by the Climate Bonds Team

Climate Bonds looks at the last six months numbers, the trends and our tips for the rest of 2017

Green Bonds Mid-Year Summary 2017

Headline figures for the Half Year (H1)

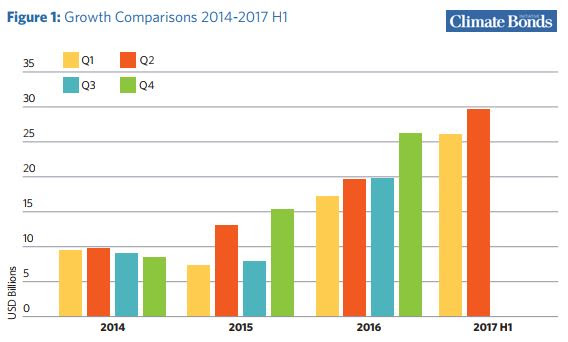

- 2017 issuance to H1: USD55.8bn

- Records broken: Quarter 2 (Q2) is the largest quarter of issuance on record at almost USD30bn

- 82 green bond deals issued in the quarter from 74 issuers

- Over 50% of issuers were first time issuers

- Green Bond transactions accounted for 3% of global bond market transactions in Q2 2017

- Top 5 largest issuers of H1:

- Republic of France (USD7.6bn),

- EIB (USD2.8bn),

- KfW (USD2.5bn),

- Bank of Beijing (USD2.2bn),

- TenneT (USD2.2bn)

Underwriters League Table

H1 shows Crédit Agricole on top, improving their rank from Q1. Morgan Stanley is the big mover and with Citi they round out the top three, HSBC coming in a close fourth.

Overall, French and US underwriters dominate and Landesbank Baden-Württemberg from Germany makes their first appearance in the top 15.

Thank you to Thomson Reuters for providing their league table data for our use. Methodology information is here.

Predictions for the rest of 2017

Sovereign issuance will increase: We have counted 8 different sovereigns that have made commitments to issuing green bonds. We’re not sure they will all be issued in 2017 but watch out for Nigeria, Kenya and Morocco.

Chinese issuance will pick up, exceeding 2016 issuance: We know there have been a lot of deals approved for issuance by PBoC, so when the market conditions are right, more issuance will come.

Harmonisation of standards looks increasingly likely: Many conversations have been convened by the Green Bonds Principles and others to strengthen harmonisation between standards, external reviews and Certification schemes.

Further, the European High Level Expert Group on Sustainable Finance has published its Interim Report, which among other things calls for an EU wide approach to green standards and labelling.

Guidance on impact reporting may be forthcoming: Post-issuance Reporting in the Green Bond Market, the Climate Bonds Study released in June, revealed that impact reporting is on the rise, but that there is little consistency and comparability.

Large development institutions have initiated this with the Harmonized Framework for Impact Reporting in 2015 but our view is that this has become a hot topic and we will see more detailed guidance for the corporate market.

USD130bn for the year looks possible: We expect issuance to increase over the rest of the year and possibly exceed the current Climate Bonds estimate for 2017 of USD130bn.

Looking ahead from 2017, the bigger question would be: Is USD1trn a year by 2020 possible?

Read the full Mid-Year Summary here.

The Climate Bonds Initiative is an “investor-focused” not-for-profit promoting long-term debt models to fund a rapid, global transition to a low-carbon economy.

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or debt instrument or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the financial merits or otherwise of any debt instrument or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

Certification under the Climate Bond Standard only reflects the climate attributes of the use of proceeds of a designated debt instrument. It does not reflect the credit worthiness of the designated debt instrument, nor its compliance with national or international laws.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.