I took a small position today in Railpower Tech (RPWRF.PK or P.TO) at C$0.46. Tom briefly discussed Railpower last November in an article on rail stocks. I don’t want to dwell too much on how I view the macro picture for rail, but suffices to say that a combination of increasing fuel prices and concerns about climate change is re-kindling interest in this sector in a significant way across North America (in other regions of the world, mainly Europe, the interest never really vanished in the first place). Tack on top of that the potential for material savings in fuel (25-45%) and reductions in harmful emissions (70-90%), and you have a nice value proposition. The company is also expanding its technology into other applications, namely port cranes. I bought this stock on news that the company was moving ahead with construction of a new manufacturing facility, and had secured financing to pay for the facility (PDF document). Railpower has experienced its share of difficulties in the recent past, as evidenced by the stock’s spectacular fall from grace. While the company has been successful in attracting a fair deal of attention to its admittedly innovative technology, execution and liquidity problems have dogged this stock for the better part of the past two years.

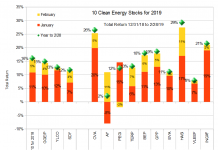

Last fall, the Ontario Teachers’ Pension Plan (OTPP), one of Canada’s largest institutional investors, threw the firm a lifeline in the form of a C$35 million (US$35.4 million) capital injection. Given OTPP’s reputation as one of the most sophisticated institutional investors in Canada, I began paying closer attention to the firm. Today, on news that they were building a factory and getting another large cash infusion from OTPP (C$20 million), I decided to dip my toes and take a small position. Before buying anything, I did a quick and dirty analysis of the firm (see table below). I liked the 274% pop in top line in 2007 over 2006, and gross and operating margins seem to be improving. I liked what I saw with regards to inventory management, which is a good measure of efficiency. Inventory appeared to me to be the major area of working capital weakness for Railpower. Finally, largely due to improved working capital management, Railpower showed a notable improvement in operating cash.

A rough calculation, using the Q1 balance sheet (PDF document) and adding the C$20 million of new financing to assets, yields a price-to-book ratio of around 2.35 at today’s closing price of C$0.75. This is therefore not a ‘cheap’ stock, but also not an outrageously expensive one based on this metric. The real value in this firm, however, may lay with its potential earnings power, which won’t be measurable until its starts to actually generate earnings. C$55 million in financing in the space of a few months from the public equity division of OTPP speaks volume, and I doubt OTPP would’ve provided this cash if it did not believe in Railpower’s ability grow earnings substantially. Moreover, operating out of a brand new, state-of-the-art facility should help the firm improve its operating performance. I can’t claim to know this company inside and out, which is why I only took a small position. I intend to do more research over the next few days to decide whether to increase my stake. If momentum takes hold of the stock and it gets pushed beyond levels where I’m comfortable, I’ll just have to table this one for the time being. UPDATE (May 27): P.TO gave back much of yesterday’s gain to close at C$0.55. Volume was higher today than it was yesterday at 18.2 million trades (Vs. ~16 million). I’m not surprised this happened as there was almost certainly going to be some profit-taking on a one-day pop of 87%. The major milestone to look for in this company for the remainder of ’08 is the ability to fill the order book.

DISCLOSURE: The author is long R.TO

DISCLAIMER: I am not a registered investment advisor. The information and trades that I provide here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

It would be great if you would update us when you have finished your DD. Was the 20 cent drop today a buying opportunity? The news of teh $55 million makes it seem so, but what is the other shoe? Thanks for your blog. Truly awesome and informative.

I like this company, and think it is going places. The timing seems right for them. New facility, OTPP, seems something is up and they are moving forward. Anymore updates would be greatly appreciated, even if you sold your position.