US Exchanges And Environmental Investing

An interesting bit of follow-up on my article last week about exchanges and environmental markets. Both the NYMEX and the Chicago Climate Exchange (CCX) have partnered up, in the past 2 weeks, with specialty cleantech and alt energy index makers to launch derivatives products. On March 14, Chicago Climate Futures Exchange (CCFE), a wholly owned subsidiary of the CCX, and WilderShares LLC, announced (PDF document) a licensing agreement to launch a futures market based on the WilderHill Clean Energy Index . The ECO is also the underlying index for the Powershares WilderHill Clean Energy Portfolio ETF...

Climate Change Will Hurt The Poor Most But the Solutions Don’t Have To

The International Center for Appropriate and Sustainable Technology (iCAST) helps communities use local resources to solve their own problems. I've been a fan of iCAST's approach of teaching people how to fish (or, in this case, how to apply sustainable technologies) rather than giving away fish since I first encountered them at a conference in 2006. Last week, they took advantage of some of their own local resources (namely the fact that the DNC was in Denver) to organize a luncheon with a panel of nationally recognized speakers, any one of whom would have been enough to draw a...

Carbon Emissions ETF

Today, while reading an article on cleantech ETFs by The Motley Fool, I found out that XShares Advisors LLC and the Chicago Climate Exchange were working on a carbon emissions-based ETF (PDF document). There is not a lot of info available on what exactly this ETF will track. We reported back in November that UBS had launched an index based on European carbon prices. As noted by Richard Kang at around the same time, this index is well-suited for something like an ETF. If any of our readers have any further insight on this, don't hesitate...

Beware The Vagaries Of Government

I just came across this article on potential problems with the emerging trade in carbon credits. The piece is not technical and I wouldn't say that it is particularly well-researched, but it does raise a key point - as the market for carbon emissions grows, the need for standardization and collaboration between governments and regulators will become ever more pressing. This could create problems. The carbon market is unique in that the commodity traded derives its value primarily from its ability to meet the requirements set by an environmental regulator. There is also a market for voluntary...

Update on the Global Carbon Market

The World Bank Carbon Finance Unit recently released its Q3 2006 update for the global market for CO2 emissions (the carbon market). The document, entitled “State and Trends of the Carbon Market 2006��? (PDF file), contains some pretty interesting information that makes it difficult not to be bullish on the future of emissions trading. Here are some numbers. At the end of Q3 2006, the total value of the market stood at $21.5 billion, up 94% on the whole of 2005 ($11.1 billion). Unsurprisingly, Europe, with its Emissions Trading Scheme, continues to account for the bulk (~99%) of...

EDF Sets Up Carbon Fund

The French electric utility EDF announced today that it is setting up a €300 million ($396 million) carbon fund to help meet its regulatory requirements under the EU ETS, Europe’s regulatory framework to control CO2 emissions. Carbon funds allow companies to make investments that create CO2 emissions reductions in emerging markets, such as upgrades to industrial operations or renewable energy projects, and use the credits generated thus to meet regulatory requirements in their home jurisdictions. This is a good way to concurrently reduce compliance costs at home and foster environmentally-friendly investments in emerging economies. I have discussed...

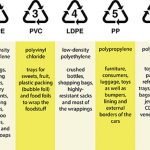

Plastic Recyclers Chasing Arrows

According to Plastics Europe Research Group, over 35 million tons of plastic material was produced globally in 2016, the last year for which full-year data is available. That brought total plastic production to 9 billion tons since 1950. All of those plastic materials remain in existence somewhere - still in use, landfills, junk yards, blowing around the countryside, waterways, oceans, fish stomachs. The post “Plastic Contagion’ on April 13th outline the dangers presented by plastic waste, ranging from respiratory failure from toxic emissions to reproductive interference in aquatic animals.

The building burgeoning volume of plastic waste has sent environmentalists scrambling for solutions to the plastic waste...

Wall Street And Climate Change Get Cosier And Cosier…

A couple of interesting news from Wall Street this week in the realm of carbon finance. Firstly, on Tuesday, JP Morgan announced the launch of what is, as far as I can tell, the first ever bond index with a special climate change risk overlay. In the interest of disclosure, I was tangentially involved with this project. While this overlay probably won't have much of an impact in the very near term, it will be interesting to see what happens once constituent firms are all subjected to some form of greenhouse gas regulation. Second, on Thursday, Lehman...

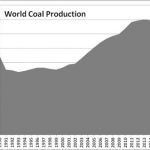

Fossil Fuel Industry: Killing the Customer

by Debra Fiakas, CFA

Published by the Climate Accountability Institute, the Carbon Majors Reportlays bare the truth about which companies are responsible for industrial greenhouse gas emissions. One hundred fossil fuel producers are linked to 71% of global industrial greenhouse gases emitted since 1988. Something like a line in the sand for climate scientists, 1988 is the year human-induced climate change was official recognized by the Intergovernmental Panel on Climate Change.

Fossil fuels in the form of coal, crude oil and gas are by far and large the culprits. Rolling forward three decades later, we can observe in the charts below that fossil fuel production...

Linking Emissions Trading Systems

For those interested in the topic of emissions trading, a new piece was just published by the International Emissions Trading Association on the topic of 'linking' different emissions trading regimes (PDF document). Linking entails allowing emission credits from one scheme to be rendered tradable in another. For example, European credits would be valid and tradable in California, and vice-versa. Beyond allowing the carbon market to become more efficient and liquid, linking could also present a range of arbitrage opportunities. For all of you environmental markets fiends out there, I would definitely recommend this paper. It's short (13...

Is Energy Sourcing the Gateway Drug to Energy Efficiency?

Tom Konrad CFA I recently interviewed Richard Domaleski, CEO of World Energy Solutions (NASD:XWES). World Energy is a comprehensive energy management services firm whose core offering is extremely price competitive energy sourcing (that is, finding an energy provider to supply all of a client's energy needs at the lowest possible cost.) They achieve competitive sourcing using an electronic energy exchange designed to achieve much better price discovery in what is traditionally a very opaque market. According to Domaleski, a recent KEMA study showed that only 7% of large commercial, industrial, and government customers are sourcing their...

US Presidential Election & Carbon Markets: Is The Climate Exchange Story Overdone?

An interesting piece yesterday in POLITICO on how carbon prices on the Chicago Climate Exchange (CCX) have been trending up in recent months, mostly since it's become clear that all three remaining presidential hopefuls will likely regulate CO2 emissions at the federal level. In fact, as per the chart above, prices for the right to emit a metric ton of CO2 have been on a tear, recovering from a pretty significant slump in the preceding months. Last week, the World Bank Carbon Finance Unit released its annual update on the state of global carbon market (PDF...

World Energy Solutions (XWES) and Ram Power (RPG.TO) Appear Promising

From Small Fries to Big Shots? Part 1 of 2 by Bill Paul Feel like rolling the dice on some small alternative energy stocks that appear to have big-time potential? Just remember: sometimes you roll snake eyes. First up: World Energy Solutions Inc. (Symbol: XWES), which currently trades on NASDAQ for $3 and change per share. Worcester, MA-based World Energy Solutions operates online exchanges for energy and green commodities, including the one administered by Regional Greenhouse Gas Initiative Inc. (RGGI), the regulatory scheme under which 10 Northeastern and Middle Atlantic states "cap" their power plants' emissions by requiring...

Carbon Offsets Work – Will the Mainstream Media Ever Get It?

The carbon markets are an area of keen interest for me personally and professionally, so it is always frustrating that the mainstream media largely refuses to learn the details. In general, layman and media who don’t understand the details of the carbon markets attack carbon offsets in two areas, first, questioning whether the credits are for a project that would have occurred anyway (a concept known in carbon as “additionality”), and second questioning whether there are checks and balances to ensure the environmental standards are adhered to and the abatement actually happens (in carbon known as the validation...

Competition In Environmental Markets Heats Up

Close followers of the environmental finance space have known it for a while; Climate Exchange (CXCHF.PK or CLE.L) is sitting on a potential gold mine. The market for environmental commodities, but especially carbon emissions, is slated to grow significantly over the next 5 to 7 years. It was therefore only a matter of time before competition sprung up, both from small players trying to leverage their technological platforms and from the big guys. The big guys came out swinging this week, with NYMEX announcing a partnership with JP Morgan and Morgan Stanley, among others, to set up a...

Biochar’s Likely Market Impacts

Biochar is still mostly a research and cottage industry, yet it has the potential to impact returns for a broad range of investors. Tom Konrad, Ph.D., CFA Biochar, or amending soil with biomass-derived carbon, shows great potential to improve the productivity of soils, as well as to increase the utilization of fertilizers by plants, while sequestering carbon to reduce the drivers of climate change. On August 10, I went to the 2009 North American Biochar Conference to look at the potential for investors. Before I went, I took a look at the publicly traded companies...