Electric Vehicle and Lithium-ion Battery Investing For Imbeciles

John Petersen In their 1969 bestseller "The Peter Principle" Laurence Peter and Raymond Hull quoted a Latin-American student named Caesare Innocente who lamented, "Professor Peter, I'm afraid that what I want to know is not answered by all my studying. I don't know whether the world is run by smart men who are, how you Americans say, putting us on, or by imbeciles who really mean it." After watching the events of the last few weeks, I think most of my regular readers would agree that the imbeciles are clearly steering the ship. Last March I went...

Cleantech Investing – Aspirations vs. Economics

John Petersen In a November 2008 thematic report, The Sixth Revolution: The coming of Cleantech, Merrill Lynch strategist Steven Milunovich identified cleantech as the sixth technological revolution. He borrowed his definition from Lux Research which describes cleantech as "the universe of innovative technologies designed to optimize the use of natural resources and reduce environmental impact" and warned that "investors must pay attention because cleantech could revolutionize much of the economy, including the utility, oil and gas and auto industries." The six technological revolutions Milunovich identified were: 1771 The Industrial Revolution ...

The Best Peak Oil Investments: PTRP – Powershares Global Progressive Transport Portfolio

Tom Konrad CFA Many investors find the prospect of selecting individual stocks simply too daunting. For those investors interested in investing in peak oil, but uncomfortable with the risks and moral dilemmas inherent in oil company stocks, there is another option: Powershares Global Progressive Transportation Portfolio (PTRP). I've been researching and writing this series about investments that will benefit from peak oil for half a year. If you've read the 20+ articles in the series so far, you've learned about several stocks that should be well positioned to benefit from rising oil prices, and you should...

Hybrid cars drive a company, and its stock

Energy Conversion Devices Inc (ENER) founded by the now-82-year-old Mr. Ovshinsky in 1960, developed the battery technology that is being used in Toyota Motor Corp.'s Prius the popular "hybrid" car model that has given U.S. automobile titans Ford Motor Co. and General Motors Corp. a run for their money. And the Rochester Hills, Mich., company though it still is unprofitable, making iit a risky bet is drawing backing from serious investors who see a hot market for its products. This story hit the news wires and the Wall Street Journal late last night. ENER...

Watch Out For Nissan

An interesting short piece in Wired's Autopia discussing Nissan's 2007 Altima Hybrid. This is interesting because it is available now and at a reasonable price, and so the impact on company sales can be measured in the short term. I'm always wary of announcements involving technologies (let alone mass production) that are years away. This harks back to the idea of bridge, or transition, technologies. Companies that are finding ways to make money from existing technologies while still keeping eye on promising future technologies are worth keeping on the radar.

BYD Stalled Despite Japanese Carmakers’ Woes in China

Doug Young BYD's G3 at the Shenzen High -Tech Fair in 2009. BYD needs more exciting new products to thrive despite Chinese buyers spurning Japanese auto brands. Photo credit: Brücke-Osteuropa. The prognosis isn't looking good for Japanese car brands in China, with Honda (Tokyo: 7267) becoming the latest predictor that the gloom plaguing Japan's big 3 automakers could last into next spring and perhaps even longer. That looks like bad news for not only Honda, Toyota (Tokyo: 7203) and Nissan (Tokyo: 7201), but also their Chinese...

Energy Storage: A Turbulent Second Quarter Foretells Major Changes

John Petersen The second quarter was a turbulent period for investors in the energy storage and vehicle electrification sectors. Johnson Controls (JCI), C&D Technologies (CHHP.PK) and the enchanted, mystical, gravity defying Tesla Motors (TSLA) were up a little. Everybody else was down as fear, loathing and uncertainty ran rampant and the congenital birth defects of EVs and batteries to power them proved to be insurmountable obstacles for all but St. Elon of Palo Alto, the patron saint of expensive toys. While the second quarter wasn't pleasant for most of the companies I track, I draw some comfort...

The Time is Right for Gas-guzzler to Dual-mode EV Conversions

Since early 2008, Axion Power International (AXPW.OB) has been quietly developing an experience base and building grass roots support for a gas-guzzler to dual-mode EV conversion initiative that has the short-term potential to transform up to 120 million gas-guzzling pickup trucks, sport utility vehicles and vans into gas sipping EV-50s. If recent articles from sources as diverse as The Daily Green, Edmunds Green Car Advisor and the Environmental Defense Fund are reliable indicators, the initiative is rapidly gaining ground. The concept is simple – add electric power trains and battery packs to America's least fuel-efficient vehicles and give...

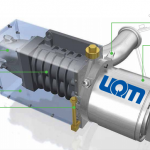

Shareholders Cry Foul as UQM Agrees to Buyout

UQM Technologies (UQM: NYSE) has agreed to be acquired by Danfoss Power Solutions for $1.71 per share in cash, providing a deal value near $100 million. UQM leadership expects timely review by government authorities and has recommended approval of the deal by shareholders. A date has not been set for the required shareholder vote. Assuming all goes according to schedule, a deal closing is possible sometime in the second quarter 2019.

Electric propulsion and generation technologies are at the core of UQM’s solutions for manufacturing, transportation and power industries. The substitution of electric motors for combustion engines has been driving demand for the UQM’s products. Market opportunities have abounded...

The Alternative Energy Fallacy

John Petersen In 2009, the world produced some 13.2 billion metric tons of hydrocarbons, or about 4,200 pounds for every man, woman and child on the planet. Burning those hydrocarbons poured roughly 31.3 billion metric tons of CO2 into our atmosphere. The basic premise of alternative energy is that widespread deployments of wind turbines, solar panels and electric vehicles will slash hydrocarbon consumption, reduce CO2 emissions and give us a cleaner, greener and healthier planet. That premise, however, is fatally flawed because our planet cannot produce enough non-ferrous industrial metals to make a meaningful difference and the prices...

Johnson Controls Forecasts Enormous Stop-Start Growth

John Petersen On June 27th Johnson Controls (JCI) hosted their 2011 Power Solutions Analyst Day and unveiled their expectations for the future of stop-start idle elimination systems. After noting that all automakers are developing a range of powertrains, JCI used this graph to emphasize their view that the overwhelming bulk of alternative powertrain vehicles over the next five years will have simple, cost effective and fuel efficient stop-start systems. You don't see much about stop-start systems in the mainstream media because politicians and reporters are too enchanted with plug-in vehicles and other exotica...

Toyota to Double Hybrid Allocation to U.S.

Toyota Motor Corp., Japan's top automaker, said Thursday it will double the allocation of Prius hybrid cars for the U.S. market in 2005, part of a companywide goal to sell 300,000 gasoline-electric hybrid vehicles worldwide by the end of next year. Toyota said the announcement coincides with the sale of its 100,000th Prius in the United States, where they went on sale in the summer of 2000.

The Best Peak Oil Investments, Part II: Hydrogen and Vehicle Electrification

Tom Konrad CFA There are many proposed solutions to the liquid fuels scarcity caused by stagnating (and eventually falling) oil supplies combined with growing demand in emerging economies. Some will be good investments, others won't. Here is where I'm putting my money, and why. This second part looks at hydrogen and electrification strategies for replacing oil. In Part I of this series, I listed four potential substitutes that have been proposed to replace oil as limited supply and growth in developing markets draw oil away from traditional users. I've since added a fifth to my list...

A123 Systems vs. BYD and Other Irrational Battery Investments

John Petersen Mother always taught me that if you can't say something nice, it's usually better to say nothing. While regular readers might question my ability to follow Mom's advice, this is an article I had really hoped somebody else would write. The quick summary is that while the shares of A123 Systems (AONE) may be a reasonable investment at current prices, the shares of BYD Co. Ltd. (BYDDF.PK) are an irrational value proposition, the shares of Ener1 (HEV) are even worse, and the shares of Valence Technologies (VLNC) are beyond understanding. Since many readers find detailed tables...

Ener1 And Delphi Sign LOI To Form Lithium Battery Joint Venture

ENER1 INC (ENEI) and Delphi Corp. (DPH), today entered into a non-binding letter of intent to create a joint venture to leverage their combined expertise in lithium batteries. Delphi and Ener1 will be negotiating definitive agreements and conducting due diligence in the coming weeks. "The combination of Ener1's vapor deposition process and its nanotechnology for production of high-rate, low-cost lithium batteries with Delphi-developed high energy capacity technology would allow the venture to have a key advantage in penetrating its target lithium battery markets," — Kevin Fitzgerald, Ener1's CEO. ENEI is up over 14% on this news...