Ethanol and isobutanol producer Gevo, Inc. (GEVO: Nasdaq) is installing equipment in its Luverne, Minnesota plant to improve efficiency in corn processing. The company is leasing a proprietary corn fractionation or slicing process developed Shockwave, LLC based in DesMoines, Iowa. The new equipment is intended to increase by-product output, including feed protein products and food-grade corn oil. With sales of more valuable by-products Gevo expects to improve overall profit margins. Shareholders can expect to see results after the first quarter 2019, when the equipment installation is expected to be complete.

Shockwave keeps a low profile with no corporate website and no one to answer phone calls. However, there are plenty of other corn fractionation companies that are worthy of investor scrutiny. The various technologies bring a higher level of profitability to dry mill ethanol production by increasing efficiency in corn feedstock utilization and creating new revenue streams. Another plus is a reduction in greenhouse gas emissions.

Front-end corn kernel fractionation is a new step for conventional ethanol dry-grind production. Conventional ethanol plants us a hammer or roller mill to grind whole corn kernels. The ground corn is missed with water and then heated to break apart the starch polymers. Free glucose is freed from the corn starch and then fermented into ethanol and carbon dioxide. The non-starch portion is carried into a feed product called distillers grains (DDGS).

It is not a very efficient approach. Each bushel of corn yields about 2.8 gallons of fuel ethanol and 17 pounds of DDGS. Corn is the largest expense for a dry grind ethanol plant, leaving ethanol and chemical producers vulnerable to corn prices.

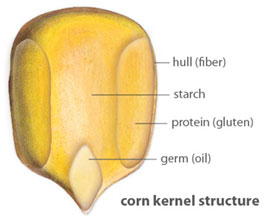

Corn kernels have three parts: germ, fiber and endosperm. Fractionation before grinding separates the three parts so that each can be used for its best attributes. The germ is high in corn oil and its best suited as feedstock for biodiesel or even as food-grade corn oil. The fiber or bran is also removed, leaving the starchy part of the endosperm or grit for fermentation into ethanol. Removal of the germ and fiber before the grinding step affects ethanol yields because the endosperm portion of the corn feedstock that heads to the fermentation step has a higher concentration in starch. Then the non-fermentable portion of the endosperm is turned into DDGS.

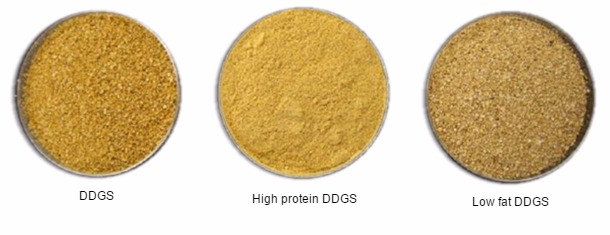

Fractionation decreases the amount of DDGS by-products that have been a mainstay of ethanol producers’ revenue streams. Those DDGS also have lower fiber and oil content, but higher protein value. However, fractionation does lead to an even higher-protein by-product that commands higher selling prices. The resulting high-protein grains stream or HPGS has a wider market, including hog and poultry feed as well as ruminants. It has similar composition to soy bean meal and is suitable for monogastric animals. Thus even though DDGS has represented as much as a quarter of ethanol producers profits in recent years, the addition of HPGS is expected to deliver even higher sales and profits.

A study described in an issue of Applied Biochemistry and Biotechnology determined that return on investment in front-end corn fractionation equipment increased by 2% on a hypothetical 40-million-gallon per year plant. Increased ethanol production and new higher protein DDGS by-products help to offset hefty capital costs associated with the additional equipment. It also provides an opportunity for Gevo and other ethanol producers to break into different animal feed markets.

A study described in an issue of Applied Biochemistry and Biotechnology determined that return on investment in front-end corn fractionation equipment increased by 2% on a hypothetical 40-million-gallon per year plant. Increased ethanol production and new higher protein DDGS by-products help to offset hefty capital costs associated with the additional equipment. It also provides an opportunity for Gevo and other ethanol producers to break into different animal feed markets.

Bio-Process Group based in Indiana is a self-described engineering solutions company. Among other processes for natural fibers, the company offers its Modular High Value (MHV) biorefining system for corn ethanol production. The system integrates fractionation, separation, fermentation and conversion technologies.

Oil seeds of all kinds are the specialty of Crown Iron Works headquartered in Minnesota. It claims to be the largest producer in North America of equipment used in oil seed preparation, processing and refining. Crown’s corn fractionation process begins with a tempering step that enables the corn kernels to absorb enough moisture for the fracturing step. The process focuses on the starchy endosperm or grit part of the kernel, sending that off to the fermentation process at the ethanol plant. The germ is then converted into high protein animal feed or edible oil.

In case anyone has missed the point, ethanol producers are keen on maximizing the amount of pure fermentable starch from their corn feedstock purchases. Cereal Process Technologies, LLC makes this concept the core marketing message for its corn fractionation equipment. CPT claims its system leads to purer germ and bran streams that command higher prices in the market for ethanol production by-products. Another point in their pitch to ethanol producers is lower energy costs since corn components that cannot be turned into ethanol are not put through the fermentation process.

No doubt there are other sources for corn fractionation equipment. Most likely those sources of private held just like the three mentioned here. Perhaps the most important takeaway here is the need for ethanol producers to adopt processes to make their plants more efficient. For price-taking competitive industry, cost reduction and efficiency are keys to success.

Investors may be hearing more about investment in operational efficiencies by ethanol products. More than 80% of corn ethanol plants in the U.S. are dry grind and they are all under pressure to maximize profits. Gevo has not yet achieved sufficient scale to deliver profits from its ethanol and isobutanol products. The company reported a 60% operating loss in the twelve months ending June 2018. However, the corn fractionation equipment can help move the needle to that end. The unique lease agreement with the elusive Shockwave equipment supplier means Gevo can also conserve its capital resources. Gevo had $27 million in cash on its balance sheet at the end of June 2018, but needs at least $1.25 million per month in cash to keep operations going.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries. Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.