Charles Morand

In early January, I said the following on the likelihood that the Obama Administration would move on carbon regulations in the near-term: "The next 12 to 18 months are unlikely to produce much in the way of vigorous environmental action on the part of government (barring subsidies for alternative energy related to the stimulus package), especially if it means additional costs on industry." Clearly, I had underestimated the power of another fundamental rule of politics – besides "don’t anger the rust belt states that gave you your presidency by burdening their industries with avoidable costs in the midst of an economic downturn" – that says that if you’re going to go big public policy-wise, do it in the first few months of your term in office so that four years on voters have forgiven you.

This is the approach Henry A. Waxman and Edward J. Markey decided to take when they introduced their mammoth American Clean Energy and Security Act of 2009 in late March (you can find the full 648 pager here or a 5-page summary here – the excellent WSJ Environmental Capital also wrote an interesting series of posts on the proposed climate bill). While there definitely are components of clean energy and energy security to this bill, it is fair to say that the most significant measure proposed is the introduction of a cap-and-trade system to control greenhouse gas (GHG) emissions. Here are some key quotes from the summary document [emphasis added]:

The draft establishes a market-based program for reducing global warming pollution from electric utilities, oil companies, large industrial sources, and other covered entities that collectively are responsible for 85% of U.S. global warming emissions. Under this program, covered entities must have tradable federal permits, called “allowances,” for each ton of pollution emitted into the atmosphere. Entities that emit less than 25,000 tons per year of CO2 equivalent are not covered by this program. The program reduces the number of available allowances issued each year to ensure that aggregate emissions from the covered entities are reduced by 3% below 2005 levels in 2012, 20% below 2005 levels in 2020, 42% below 2005 levels in 2030, and 83% below 2005 levels in 2050.

The draft allows covered entities to increase their emissions above their allowances if they can obtain “offsetting” reductions at lower cost from other sources. The total quantity of offsets allowed in any year cannot exceed 2 billion tons, split evenly between domestic and international offsets. Covered entities using offsets must submit five tons of offset credits for every four tons of emissions being offset.

The draft directs EPA to create a “strategic reserve” of about 2.5 billion allowances by setting aside a small number of allowances authorized to be issued each year thereby creating a cushion in case prices rise faster than expected. The draft directs EPA to make allowances from the reserve available through an auction when allowance prices rise to unexpectedly high levels.

The draft provides for strict oversight and regulation of the new markets for carbon allowances and offsets. It ensures market transparency and liquidity and establishes strict penalties for fraud and manipulation. The Federal Energy Regulatory Commission is charged with regulating the cash market in emission allowances and offsets. The President is directed to delegate regulatory responsibility for the derivatives market to an appropriate agency (or agencies), based on the advice of an interagency working group.

To ensure that U.S. manufacturers are not put at a disadvantage relative to overseas competitors, the draft authorizes companies in certain industrial sectors to receive “rebates” to compensate for additional costs incurred under the program. Sectors that use large amounts of energy, and produce commodities that are traded globally, would be eligible for the rebates. If the President finds that the rebate provisions do not sufficiently correct competitive imbalances, the President is directed to establish a “border adjustment” program. Under that program, foreign manufacturers and importers would be required to pay for and hold special allowances to “cover” the carbon contained in U.S.-bound products. (Unclear this would withstand a WTO (China) or NAFTA (Canadian Oil Sands) challenge).

Analysis

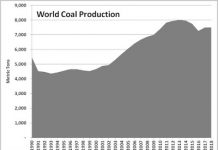

The bill therefore proposes an enforceable cap on GHG emissions effective as early as 2012, or during the current presidential term. Although the 2012 target may not seem especially daunting (-3% over a 2005 baseline), any reduction at all is no easy task. As shown in the table below, drawn from the EPA’s 2009 U.S. Greenhouse Gas Inventory Report, total US emissions of GHG have grown at an average of around 1% per year since 1990 (figures are in millions of metric tons of CO2e). Click on the table for a more comprehensive table in PDF.

A 3% reduction over 2005 equates to roughly 180 million metric tons of CO2e (using the net emissions figure – 5,986 mmt). Assuming a metric ton of carbon trades between $10-$15, this would be worth between $1.8 billion and $2.7 billion. To put this into perspective, 180 million metric tons of CO2 is the equivalent of about 9.5% of total US transportation-based CO2 emissions for 2007 (1,887 mmt), or approximately 21% of total CO2 emissions coming from industrial sources (845 mmt) (see the PDF table for these figures). The latter number is actually more relevant as most of transportation would not be included in the program (sources <25,000 tons per year are excluded). It is not a stretch to say that cutting a fifth of US industrial emissions over three years is no easy task, although this recession will undoubtedly take care of some of that.

This bill thus has the potential to generate some real – albeit small – carbon emissions trading in the US within about 3 years. For people with an interest in carbon markets, this is significant. And although carbon offsets – investing in projects that prevent GHG being emitted to generate tradable allowances – can only be used with a ratio of 4-to-1 to government-issued allowances, you can expect some significant interest in this area as well (for those not familiar with the offsets market, Bloomberg Markets Magazine ran an interesting story on the leading US player in this space, Blue Source LLC). That means money flowing into areas such livestock methane capture at the farm level, landfill gas capture, ecosystem restoration (i.e. tree planting), etc.

Beyond 2005, the targets are high enough to incent substantial investments in carbon reduction measures, as well as sustain strong trading volumes in carbon markets. Assuming such a system is launched in 2

010, the objective would be to reduce emissions at an arithmetic average of ~2% (assuming 2010 emissions are roughly equal to 2005 because of the economic crisis) per annum by 2020 vs. an arithmetic average growth rate of just under 1% per annum since 1990. Again, to put this into perspective, a 20% reduction over 2005 net emissions (5,986 mmt) equals 1,197 million metric tons, and the total CO2 emissions for the US transportation sector in 2007 stood at 1,887 million metric tons.

Does this mean the US is about to unseat Europe as the new global emissions trading hotspot? Not quite: according to a World Bank report, in 2007, some 2,061 million metric tons of CO2e were transacted on European emissions markets for a total value of $50.1 billion. An interesting factoid about the European market is that 80% of transaction volumes occurred over-the-counter in 2007.

Why Only Get Excited About Emissions Trading Now?

Why, you ask, write about this now, over a month after the draft bill was released? Because last week something happened that materially raised the likelihood that this bill could become law in something close to its current form: Senator Arlen Specter of Pennsylvania crossed the aisle. Coupled with the growing likelihood that Al Franken will prevail in Minnesota, this means that before too long the Democrats could have a filibuster-proof majority in the Senate.

Of course, certain barriers remain, including convincing Blue Dog Democrats. But overall the chances of seeing carbon trading in the US in the next couple of years has increased dramatically. The thorny issue of how to allocate allowances to industry – giving them away vs. auctioning them – was conveniently left out of the bill, no-doubt to serve as a bargaining chip as final details are hammered out.

How Do I Play US Carbon Markets?

That’s a question I’ve addressed on a number of occasions on this blog in the past two years, and luckily the range of options has been expanding over time.

On the equity side, World Energy (XWES) just got a whole lot more exciting last week when it migrated from the Pink Sheets to the NASDAQ. This is a company I noticed a couple of years ago but to which I only ever paid scant attention because the prospect for substantial environmental commodities trading seemed distant in the US. In a nutshell, World Energy provides a platform for electronic trading and auctions for various commodities like electricity, nat gas, renewable energy certificates and, most importantly, carbon credits. Electricity and gas account for most of the business right now.

Things got really interesting for World Energy when it was selected to run CO2 emissions allowance auctions for the RGGI, the first and only regulated carbon market in the US. This is a good development for the company in my view. However, the recent pop in the share’s price from a buck something on the Pink Sheets to $6.60 on the NASDAQ as at Friday close has less to do with fundamentals than it does with a reverse stock split at the end of March.

I had a quick glance at the 2008 10-K. Revenue has grown by around 290% since 2004 and now stands at $12.5 million. Gross margin has shrunk considerably over that period from 82% in 2004 to 63% in ’08. Operating margin has also deteriorated, going from 3% to -55%. However, this is a marked improvement over 2007 when operating margin was -89%. World Energy earned -$0.08 per share in 2008 vs. -$0.11 in 2007.

Balance sheet-wise, the company has a current ratio of 1.20, down from 2.36 in 2007. This drop is due in large part to cash burn, as the cash ratio went from 1.8 in 2007 to 0.46 in 2008. World Energy has no short or long-term debt besides around $3,700 in capital leases. The company has an undrawn credit facility worth $3 million.

Dramatic margin compressions and high cash burn are normal occurrences in rapidly-growing companies. At this time of year in 2006, this wouldn’t have particularly worried me. However, at the current burn rate (cash went firm $7 million at the end of 2007 to $1.7 million at the end of 2008), World Energy will most likely have to raise equity sooner rather than later, which could be problematic in the current market environment and result in significant dilution. I would thus wait a little longer before touching this stock, at least until Q1 results are released and the company’s cash position can be ascertained.

Another way to play emissions trading through the stock market is through Climate Exchange PLC (CXCHY.PK), the owner of the Chicago and European climate exchanges. This company is the global leader in running carbon exchanges and its primary listing is on the LSE AIM. However, for US investors, the fact that the stock trades only on the Pink Sheets Grey Market (scroll down to the end, just before the skull-and-bones!) makes this a more complicated proposition.

Nevertheless, Climate Exchange is fast-becoming a serious play on carbon trading and financials are improving – revenue grew from £13.8 million (~$21 mm) in 2007 to £22.8 (~$34 mm) million in 2008 while operating margin went from -64% to -12% over the same period. The company has a current ratio of over 4 with ample cash reserves (cash ratio of 3.19). Revenue is growing fast, profitability is within sight and there are no pressing liquidity needs.

Two exchange traded products that actually track carbon credit prices, the iPath Global Carbon ETN (GRN) and AirShares EU Allowances Fund (ASO), are also now available to US investors. In both cases, however, there is a very strong European emissions component, and the timeline for integrating US emission allowances into these products is uncertain. While both could experience a temporary bounce if a climate bill passes, they remain an overall lousy play on US emissions trading due to the lack of exposure to US emissions (duh…)

Lastly – and this is definitely more long-term in nature – there is a very real possibility that natural gas could be a big winner as this would strengthen a trend toward its growing prevalence in US power generationon. This may be an interesting angle for those who like nat gas right now anyways and may be thinking a few years out as well. The main play here would be the US Natural Gas ETF (UNG). Somewhat paradoxically, then, a strong climate bill might provide a catalyst toward a more gas-centric long-term energy policy.

Update (May 6, 2009): In the original entry, I stated that the company had $3.7 million in capital leases. I had mis-read the actual figure which is $3,700.

Disclosure: Charles Morand does not hold a position in any of the securities discussed in this article.

of course World Energy also trades on the Toronto Stock exchange…

Indeed it does – thanks for pointing this out for our Canadian readers Chris.

I hope the companies involved in energy trading will not get in the way of passing the climate bill. Long term and global solutions for global climate change should be considered first before profits.