EPA Administrator Scott Pruitt Resigns

by Jim Lane

In Washington, EPA Administrator Scott Pruitt has resigned.

US President Donald Trump announced the exit on Twitter, commenting, “President Donald Trump announced Pruitt’s exit, saying on Twitter “I have accepted the resignation of Scott Pruitt as the Administrator of the Environmental Protection Agency. Within the Agency Scott has done an outstanding job, and I will always be thankful to him for this.”

Deputy Administrator Andrew Wheeler becomes acting administrator.

The Digest’s Take

Elsewhere in the media, it is widely reported that Pruitt was undone by a growing number of controversies and investigations relating to his conduct as EPA Administrator, particularly relating...

Highlands EnviroFuels Wants Gevo’s Isobutanol Tech For Florida Plant

Jim Lane Plant to convert sugar cane and sweet sorghum to 20-25 million gallons per year of Isobutanol From Colorado, Gevo (GEVO) announced that Highlands EnviroFuels has signed a letter of intent to become a Gevo licensee to produce renewable isobutanol. Highlands will build a commercial-scale “Brazilian-style” syrup mill in Highlands County, Florida, which would have a production capacity of approximately 200,000 metric tons of fermentable sugar per year. The facility will process locally grown sugar cane and sweet sorghum to a high quality syrup as a clean sugar stream for fermentation and recovery of isobutanol....

List of Biodiesel Stocks

Biodiesel stocks are publicly traded companies whose business involves producing biodiesel made from oils and fats for use as a fuel diesel engines, either alone or blended with petroleum derived diesel. Common feedstocks include soybean oil, palm oil, and waste oils from the food industry. Biodiesel is the most widely produced and used advanced biofuel, and all biodiesel stocks are also biofuel stocks.

This list was last updated on 7/20/2022.

China Clean Energy Inc. (CCGY)

FutureFuel Corp. (FF)

Green Star Products, Inc. (GSPI)

Greenshift Corporation (GERS)

Methes Energies International (MEIL)

Neste Oil (NEF.F)

PetroSun, Inc. (PSUD)

RDX Technologies, Inc. (RDX.V)

If you know of any biodiesel stock that is...

A Disappointing Supreme Court Biofuel Decision. Why It’s Not Over Yet

By Jim Lane

The case

Last week’s decision stems from a May 2018 challenge brought against EPA in the U.S. Court of Appeals for the Tenth Circuit by the Renewable Fuels Association, the National Corn Growers Association, National Farmers Union, and the American Coalition for Ethanol, working together as the Biofuels Coalition. The petitioners argued that the small refinery exemptions were granted in direct contradiction to the statutory text and purpose of the RFS and challenged three waivers the EPA issued to refineries owned by HollyFrontier Corp. and CVR Energy Inc.’s Wynnewood Refining Co.

The case is HollyFrontier Cheyenne Refining, LLC v....

Amyris’ “Fene Economy”

by Debra Fiakas CFA There are not many companies with the courage to stage an initial public offering, but renewable chemicals and materials producer Amyris, Inc. (AMRS: Nasdaq) was undaunted. The company sold 5.3 million shares at $16.00 earlier this month, raising $78.8 million in net proceeds. Amyris has done fairly well in raising capital. In December 2009, the Department of Energy awarded Amyris a $25.0 million grant to build a pilot plant that will produce diesel and petrochemical substitutes through the fermentation of sweet sorghum. Then Temasek Holdings invested $47.8 million into the company. The Amyris vision...

Why We Can’t Take Our Eyes Off Gevo

Jim Lane So, feel the bioeconomy backbeat and let the music flow. AY-YI YI-YA AAAY, Gevo (GEVO) just can’t stop dancin’. (Whoops, that was Becky G‘s Can’t Stop Dancin’, not Gevo’s.) But there’s something so cool in that technology that we can’t take our eyes off the company and its progress, even though looking at the balance sheet can feel like watching a car crash in slow motion. This week, Gevo executed a series of moves including signing up its first direct customer for hydrocarbons for the proposed expansion of its Luverne, Minnesota plant. The highlight was a...

Clearfish Research Profiles Pacific Ethanol (PEIX)

Pacific Ethanol (PEIX) is building a refinery in California for corn based ethanol production in the heart of the California agricultural and dairy land (the biggest agricultural and dairy producer in the country). The refinery is supposed to come on line in Q4 2006, and there are plans for 4 more subsequent refineries. As there is unlikely to be any increased ethanol demand in California (see background above), the supply capacity they are bringing online must be able to disrupt the current out-of-state supply and/or undercut the current prices. They are one of the biggest distributors of that alternate...

No Eeyores for KiOR

Jim Lane Analysts are bullish as KiOR’s (KIOR) drop-in biofuels technology transitions to commercial phase – what factors are driving all the good vibes? There are a lot of Eeyores around the advanced biofuels space these days – well, around the United States and to a great extent the EU as a whole, really. Gloomy, pessimistic, chronically depressed. Investors have been, in a similar mood, hammering advanced biofuels and biobased material stocks – in some cases to within a few bucks of cash on hand. KiOR, by contrast, has been generally able to create and sustain its...

Rentech After Fischer-Tropsch

by Debra Fiakas CFA A long article appearing in early March 2014 on Biofuels Digest about Emerging Fuels Technology (EFT) gave me pause. The article has since been removed from the site but it was an interesting primer on Oklahoma-based EFT’s use of the Fischer-Tropsch process to convert carbon-based feedstock to liquid fuel, otherwise called Gas-to-Liquids. While Emerging Fuels Technology has been listed in Crystal Equity Research’s Alternative Chemicals Group of the Beach Boys Index of companies trying to harness energy from the sun through biomas, I must admit the company had not been taken seriously. ...

Corn Ethanol Emissions Savings Skyrocket

Jim Lane In Washington, an explosive new peer-reviewed report from ICF found that greenhouse gas emission reductions from typical corn-based ethanol production have soared to 43 percent compared to 2005-era gasoline. The report projects that by 2022, corn-based ethanol will achieve a 50 percent reduction, and could reach “76 percent in 2022 if there is more widespread adoption of optimal crop production and biorefinery efficiency.” The report, issued by the U.S. Department of Agriculture, based its revolutionary emissions math on a November 2014 study by researchers at Iowa State University, which found that farmers around the world have...

A (nearly) Pure-play Biodiesel Stock

On January 29th, M~Wave and private vertically integrated Biodiesel distributor Blue Sun Biodiesel announced a merger between the two, with Blue Sun becoming a division of M~Wave, and the merged company being renamed Blue Sun Holdings. Managerial control will also pass to "certain directors and the officers of SunFuels." If this merger goes through as planned in the second quarter of 2007, US investors will have their first opportunity to invest in a stock focused on a biofuel which is much less controversial among environmentalists than corn-based ethanol. Estimates of the well-to-wheels Energy Return on Energy Invested...

Betting On Renewable Diesel: Valero or Darling?

Valero Energy (VLO: NYSE) recently disclosed ongoing discussions to expand its renewable diesel production to a second plant that would be built and managed by its Diamond Green Diesel joint venture with Darling Ingredients (DAR: NYSE).

The proposed plant that would be located in Port Arthur, Texas and turn out 400 million gallons of renewable diesel and 40 million gallons of naptha per year. As a food by-products processor Darling has easy access to low-cost used cooking oils and animals fats that serves as the feed stock for Diamond Green’s renewable diesel production.

Valero management has cited increasing global demand for low- to no-carbon...

More Than Ethanol at Green Plains

Last week ethanol producer Green Plains (GPRE: Nasdaq) reported financial results for the quarter ending June 2018. As expected the company reported a net loss, but actual results were far better than expected. The news gave traders a reason to celebrate with bids that led to a gap higher at the opening on the first day of trading following the announcement. Cooler heads came into the market as the day wore on and the stock closed below the open on heavy volume. Nonetheless, the stock finished the week higher and appears prepared to challenge lines of volume-related price resistance in the trading sessions ahead.

There may...

More Sorghum Sowers

by Debra Fiakas CFA Sorghum Bicolor photo by Matt Lavin The post “Ceres Plants Seeds of Success” featured seed and trait developer Ceres, Inc. (CERE: Nasdaq). This agricultural technology company develops seeds and traits for high-energy, low-cost feedstocks like sorghum. Ceres is not the only player in the sorghum game. The presence of large agriculture products suppliers like Monsanto Company (MON: NYSE) and Dow AgroSciences of the Dow Chemical Company (DOW: NYSE) provide some validation of sorghum demand even if also triggering competitive concerns. DuPont’s Pioneer HiBred...

Cosan: No Haven for Ethanol Investors

by Debra Fiakas CFA The stark reality of basing their business model on a food commodity has been brought into sharp focus for ethanol producers. The drought settling across the U.S. corn crop is helping drive up corn prices for hog producers, chicken farms and ethanol plants alike. Investors who simply must have a position in ethanol might think the sugarcane-based ethanol producers could offer a safe haven against the supply and margin squeeze that is certain to hobble GreenPlains Renewable Energy (GPRE: Nasdaq), Pacific Ethanol (PEIX: Nasdaq) and Poet (private), among others relying on corn feedstock....

Aviation Biofuel Overview

by Debra Fiakas, CFA

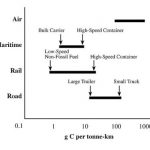

The aviation industry contributes about $2.7 trillion to the world’s gross domestic product. It may seem like a big number, but that is only 3.6% of the world’s wealth. Aviation may be a minor player in terms of creating wealth, it is a big culprit in climate change. Flying around the world accounts for as much as 9% of humankind’s climate change impact. Indeed, compared to other modes of transportation, flight has the greatest climate impact.

The negative impact of carbon emitted by aircraft is made even worse by the fact that the emissions point is mostly at cruising altitudes high...