US Presidential Election & Carbon Markets: Is The Climate Exchange Story Overdone?

An interesting piece yesterday in POLITICO on how carbon prices on the Chicago Climate Exchange (CCX) have been trending up in recent months, mostly since it's become clear that all three remaining presidential hopefuls will likely regulate CO2 emissions at the federal level. In fact, as per the chart above, prices for the right to emit a metric ton of CO2 have been on a tear, recovering from a pretty significant slump in the preceding months. Last week, the World Bank Carbon Finance Unit released its annual update on the state of global carbon market (PDF...

Trading Places: Will America’s Carbon Market Outsize Europe’s?

Charles MorandIn early January, I said the following on the likelihood that the Obama Administration would move on carbon regulations in the near-term: "The next 12 to 18 months are unlikely to produce much in the way of vigorous environmental action on the part of government (barring subsidies for alternative energy related to the stimulus package), especially if it means additional costs on industry." Clearly, I had underestimated the power of another fundamental rule of politics - besides "don't anger the rust belt states that gave you your presidency by burdening their industries with avoidable costs in the midst...

EDF Sets Up Carbon Fund

The French electric utility EDF announced today that it is setting up a €300 million ($396 million) carbon fund to help meet its regulatory requirements under the EU ETS, Europe’s regulatory framework to control CO2 emissions. Carbon funds allow companies to make investments that create CO2 emissions reductions in emerging markets, such as upgrades to industrial operations or renewable energy projects, and use the credits generated thus to meet regulatory requirements in their home jurisdictions. This is a good way to concurrently reduce compliance costs at home and foster environmentally-friendly investments in emerging economies. I have discussed...

Investing in Climate Change

This post was supposed to be about coal-to-liquids (CTL), but I came across interesting info yesterday after opening a former colleague’s mail that I thought would make for a more interesting post. The CTL piece will thus have to wait a bit. What was in the package was a hard copy of the January/February 2007 edition of CNBC European Business. This edition is dedicated to climate change, but, more importantly, to how some firms are positioning themselves to benefit from the markets that will be created as a result of regulatory and other actions to tackle greenhouse gas...

Fossil Fuel Industry: Killing the Customer

by Debra Fiakas, CFA

Published by the Climate Accountability Institute, the Carbon Majors Reportlays bare the truth about which companies are responsible for industrial greenhouse gas emissions. One hundred fossil fuel producers are linked to 71% of global industrial greenhouse gases emitted since 1988. Something like a line in the sand for climate scientists, 1988 is the year human-induced climate change was official recognized by the Intergovernmental Panel on Climate Change.

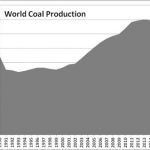

Fossil fuels in the form of coal, crude oil and gas are by far and large the culprits. Rolling forward three decades later, we can observe in the charts below that fossil fuel production...

Carbon Offsets Work – Will the Mainstream Media Ever Get It?

The carbon markets are an area of keen interest for me personally and professionally, so it is always frustrating that the mainstream media largely refuses to learn the details. In general, layman and media who don’t understand the details of the carbon markets attack carbon offsets in two areas, first, questioning whether the credits are for a project that would have occurred anyway (a concept known in carbon as “additionality”), and second questioning whether there are checks and balances to ensure the environmental standards are adhered to and the abatement actually happens (in carbon known as the validation...

Is Energy Sourcing the Gateway Drug to Energy Efficiency?

Tom Konrad CFA I recently interviewed Richard Domaleski, CEO of World Energy Solutions (NASD:XWES). World Energy is a comprehensive energy management services firm whose core offering is extremely price competitive energy sourcing (that is, finding an energy provider to supply all of a client's energy needs at the lowest possible cost.) They achieve competitive sourcing using an electronic energy exchange designed to achieve much better price discovery in what is traditionally a very opaque market. According to Domaleski, a recent KEMA study showed that only 7% of large commercial, industrial, and government customers are sourcing their...

Carbon Emissions ETF

Today, while reading an article on cleantech ETFs by The Motley Fool, I found out that XShares Advisors LLC and the Chicago Climate Exchange were working on a carbon emissions-based ETF (PDF document). There is not a lot of info available on what exactly this ETF will track. We reported back in November that UBS had launched an index based on European carbon prices. As noted by Richard Kang at around the same time, this index is well-suited for something like an ETF. If any of our readers have any further insight on this, don't hesitate...

Avoiding a Carbon-Price Backlash

by Tom Konrad, Ph.D. Economics and Greenery, a Belated Rapprochement It is truly a triumph of economic ways of thinking that many of environmental activists are championing market-based approaches to tackling climate change. Those people who are not for cap-and-trade on global warming gas emissions promote the even more economically rigorous carbon tax. The most common defense against criticisms of subsidies for renewable energy is to retort that the fossil fuel industry benefits from much large subsidies. Not only do fossil fuels get generous subsidies in direct and indirect payments, but they seldom pay anything like the indirect costs...

Climate Legislation: Who wins? Who loses?

Most Americans now agree that something needs to be done to reduce our greenhouse gas emissions. Hopefully most Americans now appreciate that this is not a small, but even more so, not a simple problem. I am a big believer that the playing field for our low carbon future should start level, and the market should be structured to allow our major power and energy companies a chance to lead the way, instead of simply dishing out punishment for our combined historical choices. Carrots and sticks work well together, but sticks alone are not going to solve our...

Ten Insights into Carbon Policy and Its Implications

On November 27, I attended the National Renewable Energy Laboratory's (NREL) Fifth Energy Analysis Forum, hosted by NREL's Strategic Energy Analysis & Applications Center. The forum focused on carbon policy design, the implications for Renewable Energy and Energy Efficiency. As a stock analyst focused on that sector, I am extremely lucky to have NREL as a local resource: the quality and the level of the experts at NREL and the ones they bring in is probably not matched anywhere in the country, and conferences like these provide priceless insights into what these Energy Analysts are thinking. Why should investors...

World Energy Solutions (XWES) and Ram Power (RPG.TO) Appear Promising

From Small Fries to Big Shots? Part 1 of 2 by Bill Paul Feel like rolling the dice on some small alternative energy stocks that appear to have big-time potential? Just remember: sometimes you roll snake eyes. First up: World Energy Solutions Inc. (Symbol: XWES), which currently trades on NASDAQ for $3 and change per share. Worcester, MA-based World Energy Solutions operates online exchanges for energy and green commodities, including the one administered by Regional Greenhouse Gas Initiative Inc. (RGGI), the regulatory scheme under which 10 Northeastern and Middle Atlantic states "cap" their power plants' emissions by requiring...

Some Emissions Trading News

A lot has happened in the world of carbon finance and emissions trading since we last wrote about this topic, so I felt this might be good time to provide a quick update. (A) The World Bank Carbon Finance Unit recently released its State and Trends of the Carbon Market 2007 (PDF document), a periodic assessment of the scale and characteristics of the global market for carbon dioxide emissions. The Bank found a large increase in the volumes traded (131%) and dollar value (177%) of the global carbon market in 2006 over 2005. Unsurprisingly, the EU ETS...

Hedging Your Climate Risks

Whether you agree it's because of human activity or not (and, for the record, I do), there's no doubt that the weather has been a little wacky over the past few years, driving a range of events that have had very real repercussions on businesses and the economy. Hurricane Katrina is one obvious example, but there have also been other, more subtle cases. Many ski resort operators in North America, for instance, were beginning to believe that winter would never arrive on the eastern side of the continent. In the west, we're now being told that cold weather...

Biochar’s Likely Market Impacts

Biochar is still mostly a research and cottage industry, yet it has the potential to impact returns for a broad range of investors. Tom Konrad, Ph.D., CFA Biochar, or amending soil with biomass-derived carbon, shows great potential to improve the productivity of soils, as well as to increase the utilization of fertilizers by plants, while sequestering carbon to reduce the drivers of climate change. On August 10, I went to the 2009 North American Biochar Conference to look at the potential for investors. Before I went, I took a look at the publicly traded companies...

Climate change, carbon trading and America…it’s only a matter of time

Just a quick follow-up on my carbon trading post a few days ago. Thanks to GreenBiz.com for the heads up on the results of a survey that were released during MIT's seventh annual Carbon Sequestration Initiative Forum. The results show that climate change now tops the list of environmental concerns for Americans. I don't want to reveal too much here since this is a GreenBiz.com story, but it suffices to say that this provides yet more ammunition to the political backers of a framework to reduce greenhouses gases in America. Momentum is building and there will definitely be some...