Two Stocks That Could Benefit From NuScale’s Sucess

After toiling away for almost two decades, perfecting its nuclear power reactor design, NuScale Power is on the cusp of commercial stage with its innovative Small Modular Reactor (SMR). The company has applied for certification by the U.S. Nuclear Regulatory Commission (NRC) and expects to approval by 2021. In a departure from conventional construction methods NuScale’s SMR is to be manufactured in a factory setting and assembled on site. NuScale has also lined up a first customer, the Utah Associated Municipal Power Systems (UAMPS), which is planning to build a nuclear power plant with twelve of NuScale’s 50-gigawatt SMRs. UAMPS expects its project to be...

Yellow Cake Debut

by Debra Fiakas, CFA

Investors have a new opportunity for a stake in nuclear power. Last week a successful initial offering was staged by a new player in the uranium supply chain. Yellow Cake, plc. (YCA: LON) sold 76 million shares at £200 per share, raising £151 million (US$200 million). Uranium Participation Corporation (U: TO)took US$25 million of the deal, giving the Canada-based uranium speculator a 16% stake in the company. Yellow Cake is listed on AIM under the symbol YCA. In its third day of trading the stock closed up 1.25% from its debut.

Yellow Cake means to be a player in the uranium market, buying and...

Energy Dominoes From Japan

Joe McCabe Energy amazes me; the ramifications from elementary school physics of converting potential energy into kinetic energy. It's happening everywhere around us, and can have far reaching ramifications. An example is the potential energy in the form of pressure built up under Japan in plate tectonics before the recent earthquake, turned into land shaking, country moving, tsunami creating kinetic energy that reaches across the world. There are other forces, lets call it society energy, that can create financial shock waves in the energy industry including political, religious, and inaccurate supply curve assumptions. Energy Industry Domino...

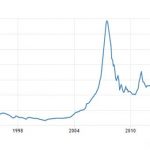

Spotting A Uranium Rebound: Inventories Are Key

The chart of spot uranium prices presents a dismal picture for this key energy commodity. After a brief spike in early 2006, the spot price has been in a long-term slide down hill. In the last year and a half it appears the price as found a level of support at the $20.00 price level as the shares have bounced around between that support level and up to the high 20s. With each bound higher shareholders of uranium producers cheer the end of what has been a long ‘down’ cycle. A click up to US$27.50 in recent days has...

Watch This Nuclear Player Boil

by Debra Fiakas CFA The last post on Chicago Bridge and Iron (CBI: NYSE) noted the entrance of CBI into the nuclear field with the acquisition of The Shaw Group, which has an exclusive relationship with Toshiba Corporation related to the Toshiba Advanced Boiling Water Reactor (ABWR). More evolutionary than revolutionary the ABWR is supposed to be superior other designs in its light water reactor class. ABWR produces power by superheating water to the boiling point. The resulting steam is then used to drive a turbine attached to a generator. Other light water reactors also heat...

Exelon’s Dividend Siren Song

by Debra Fiakas CFA When the market gets volatile, many investors dive behind the protective shield of dividends. Exelon Corporation (EXC: NYSE) is an owner of nuclear power generation plants and is included in Crystal Equity Research’s Atomics Index of companies using the atom to create energy because more than half of its power output is generated at nuclear power plants. The company offers a handsome dividend near $1.24 per year. Granted it is not a small-cap company, which is the usual target for this column, but yield is beguiling. At the current price the dividend yield is...

Nuclear Stocks: Too Hot for an Eco Portfolio?

Guest Author Nuclear energy is not the “bad boy” it once was For many years, nuclear energy was labelled as a potential threat to the environment as well as the global population. Interestingly enough, the memories of the disasters at Chernobyl and Three Mile Island are now distant and the perspective of nuclear energy is changing in positive fashion. The growing worries created by the ballooning demands on the world’s energy sources, an increase in the competition for energy supplies, rising concerns regarding global warming, and the volatility of the gas and oil prices are reasons that...

A Light At The End Of The Bridge For Lightbridge?

by Debra Fiakas CFA Earlier this week nuclear fuel technology developer, Lightbridge Corporation (LTBR: Nasdaq), reported year-end 2015 financial results and provided an update on recent accomplishments. Not unexpectedly, Lightbridge reported a net loss of $4.3 million or $0.24 per share for the year. During the year the company scraped together $900,000 in revenue from consulting services, an effort to leverage the expertise of its scientists and engineers as they continue work on new fuel technologies. The contribution margin of the consulting work was $216,239 - not nearly enough to cover administrative spending or the costs of...

Junior Uranium Miner ’In Position’ to Grow

by Debra Fiakas CFA To understand UR Energy, Inc. (URG: NYSE AMEX, URE: TSX) investors need to polish up on their Latin phrases. UR Energy is planning to mine uranium for the nuclear power industry using a mining practice called in situ or literally in position. In conventional mining operations large amounts of uranium-laced rock are cut out of the earth and sent to a milling center where the rock is crushed as the first step in separating uranium from the other minerals. In situ miners like UR Energy leave the earth and rock undisturbed, instead injecting oxygenated...

Clean Energy Stocks to Fill the Nuclear Gap

Tom Konrad, CFA If the Japanese use less nuclear power, what will take its place? I'm astounded by the resilience and discipline of the Japanese people in response to the three-pronged earthquake, tsunami, and nuclear disaster, perhaps in large part by my cultural roots in the egocentric United States, where we seem to have forgotten the virtue of self-sacrifice for the greater good. Yet while Japanese society has shown itself to be particularly resilient, the Japanese electric grid is much less resilient. According to International Energy Agency statistics, Japan produced 258 TWh of electricity from...

Admin Reviews Fuel Production To Mixed Nuclear Reactions

by Debra Fiakas, CFA

The U.S. Administration took a swing at the uranium ball, but it is not clear if it was a miss and strike out or just a walk. Some in the uranium industry are applauding a decision by the Trump Administration on the January 2018 petition by U.S. uranium producers Energy Fuels (UUUU: NYSE) and Ur-energy (URG: NYSE), requesting protection from uranium imports. The U.S. Commerce Department had investigated the petition under Section 232 of the 1962 Trade Expansion Act. No new trade restrictions are being implemented at this time, but the Administration is establishing a working group to analyze U.S. nuclear fuel production. A report...

An uNclear Future

25 years on from Chernobyl: Nuclear’s unclear future, and the on-going renaissance for alternative energy stocks Karl L. Mitchell, Ph.D. Summary On April 26th, 1986, the world’s worst nuclear accident occurred at the Chernobyl nuclear power station in northern Ukraine. The blast spewed a cloud of radioactive fallout over much of Europe, causing many hundreds of thousands to flee from their homes in Ukraine, Belarus and western Russia. 25 years later we are facing the only other level 7 event on the International Nuclear Event Scale; at Fukushima, Japan. Although less immediately catastrophic, it has resulted in...

Four Green Money Managers’ Top Stock Picks

Green money managers' stock picks after the Japanese nuclear crisis. Even as the nuclear disaster in Japan unfolds, it's clear that the world's energy industry will be forever changed. Russian reactors were never considered safe, but a Japanese to have a nuclear meltdown is an entirely different story. Market Reaction Since Monday, nuclear stocks and ETFs have been plummeting. As of Wednesday night, The Market Vectors Uranium + Nuclear Energy ETF (NYSE:NLR), the iShares S&P Global Nuclear Energy Index (NASD:NUCL), PowerShares Global Nuclear Energy Portfolio ETF (NYSE:PKN), and the Global X Uranium ETF (NYSE:URA) are down...

A Nuclear Waste Disposal Stock

Debra Fiakas CFA Many are firmly opposed and a few more are skeptical of the nuclear energy industry. A big concern is the waste resulting from the uranium enrichment process that is part and parcel of the reactors we have chosen to use for nuclear power generation. Some see recycling of the waste as an answer. First a short primer on uranium and then the recycling story. Natural uranium consists of a mixture of three radioactive isotopes which are identified by the mass numbers U-238 (99.27% by mass), U-235 (0.72%) and U-234 (0.0054%). Uranium is everywhere...

Offshore Wind A Big Part Of Why GE Wants Alstom

Who's the Energy Alpha Dog? GE or Siemens? By Jeff Siegel General Electric (NYSE:GE) wants to acquire one of the largest companies in France, and it could get what it wants if Germany doesn't get in the way. Alstom SA (AOMFF), the target of GE's desires, is a French energy and transportation company with a market value of approximately $11.5 billion. It deals in hydroelectric and nuclear power, environmental control systems, wind turbines and battery storage, as well as trains and rail infrastructure. It's a huge company, and GE could spend as much as $13 billion to...

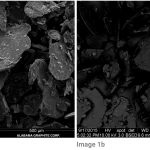

Yankee Graphite

Several graphite developers have made plans to integrate forward into the hottest segment of the market - battery-grade graphite. According to Industrial Minerals, spherical graphite suitable for lithium ion battery anodes is priced in a range of $2,700 to $2,800 per metric ton in China where many battery manufacturers are located. This compares quite well to the range of about $655 to $790 per metric ton for flake graphite concentrate.

The integration strategy has sent the sector into a frenzy of activity to prove their graphite meets expectations of battery manufacturers. The only graphite deposit in the U.S. mainland is under development by Westwater Resources...