Tom Konrad

What will the New Year hold for Clean Energy?

For the people who manage clean energy portfolios, mutual funds, and indexes the question is more than idle curiosity. Getting the answer right means finding the stocks which will put a shine on your solar portfolio’s returns. Getting it wrong means the competition will blow away your wind stocks.

I asked my network of green money managers for their predictions. This is the second in a series on their predictions and stock picks from my panel. This first article focused on what they had to say about trends in the solar sector, this article will take a look at their predictions for the Smart Grid.

Sam Healy: Regulatory Certainty Boosts EnerNOC

Sam Healy is a portfolio manager at Lamassu Capital. Healy’s top trend for 2013 is the maturation of the Demand Response (DR) industry, and its implications for DR leader EnerNOC (NASD:ENOC). He says,

At this point, most of the [DR] rules and reg[ulations] are set, with the exception of the pending EPA decision regarding diesel generator use as back up power for DR which is due the 14th but may be pushed back. Assuming this issue gets settled ENOC will finally have a clean regulatory situation, pricing as a tail wind, and visibility into a nice 2013 and 2014. If this plays out the company could really start to generate FCF [free cash flow] and EPS [earnings per share] and I suspect the investor worries will decrease.

Healy and Lamassu Capital own shares of EnerNOC.

Garvin Jabusch: Increased Spending on Smart Grid

Garvin Jabusch: Increased Spending on Smart Grid

Garvin Jabusch is cofounder and chief investment officer of Green Alpha ® Advisors, and is co-manager of the Green Alpha ® Next Economy Index, or GANEX and the Sierra Club Green Alpha Portfolio. He also authors the blog ”Green Alpha’s Next Economy.”

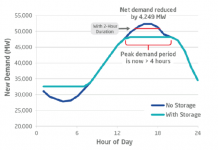

Healy gets some support from Jabusch, who thinks “infrastructure upgrades to accommodate a renewables-friendly distributed smart grid (especially where networks have been damaged (such as in the wake of superstorm Sandy)” will have a significant impact on clean energy stocks in 2013. Demand response is probably the cheapest way to increase grid stability, and back-up generatiors many firms install in response to Sandy-style blackouts can also be used to provide DR, with firms like EnerNOC acting as middlemen between the owners of back-up units and the utility.

Rafael Coven: EnerNOC and Smart Meters Under Pressure

Rafael Coven: EnerNOC and Smart Meters Under Pressure

Rafael Coven is Managing Director at the Cleantech Group, and manager of the Cleantech index (^CTIUS) which underlies the Powershares Cleantech ETF (NYSE:PZD.)

While Coven thinks the market will have a “Greater focus on generating cash flow and the ability to be profitable without… government largess,” he’s skeptical of EnerNOC’s ability to make the grade. He expects a

Stronger entry of major utilities and industrial companies into the Demand Response/Demand Management space. This will put increasing pressure on the likes of EnerNOC and could either severely hurt ENOC or push it to be acquired by an Electric Utility or services company.

He asks, “If a stand alone company’s product [like EnerNOC’s Demand Response] is really that good, then one should ask why hasn’t one of the big boys licensed the technology or bought the company?” He predicts

Continued aggressive acquisitions by conglomerates such as ABB Group (NYSE:ABB), Siemens (NYSE:SI), Schneider Electric (Paris:SU, OTC:SBGSF), General Electric (NYSE:GE), Eaton (NYSE:ETN), Johnson Controls (NYSE:JCI), Honeywell (NYSE:HON), and Emerson (NYSE:EMR) of energy controls, sensor, software, and services companies. … These are the companies than can really leverage the technologies and scale them into global businesses. As such truly innovative companies in smart energy space are perfect candidates for acquisition.

Demand Response is not the only Smart Grid business Coven sees coming under pressure. He also expects “ Increasing commoditization of smart meter business. The buyers buy in bulk, and bid on price. If the products aren’t truly innovative to the degree that they can charge higher prices, I suspect that pricing will get worse.”

Coven does see one bright spot: Grid security, where expects increasing spending.

Bottom Line

While Healy and Jabusch see tail winds for the smart grid and demand response industries, Coven may be right that increased revenues may not lead to greater profitability. The last few years of booming solar installations and crashing solar stock prices should serve as an object lesson in that regard.

On the other hand, if Coven’s prediction of aggressive acquisitions by conglomerates bears fruit, EnerNOC’s shareholders may benefit if more or more of these well capitalized companies decides they want EnerNOC’s technology or customers.

Disclosure: I own ABB and JCI. I have no positions in the other stocks mentioned. Sam Healy owns ENOC.

This article was first published on the author’s Forbes.com blog, Green Stocks on December 17th.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This ar

ticle has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.