The Difference between Reality and Pandering

Garvin Jabusch Innovation and increasing economic efficiency have always been the keys to profits and wealth. Getting more value out of systems without commensurate increases in inputs is the definition of growing efficiency, and it has been the engine of human economies since someone figured out how to use energy from a water wheel to grind grain instead of doing it by hand with a stone bowl and pestle. With that development (to simplify), a couple family members could run the wheel, freeing up everyone else for other pursuits. This kind of gain is the hallmark, to greater and...

Why Do Green Energy Experts Buy Solar Stocks?

Tom Konrad CFA Green energy experts accept that solar panels are one of the least cost effective ways to reduce your carbon footprint. Nevertheless, many buy solar stocks. They should rethink their investment strategies. I recently spoke on "Stock Selection in the Era of Peak Oil and Climate Change" at the ASPO 2009 International Peak Oil Conference. Whenever green energy enthusiasts find out that I analyze green energy stocks professionally, they react in one of two ways. Many want to know my top stock pick in general (New Flyer Industries NFI-UN.TO/NFYIF.PK) or in their favorite sector (see below.) ...

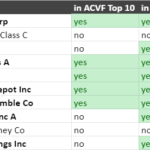

Are ESG Funds All That Different?

by Jan Schalkwijk, CFA

ESG investing is all the rage these days. That is, investing that includes the non-traditional environmental, social, and governance factors in the investment process. Its appeal to the broader investment industry is twofold:

1) The writing is on the wall: as wealth is passed down to younger generations who in the aggregate care more about values alignment, the asset management industry does not want to lose the assets and the fees they generate.

2) Thematic investing is popular and ESG is one of the hottest themes. Wall Street is not going to miss out. Much like crypto...

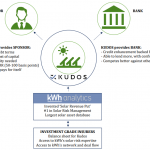

How Weather Risk Transfer Can Help Wind & Solar Development

by Daryl Roberts

The Need To Accelerate Renewables Adoption

Renewables are growing rapidly as a percentage of new electric generation, but are still being assimilated too slowly and still constitute too small of a fraction of total generation, to be able to transition quickly enough to scale into a low carbon economy in time to mitigate climate change.

The issue of providing public support, with subsidies and other reallocation methods, is a politically charged subject. High carbon advocates, for example American Petroleum Institute, argues that support for renewables distorts the market. On the other hand, it has been argued, for example by...

What I’m Selling (and will be Buying) in the Market Turmoil

The market is in turmoil, and it seems like everyone I talk to wants my take on what's happening this week. So here's my take: I really don't know if the various bailouts and decisions not to bail out made by Paulson et al will turn out to be good decisions or not. I do know that the mess we're in is due to hard decisions which have been put off for years at the highest levels, and I do know that the American taxpayer is going to be feeling the pain for a generation, if not...

An Investor’s Reaction to a Trump Victory

See my response here: https://www.greentechmedia.com/articles/read/how-one-clean-energy-investor-is-reacting-to-a-trump-victory Tom Konrad

Market Call: We’re Near the Peak

Tom Konrad, Ph.D. The current rally from the March 5 bottom has been breathtaking, especially in Clean Energy, with my Clean Energy Tracking Portfolio up 70.5% since it was assembled at the end of February (as of May 1), 11% higher than it was at the three month update last week, and the S&P 500 is up 41% from its March low. Even in a better economic climate, gains of this magnitude would have me running for cover. In the current economic climate, with a gigantic mountain of debt keeping consumers out of the stores, makes me feel this...

An Elephant Hunter Explains Market Dynamics

John Petersen Friday afternoon was a strange time for Axion Power International (AXPW.OB). After trading 200,000 shares early in the day, Axion filed $28 million mixed shelf registration with the SEC at about one o'clock and the fly on the wall reported the filing within minutes. It seems that some stockholders were spooked by the news and assumed that Axion would sell stock right away instead of waiting for the fall deal season. Their knee-jerk selling shoved another 1.1 million shares into the market in three hours and made Friday the second heaviest trading day in Axion's history....

Stocks We Love to Hate

Investing in clean energy is both an economic and a moral decision. From an economic perspective, I believe that constrained supplies of fossil fuels (not just Peak Oil, but also Peak Coal and Natural Gas) are leading to a permanent rise in the value of all forms of energy. From a moral perspective, I know that we and the vast majority of our children are limited to this one planet for generations to come, so we should abuse it as little as possible, so, of all the possible forms of energy to invest in, clean energy (Renewable and...

Green Energy Investing For Beginners, Part I: Stocks, Mutual Funds, or ETFs

Tom Konrad CFA Investing in green energy can be good for both the climate and your wallet. How good depends on choosing the right investment vehicles (mutual funds, ETFs, or stocks) and sectors to invest in. This will get you started. More and more investors are investing in green energy. According to the Cleantech Group, the Cleantech sector is now the largest sector for venture capital investment. Green Energy is not just for venture capitalists. Small investors have done well in 2009. Since the market bottomed at the start of March, the average green energy mutual fund topped...

Free Talk: A Permaculture Portfolio

For readers in the Hudson Valley, I will be giving a free talk next Monday night. I will speak about applying permaculture design principles to your investment strategy. While I developed my own strategy over the last two decades without any reference to these design principles, now that I'm familiar with them, I realize that I have been thinking along these lines for a long time. The design principles are remarkably robust and intuitive.

I used to think Permaculture was just about redesigning our food systems, but it's much much more than that.

The talk is sponsored by the Rondout Valley...

Your Portfolio is Hooked on Fossil Fuels

Garvin Jabusch Oil addiction photo via BigStock You are drilling for oil and natural gas, and you probably don’t even know it. What, you say you’ve never been near a drilling rig, and aren’t even sure what one looks like? You’re still drilling, because companies you own are drilling. Many financial advisors and asset managers routinely assume that broadly diversified stock portfolios will have holdings in fossil fuels companies. Even most stock mutual funds that identify themselves as ‘green’ funds contain natural gas and even oil holdings. This...

The Trump Trade

by Garvin Jabusch The first two weeks under the Trump administration have been a shock to the system. With the change in administration, how will you approach your stock portfolio(s)? For starters, your fundamentals should remain unchanged. For me, that means looking for great companies in expanding markets that are enabling long-term economic growth, and reducing systemic risks. Of course, this also means buying these stocks at low valuations. Benjamin Graham and Warren Buffett were right about ‘wonderful companies at fair prices.’ That is never going to change. With that said, let’s look at what has changed and...

Trading Options and Foreign Stocks: When Low Trading Volume Is Not Illiquid

Tom Konrad, Ph.D., CFA

As usual, I am putting together my Ten Clean Energy Stocks for 2020 model portfolio for publication on January 1st or 2nd next year. As I wrote in November, expensive valuations for the US clean energy income stocks I specialize in mean that the 2020 model portfolio will contain more than the usual number of foreign stocks, and I am also planning on including a little hedging with options.

Why option strategies are now affordable

I have never included options in the model portfolio before because the commission structure did not make it cost effective for small investors...

When to Sell: Five Rules of Thumb

A common complaint about investment writers is that we are always willing to tell you the next stock to buy, but we don't always get around to telling you when to sell. I'm as guilty of this as most: generally, I write about the stocks I'm interested in... which are the ones I'm buying, not selling. And, although I write the occasional negative article (Petrosun Drilling most recently, but also US Sustainable Energy and Global Resource Corporation), these were more stocks to avoid, rather than stocks which had seen their run. This is unlikely to change. For a start,...

The Short Side of Clean Energy

Green Energy Investing For Experts, Part I Tom Konrad, CFA You don't have to be long Renewable Energy stocks to have a green portfolio. Shorting, selling calls, or buying puts on companies and industries which are heavily dependent on dirty and finite fossil fuels not only makes a portfolio greener, it can protect against the effects of a permanent global decline caused by peak oil. Nate Hagens presented this slide at the 2009 International Peak Oil Conference: It shows his conception of the different schools of thought among those of us who understand peak oil. Those represented in...