The hydrogen technology developer Hydrogenics Corporation (HYGS: Nasdaq) is taking on wind energy. The company’s fuel cell power systems for stand-by and site power sources, hydrogen generators for industrial situations, and energy storage and fuel solutions for fleet owners. Hydrogen has gained in popularity because it is a zero-emission fuel source when burned with oxygen. The energy efficiency of hydrogen as a transportation fuel is also enticing. An electric motor powered by hydrogen fuel cell is two to three times more efficient than an internal combustion engine running on gasoline.

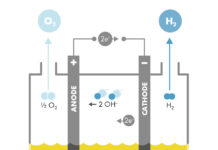

Hydrogen is not without its critics. One of the criticisms is that hydrogen is not entirely a carbon-neutral fuel source. The majority of hydrogen in the United States is produced in a steam reforming process using natural gas. However, the argument is short-sighted given that hydrogen can be produced from water through electrolysis. Combined with a renewable energy source such as wind or solar to trigger the electrolytic process, hydrogen can be low-carbon as well as zero-emissions.

This is why Hydrogenics is tying up to a wind energy project. The company will supply a 2.5 megawatt electrolyzer-based energy storage system to the Varanger Kraft wind farm in Raggovidda, Norway. The wind farm has a 200 megawatt capacity, but the local electrical grid cannot accept all it. Operated by Stattnett, the grid can only accept 45 megawatts. It is not economically to invest in a more robust electrical grid for the region where reindeer may out number people. Power producer Varanger along with its partners want to channel some of the unused wind energy to produce hydrogen with the Hydrogenics system. The result with be a fully green fuel source that can be storage.

Hydrogenics has traveled a long road to reach its Norway customers. Management’s persistence appears to be paying off. In the twelve months ending June 2018, the company reported US$47.5 million in total sales. The company is still investing heavily in product development and has bloated operating costs. In that same period the company reported a $7.0 million loss before depreciation, amortization and interest.

Operations used a total of $7.5 million in cash resources in that twelve month period. With $13.9 million in cash on the balance sheet, management may have some maneuvering room. There is time to win more customers like Varanger Kraft as well as bring new products to market.

It seems the company has already been hard at work on business development. Backlog at the end of June was US$132 million. Unfortunately, this was lower than three months earlier after an order valued at $7.5 million was cancelled. Nonetheless, at least $51 million of the backlog is expected to be converted into revenue over the next year, given the impression of modest but solid growth.

That cancelled order may have added to investor worries over Hydrogenesis. The shares have traded off throughout 2018, and only experiencing a partial recovery in recent weeks. Trading closer to the 52-week low price than the 52-week high price, the stock appears poised for a recovery. .

The company will report financial results for the third quarter ending September 2018. The consensus estimate is for a loss of $0.07 per share. There are four contributions to the consensus estimate, falling in a very wide range from a loss of $0.13 to a loss of $0.02. The lack of agreement among analysts following the Hydrogenesis suggests that there will be some who are unpleasantly surprised and others who may want to throw a party.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries. Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

This article was first published on the Small Cap Strategist weblog on 10/19/18 as “Hydrogenics: Ready to Throw a Party.”