Alternative Energy & Conventional Energy: Is An Image Worth A Thousand Words?

It wasn't long ago that people still believed the price of energy commodities - and crude oil in particular - had a greater impact on alt energy stocks than did general movements in equity markets or even fundamental factors. The logic went something like this: even though oil and most of the sub-sectors that make up the broad alt energy space (e.g. solar) are not in direct competition with one-another, expensive oil is the number one driver behind governments searching for alternatives to the way we currently meet our energy needs. For a time, this theory may have...

Crowdfunding and Clean Energy

by Beth Kelly The digital era has enabled an “entrepreneurial explosion”, equipping ordinary people with the tools to invest in a myriad of early stage companies. Rather than investing millions of venture capital at once, interested individuals can use online platforms like Indiegogo and Kickstarter to invest smaller sums in projects they feel passionate about. Crowdfunding holds vast potential in the renewable energy sector in particular, opening up a world of opportunity for both investors and “green” project developers. Now that renewable energy technology is becoming viable and cost-effective, firms in the industry are turning to crowdsourcing...

The Rare Earth Supply Chain: Ores, Concentrates, Compounds, Oxides and Metals

REE Refining 101 by Kidela Capital Group “There is a reason why the Rare Earths are called rare. They’re not called rare because they’re truly rare. They’re called rare because it’s very difficult to isolate these elements individually and it takes a lot of skill to do that.” Constantine Karayannopoulos, chief executive of Neo Material Technologies1 Rare Earth Elements have become an indispensable part of modern life, found in everyday items like computers, camera lenses and high efficiency light bulbs to complex, emerging technologies in the optics, medical and defence spheres....

Investing in Climate Change…Again And Again

I caught this one a little late, but thought it might still be useful. The Globe & Mail, Canada's main national newspaper, is running, in its investment section, a segment on investing in climate change. I didn't find all of it useful, but there are some interesting nuggets of information that are worth sharing. More specifically, I enjoyed the piece on cleantech ETFs called "Go clean, invest green". It discusses The PowerShares WilderHill Clean Energy Portfolio , the PowerShares WilderHill Progressive Energy Portfolio , the PowerShares Cleantech Portfolio and the Claymore/LGA Green ETF . ...

Cleantech Stimulus Still Not Stimulating

David Gold The stimulus bill along with the $31B cleantech element focused on grants and loan guarantees through the Department of Energy was passed into law over 18 months ago. About a year ago I wrote about how the cleantech stimulus was not very stimulating to our economy. I suggested at that time that the goals of stimulus and of long-term investment are largely incompatible, and the evidence is bearing that out. At the time, I felt like a bit of an outcast for having such a critical view and yet being an ardent supporter of clean technologies...

Introduction to Investing in Renewable Energy

UPDATE 3/4/2011: An up-to date article on selecting green mutual funds and ETFs can be found here. Why Invest in Renewable Energy? Given all the attention that renewable energy is getting in the news over the last couple years, investing in renewable energy has become a hot topic. People are drawn to renewable energy for one of several reasons: To fight Global Warming To prepare for Peak Oil. To improve Energy Security and local economies. To cash in on the above trends. The beauty of investing in renewable energy companies is that these goals are not...

What Obama Did To Coal Investors, What The Next President Might, And How Investors...

by Tom Konrad Ph.D., CFA Investing in the past is a good way to lose money. Just ask anyone who has been investing in coal stocks since Obama we re-elected. A glance at the chart above shows that the VanEck Vectors Coal ETF (KOL) is down about 50% over the last four years, even while the broad market (as represented by the SPDR S&P 500 ETF (SPY)) has gained almost 50%. But even if we knew this was going to happen, should investors have rushed into the energy sectors most loved by liberals: That is, Wind, Solar,...

Why Clean Energy Investors Need to Care About Politics

Tom Konrad I believe that investments in clean energy should outperform the market as a whole for two reasons. First, the inability of fossil fuel supplies to keep up with demand will raise prices and improve the environment for alternatives. Second, growing awareness of the seriousness of Climate Change will lead to increased regulation of greenhouse gas pollution, which should benefit clean energy relative to conventional energy. While I am certain that at some point reality will galvanize public opinion and political action on climate change, the sooner the politicians take action, the better for the planet, and the...

Ten Solid Clean Energy Companies to Buy on the Cheap: These Almost Made It

In the future, I plan to avoid doing lists of ten stocks. I've found the writing to be somewhat repetitious, and I suspect some readers feel the same way. Look for more threes and fives. That said, there are more than enough solid companies with strong clean energy arms. These companies are my favorite investments right now, both because I think that now is a time to play it very safe in the stock market (I'm also increasing my cash reserve), and because these companies allow me to use Cash Covered Puts. Since I do have several...

Scrappy Companies For Scrappy Investors

By Tom Konrad, Ph.D., CFA

Supply and Demand

One uncomfortable fact for green investors is that the clean energy transition is going to require a lot more mines. Lithium, nickel, cobalt, copper, manganese, graphite, even steel: just name and industrial commodity, and we’re probably going to need a lot more of it.

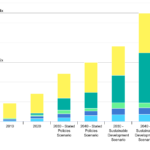

Total mineral demand for clean energy technologies by scenario, 2010-2040

Even worse, it’s not at all clear where all these materials are going to come from. While there are plenty of all the elements we need in the Earth’s crust, actually mining them all in the next 20 years is not...

Presentation: A Permaculture Portfolio

Unfortunately, my attempt to record my presentation last Monday failed... still learning to use Screencastify. There was a lot that was not in the text of the presentation itself- I use slides more as a reminder of what I want to talk about than a script.

On the other hand, it would have been a 2 hour recording, so flipping through the slides will be at least save you time. The link to the PDF version is below:

A Permaculture Portfolio

Feel-Good Government Grants Leading Cleantech Astray

David Gold Grants for smart grid projects. Grants for battery manufacturing lines. Loan guarantees for renewable energy project development. Grants to private companies for energy efficiency projects. And with each it seems that the cleantech world cheers. Yet for all our desire to create sustainability in our consumption and use of energy, this model of getting us there is not only unsustainable but is of questionable value. I want to emphasize that I am speaking about government grants to the private sector where the government is not the end customer and...

Energy Efficiency and Solar Lead Alternative Energy Stocks Skyward

By Harris Roen Industry Day Week Qtr Year Energy Efficiency -0.3% 2.3% 18.7% 49.9% Environmental -0.2% 1.1% 9.8% 11.8% Fuel Alternatives -0.3% 1.3% 19.6% 29.2% Smart Grid -0.1% 2.4% 9.5% 31.9% Solar 0.5% 6.8% 40.3% 52.8% Wind 0.0% 2.1% 9.7% 21.6% Average -0.1% 2.7% 17.9% 32.9% Data as of: 7/17/2013 Alternative energy stocks are up over 30% on average for the year, reflecting impressive gains off of widely oversold lows in 2012. Almost three-quarters of...

Financing Clean Energy: Perspectives

Tom Konrad, Ph.D. I recently moderated a panel on Financing Renewable Energy for the Colorado CFA Society. I took down choice quotes, with the plan of using them on Alt Energy Stocks' new twitter feed. I ended up with enough material for a short article. My panelists were Garvin Jabusch, COO of Green Alpha Advisors, a green-focused investment advisory firm in Boulder; David Gold, a partner at Access Venture Partners, and manager of their Cleantech investments, and Brian Greenman, of Greenman Financial Advisors, who does project development and finance for community wind developers. The broad range of perspectives seemed...

Stock Picking For Green Investors (Presentation)

Here is a short presentation on stock picking for green investors by AltEnergyStocks Editor Tom Konrad CFA, Ph.D., with a couple stock picks. I gave this presentation as part of a workshop on divestment from fossil fuels and investment in green stocks at the third annual Climate Solutions Summit. The Divestment part is here.

Climate Change & Corporate Disclosure: Should Investors Care?

Charles Morand On Monday morning, I received an e-copy of a new research note by BofA Merrill Lynch arguing that disclosure by publicly-listed companies on the issue of climate change was becoming increasingly "important". The note claimed: "e believe smart investors and companies will recognize the edge they can gain by understanding low carbon trends." I couldn't agree more with that statement. It was no coincidence that on that same day the Carbon Disclosure Project (CDP), a non-profit UK-based organization that surveys public companies each year on the state of their climate change awareness, was...