Tom Konrad CFA

Compared to the peak of the Yieldco bubble in May, many Yieldcos have dropped by more than half, and most by more than a third.

Some of this decline is because rapid dividend growth depends on an endless supply of cheap investor capital which is another way of saying that we can have rapid dividend growth or high dividend yields, but not both. Part of the decline was due to the realization that many Yeildcos (most notably Terraform Power (TERP), Terraform Global (GLBL), and Abengoa Yield (ABY)) were not immune to the financial problems at their sponsors, and so they were far more risky than many investors previously thought.

These problems affect different Yieldcos differently. NextEra Partners (NEP) has a strong sponsor, others (Brookfield Renewable Energy Partners (BEP) and Hannon Armstrong Sustainable Infrastructure (HASI)) develop projects internally, while Pattern Energy Group (PEGI) has a private sponsor, with very strong investor protections in place to protect investors from conflicts of interest. While these Yieldcos have fallen as investors began to demand higher current yield instead of only the promise of rapid future yield growth, they are much less vulnerable financial difficulties at their sponsors.

These effects can be seen in the following chart, which shows that Yieldcos with high expected growth, and/or public sponsors have fallen the farthest since the peak of the Yieldco bubble in May.

With Yieldcos having declined so much, there is likely opportunity, but is it in the giant declines of the riskiest Yieldcos, or the smaller declines of the safer ones?

Valuation With The Dividend Discount Model

The answer lies in valuation. For income stocks like Yieldcos, the dividend discount model (DDM) is by far the best valuation method. DDM valuation requires us to estimate future dividends, and also choose a required rate of return (discount rate) which should be higher for riskier Yieldcos. If we choose our discount rate to accurately reflect the likely risks, we can use DDM to compare valuations of Yieldcos with entirely different risk profiles.

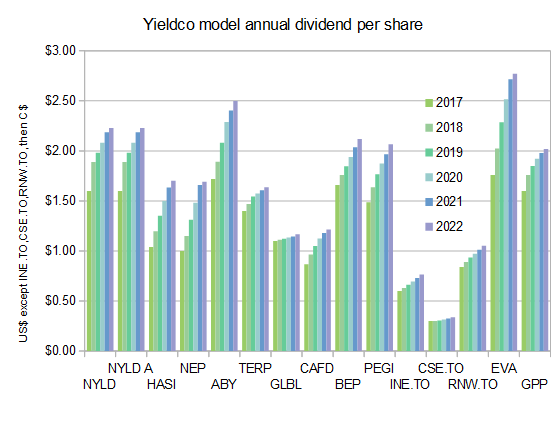

Below are my estimates of Yieldcos’ dividend growth rates going forward:

When these are combined with the current dividend, we get estimated dividends for future years:

Given future dividends, the dividend discount model gives us stock valuations for any required rate of return. I show these below (as a fraction of the closing market price on December 11th) for ranges of discount rates that reflect my estimation of the relative riskiness of each Yieldco.

You can click on any of these charts to see a larger version.

Evaluation of Results

For investors who accept my dividend and discount rate estimates, it’s clear that almost all Yieldcos are currently trading below their inherent worth. The only exceptions are NextEra Energy Partners (NEP), and Capstone Infrastructure Corp (TSX:CSE or MCQPF.)

NEP seems to be trading at a relative premium because it is widely seen to have the strongest sponsor, NextEra (NEE) with the largest list of right of first offer (“ROFO”) projects that can be dropped down to its Yieldco, and minimal risk of financial instability at the sponsor. I personally feel that ROFOs are greatly overvalued in the current climate. Few Yieldcos have any cash to invest in new projects, and those that do can easily buy project from any number of developers.

Capstone Infrastructure is the only other fairly valued Yieldco in my list. It is one of the few Yieldcos I owned before the recent decline, and the only one showing a gain since May. This gain is in part due to the recent announcement that Capstone has retained investment banks to help it “review and consider various alternatives.” This is investment banker speak for the company being available for sale if a sufficiently attractive offer should emerge.

Terraform Power (TERP) is also trading near fair value, at least at the high discount rates that reflect the financial strains at its sponsor, SunEdison (SUNE), and SunEdison’s recent moves in taking control of the boards at Terraform Power and its sister Yieldco, Terraform Global (GLBL). TERP recently advanced when it received news that SUNE had revised the terms of its much-criticized deal with Vivint (VSLR), and the Yieldco emerged as the biggest beneficiary of the new deal, likely because of the attentions of activist investor David Tepper.

While Terraform Global’s share price also benefited from the news, it did not appreciate nearly as much, because Tepper has not disclosed any position in GLBL and it was not a direct beneficiary of the revised Vivint deal. Terraform Global remains one of the best-valued Yieldcos, even at discount rates that reflect the very real risks of owning this company.

By far, the best valued Yieldco is Pattern Energy Group (PEGI). Pattern combines a high (8%) current yield with continued prospects for modest yield growth and strong protections for investors. By my estimate, PEGI is trading at a 50% discount to its true value even at a 9% required rate of return.

The next best values are still very attractive and trade around 60% of fair value. They are NRG Yield (NYLD and NYLD/A), Hannon Armstrong Sustainable Infrastructure (HASI), Terraform Global (GLBL), 8point3 Energy Partners (CAFD), Brookfield Renewable Energy Partners (BEP), Innergex Renewable Energy (TSX:INE or INGXF), TransAlta Renewables (TSX:RNW or TRSWF), Enviva Partners, LP (EVA), and Green Plains Partners (GPP).

One quick note of caution on wood pellet and ethanol producers Enviva and Green Plains is that these two are Master Limited Partnerships, and are generally not appropriate to own inside a retirement account such as an IRA. In addition, my research into the newly listed Green Plains has so far been cursory, so I do not have a lot of confidence in the numbers used to produce my estimate of its fair value.

Another way to look at these estimates is to calculate the required rate of return needed to justify the current price from expected cash flows. I calculated the internal rates of return in the above chart under the assumption that the shares would be held until 2037, at which point they would be sold at the current market price.

Conclusion

While nearly all Yieldcos are excellent values and good additions to any value or income-oriented portfolio, some are far better than others. Investors looking to add just a few Yieldcos to their portfolios should focus on Pattern Energy Group (especially for risk-averse investors), Enviva (in taxable accounts), and Terraform Global (for investors willing to accept a high degree of risk in return for extremely high (25%) expected annual returns.)

The Green Global Income Portfolio, which I manage, owns all of these except NEP (because of valuation) and GPP (pending further research.) It has recently been increasing its stakes in the ones with the best valuations by this analysis.

Disclosure: Long NYLD/A,HASI,ABY,TERP,GLBL,CAFD,BEP,PEGI,INE.TO,CSE.TO,RNW.TO,EVA

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.