes with his energy plan and alt energy policies. Pickens has been campaigning for his plan nearly as hard as the candidates have been campaigning for the White House, and his recent rapprochement with the Democratic Party...

Are the Declines in Solar and Wind Stocks Structural, or Cyclical?

Tom Konrad, CFA Last week, I asked three green money managers if they thought cleantech stocks, especially solar and wind sectors were near a bottom. While they did tell me about eight cleantech value stocks, they were not ready to call the bottom. Commoditization in Clean Energy In response to my questions, Rafael Coven, the manager of the Cleantech Index (^CTIUS), which is the index behind the Powershares Cleantech Portfolio ETF (PZD,) ...

Delusions: The Secret to Lost Opportunities

By Jeff Siegel This past Thursday, as we sat down to yet another Thanksgiving feast, the obligatory What are you thankful for? question surfaced. To be honest, I've never been a fan of playing this game. After all, if you're thankful for something, why do you have to wait until November 24th to talk about it? Nonetheless, I played along that afternoon and decided I was thankful for all the great thinkers over the years that enabled progress and allowed us to enjoy the many comforts and conveniences we take for granted...

Presentation: A Permaculture Portfolio

Unfortunately, my attempt to record my presentation last Monday failed... still learning to use Screencastify. There was a lot that was not in the text of the presentation itself- I use slides more as a reminder of what I want to talk about than a script.

On the other hand, it would have been a 2 hour recording, so flipping through the slides will be at least save you time. The link to the PDF version is below:

A Permaculture Portfolio

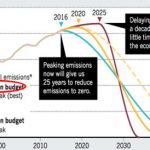

Green New Deal Roadmap – Accelerating Renewable Energy Infrastructure Development

Investment in renewable energy is rising, but clearly needs to grow faster to meet the goals for an expedited transition away from carbon infrastructure if we are to avoid dangerous climate change, given that now even the Trump administration forecasts a 7°C increase by 2100, which would be catastrophic.

The Paris Agreement determined that in order to keep warming below 2°C, the global economy would need to be restricted to a 600 gigaton carbon “budget”, and completely decarbonize by 2040.

Emissions must be cut by 70% in the Paris-congruent Remap case, and 90% of those cuts in energy-related CO2 emissions can...

Energy Trends That Matter For Investors

By Harris Roen The US is by far the world’s greatest user of energy per capita in the world. Each American uses about 87,000 kilowatt-hours per year – that is twice as much as the European Union (EU), the next closest consumer! Understanding energy trends in this country is extremely important for investors who want to understand how the energy landscape will look 10, 20 or 30 years from now. Figure 1: Global Per Capita Energy Use The U.S. Energy Information Agency (EIA) made public an early release of its in-depth Annual Energy Outlook. This...