What I’m Selling (and will be Buying) in the Market Turmoil

The market is in turmoil, and it seems like everyone I talk to wants my take on what's happening this week. So here's my take: I really don't know if the various bailouts and decisions not to bail out made by Paulson et al will turn out to be good decisions or not. I do know that the mess we're in is due to hard decisions which have been put off for years at the highest levels, and I do know that the American taxpayer is going to be feeling the pain for a generation, if not...

Better, or Beta?

Tom Konrad, Ph.D., CFA My Quick Clean Energy Tracking Portfolio has produced unexpected out-performance. Is it because of high beta (β) in a rising market? I recently asked why two portfolios which I had designed to track green energy mutual funds ended up out-performing them by a wide margin. This is the first of a short series of articles looking into possible causes. Could the portfolios be outperforming because the stocks they contain rise more when the market rises (and fall more when the market falls) than do the mutual funds they were designed to track? In...

Shorting The Least Green Companies

Newsweek recently released its 2009 Green Rankings for America's 500 largest corporations. Investors would do well to examine the bottom of the list, as well as the top. Tom Konrad, Ph.D., CFA I'm getting more and more company in worrying about a market peak. If you, like me, are Interested in green investing, and hedging your exposure to a market decline, you should probably also be interested in turning Newsweek's Green Rankings upside-down, and use some decidedly un-green companies as a hedge against the market risk of your greener portfolio. If you believe that...

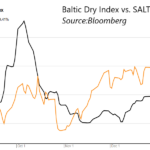

SALT: Buying the Balitc Dry Dips

by Tom Konrad, Ph.D. CFA

The Baltic Dry Index (BDI) is a shipping and trade index created by the London-based Baltic Exchange. It measures changes in the cost of transporting various raw materials, such as coal and steel.

Since the BDI is a measure of the income which firms that own dry bulk cargo ships can earn, changes in the BDI tend to drive changes in the stock prices of such companies.

Stock Price Correlation

Until recently, one such company was Scorpio Bulkers (SALT), one of my Ten Clean Energy Stocks for 2021 picks. The chart below shows the last 5 years, with...

Short Demand for Cree High and Rising

I got a call from my broker this morning asking me if I'd be willing to loan out my shares of Cree, Inc. (NASD:CREE) to a short seller. Since the only cost to me is that I will not be able to vote my shares, and I will earn 2.5% per annum on the value, I said "yes." Normally, brokerages get the shares they lend out to shorts from margin accounts with a margin balance. Since I never carry a balance (although I do have a margin account in order to trade options) they must ask my permission...

When to Sell: Five Rules of Thumb

A common complaint about investment writers is that we are always willing to tell you the next stock to buy, but we don't always get around to telling you when to sell. I'm as guilty of this as most: generally, I write about the stocks I'm interested in... which are the ones I'm buying, not selling. And, although I write the occasional negative article (Petrosun Drilling most recently, but also US Sustainable Energy and Global Resource Corporation), these were more stocks to avoid, rather than stocks which had seen their run. This is unlikely to change. For a start,...

Will Climate Advocacy Pay for Shareholders?

On Monday, we learned about big coal companies pushing back against the major US corporations of the US Climate Action Partnership (USCAP,) which advocates for mandatory regulation of greenhouse gas with their own lobbyists. Since I have advocated buying companies that take a proactive stance on climate change, I thought it might be instructive to compare the returns of the original ten members of US-CAP with the returns of the big coal coal companies (more companies have since joined,) over the six months since the Climate Action Partnership issued their Call for Action on Climate Change. The Payoff ...

Calling for a Marshall Plan, not a Manhattan Project

Electricity too cheap to meter. For many renewable energy advocates, that is the holy grail… new technology which will not only solve the problem of carbon emissions, but be so transformative that we no longer have to worry about turning off the lights when we leave the room. We could argue for days about the viability of any such technology, be it cold fusion, hydrogen, or photovoltaic nanodots. I personally have strong opinions about the likelihood of any technology to produce energy so cheaply that it would not make sense to use some mechanism...

Market Call: We’re Near the Peak

Tom Konrad, Ph.D. The current rally from the March 5 bottom has been breathtaking, especially in Clean Energy, with my Clean Energy Tracking Portfolio up 70.5% since it was assembled at the end of February (as of May 1), 11% higher than it was at the three month update last week, and the S&P 500 is up 41% from its March low. Even in a better economic climate, gains of this magnitude would have me running for cover. In the current economic climate, with a gigantic mountain of debt keeping consumers out of the stores, makes me feel this...

Twelve Green Investment Themes From Putin’s War on Ukraine

By Tom Konrad, Ph.D., CFA

Horrific, Tragic, Unprovoked, Heartbreaking. There is no lack of adjectives to describe Putin’s war on Ukraine. And while there probably can’t be too much coverage of the tragedies and war crimes, many others can write those far better than I.

As an economic and stock market commentator, the adjective I will focus on is world-changing. There is no doubt that the first land war in Europe since World War II, piled on top of a global pandemic, is already reshaping the economy in dramatic ways.

Some of those changes, like Europe switching away from Russian gas and...

Opportunity Hiding in Plain Sight

Information asymmetry, climate investing and the active management edge.

By Garvin Jabusch

The theory of efficient markets says all stock prices are perpetually accurate, because investors always have complete and up-to-date information about their holdings.

But as any casual observer knows, information and topical awareness are not evenly distributed, even among professional analysts. Reality is always far more complicated than equity markets can quickly assimilate, meaning information asymmetry is a constant. While usually considered a type of market failure, information asymmetry is frequently used as a “source of competitive advantage.” The person with the most information is best equipped to make the best...

Neutralizing Your Peak Oil Risk

by Tom Konrad Lifestyle Risks from Peak Oil In the US, we all have a large exposure to the risk of rising energy prices. In addition to the cost of gasoline, the whole US economy runs on oil, so a rise in the oil price is likely to affect our jobs, and the prices of all our assets, including our homes. If other people have less money to spend and invest because of high oil prices, there will be a fall in demand for anything they were buying or investing in. House prices in exurbs and suburbs where the...

Trading Options and Foreign Stocks: When Low Trading Volume Is Not Illiquid

Tom Konrad, Ph.D., CFA

As usual, I am putting together my Ten Clean Energy Stocks for 2020 model portfolio for publication on January 1st or 2nd next year. As I wrote in November, expensive valuations for the US clean energy income stocks I specialize in mean that the 2020 model portfolio will contain more than the usual number of foreign stocks, and I am also planning on including a little hedging with options.

Why option strategies are now affordable

I have never included options in the model portfolio before because the commission structure did not make it cost effective for small investors...

An Elephant Hunter Explains Inflection Point Investing

John Petersen In "An Elephant Hunter Explains Market Dynamics" I discussed the two basic types of public companies; earnings-driven companies that are “bought” in top-tier weighing machine markets and event-driven companies that are “sold” in lower-tier voting machine markets. Today I'll get a bit more granular and show how "sold" companies usually fall into one of two discrete sub-classes that have a major impact on their stock market valuations. As a starting point, I'll ignore the China-based companies that are listed in the US because their quirky metrics would only confuse the analysis. Then I'll break...

Step By Step Fossil Fuel Divesting With Mutual Funds

by Tom Konrad Ph.D., CFA

A large and growing number of individual investors are showing an interest in divesting from fossil fuels. Where in the past I have been asked to give a talk on divestment once every year or two, I’ve spoken on the subject three times so far in 2020. (Here is a recording of a presentation I did for my college alumni association.)

The response to these talks has been overwhelmingly positive, but I’m left with the impression that a lot of the less financially sophisticated attendees are still not sure where to start. For most of these...

The Black Swan and My Hedging Strategy

Tom Konrad, Ph.D., CFA Nassim Nicholas Taleb's The Black Swan: The Impact of the Highly Improbable changed the way I trade; I can't give a book higher praise. This isn't a book review; since the book is over two years old, and I did not get around to reading it until this Spring, I direct readers to this Foolish Book Review, which agrees with my viewpoint quite well, and to the New York Times for a detailed critique. The latter seemed overly nit-picky to me, but then I'm a fan. Human Biases Recently,...