Tom Konrad CFA

![new_logo1[1].jpg](http://www.altenergystocks.com/wp-content/uploads/2017/08/new_logo1_1_.jpg) I sometimes think Alterra Power (TSX:AXY, OTC:MGMXF) is unfairly lumped with other small, renewable energy developers.

I sometimes think Alterra Power (TSX:AXY, OTC:MGMXF) is unfairly lumped with other small, renewable energy developers.

A typical problem for small developers over the last few years has been raising the funds to invest, even when they have compelling prospects. For instance, Western Wind Energy stock (TSX:WND,OTC:WNDEF) has been beat up recently because a large Federal cash grant is delayed. Finavera Wind Energy (TSXV:FVR, OTC:FNVRF) has been declining for most of the year as they look for a strategic partner to help fund their permitted wind developments, despite significant progress permitting those projects and obtaining a bridge loan to fund operations and development in the meantime.

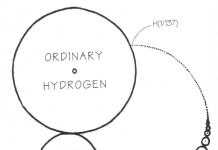

Alterra, on the other hand, has plenty of cash on its books to invest, and does not need to look for partners. Two news items today drove that point home. First, they announced that their Dokie Wind Farm (which commenced commercial operations in 2011) had funded its loan reserve and commenced equity distributions back to Alterra. Second, that the company had received an unsolicited offer for their stake in their HS Orka geothermal plant in Iceland.

With $57 million cash on the books ($0.12 per share), Alterra has no immediate need to sell its 66.6% stake HS Orka, but it has agreed to explore the deal. Alterra’s VP Corporate Relations, Anders Kruus, stated, “[W]e felt we should consider this unsolicited proposal if it maximizes value for Alterra shareholders and is supported by Icelandic stakeholders.” In other words, they’ll sell if the price is right and it does not cause political waves in Iceland, where Alterra plans to continue to do business.

It’s a nice position to be in, and maybe investors are starting to recognize it. The stock is up C$0.05, or 13.5% to C$0.40 as I write, although it’s still trading at only a little more than 50% of book value.

Disclosure: Long MGMXF, WNDEF, FNVRF

This article was first published on the author’s Forbes.com blog, Green Stocks.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.