https://renewableops.brookfield.com/

Tag: Brookfield Renewable Energy Partners (BEP)

Ten Clean Energy Stocks For 2019: April Ascent

In April, my 10 clean energy stocks model portfolio continued to power ahead, despite the concerns about market valuation I expressed last month. As I said at the time "me being nervous about the market is not much of an indicator that stocks are going to fall" at least in the short term. So I continue to trim winning positions and increase my allocation to cash as stocks advance.

Both the model portfolio and the Green Global Equity Income Portfolio (GGEIP) were up 4.5% and 3.6% respectively in April. This was solidly ahead of their clean energy income benchmark YLCO...

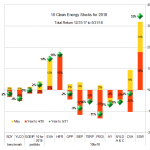

Too Good To Last? Ten Clean Energy Stocks For 2019

The first quarter of 2019 saw the market's largest quarterly gain in a decade, and my 10 clean energy stocks model portfolio outperformed both the broad market and the clean energy income ETF I use as a benchmark (see chart above.)

Performance that strong makes me nervous, especially since the last time we saw gains like these it was the stock market rebound from the financial crisis. In this case, while the market was down in the last quarter of 2018, it had only been enough of a decline to blow a little of the foam off the top of...

10 Clean Energy Stocks For 2019 – First Two Months Results

It's hard to find anything to complain about in the first two month's performance of my 10 Clean Energy Stocks for 2019 model portfolio. Unfortunately, I'm about to go on vacation and don't have time to do an update on all the earnings reports that have come out over the last two weeks. I will try to get to them individually as I have time.

Strategically, I'd like to say I'm getting very nervous about this market rally, and think that readers should be taking profits opportunistically and increasing your cash positions.

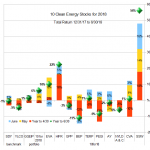

Ten Clean Energy Stocks For 2018: Wrap Up

by Tom Konrad Ph.D., CFA

Almost every major index fell in 2018. My Ten Clean Energy Stocks model portfolio and the Green Global Equity Income Portfolio (GGEIP), the real-money portfolio that I manage were not exceptions. Still, I'm satisfied with their performance: the model portfolio lost only 1.3 percent for the year, while GGEIP was down 2.6 percent. That's well ahead of most indexes, including my benchmarks YLCO (down 7.8 percent) and SDY (down 4.1%.) These benchmarks are intended to reflect the performance of clean energy dividend stocks and general of dividend stocks, respectively. Non-income oriented indexes such as the...

Ten Clean Energy Stocks For 2019

by Tom Konrad Ph.D., CFA

Looking forward to 2019, I'm more optimistic than I have been since the start of 2016, in the wake of the popping of the YieldCo Bubble in late 2015.

The bear market that started in late 2018 seems like it's far from over, but I expect in early 2019 will see it enter a less chaotic phase. After the wild declines and swings of late 2018, I expect investors will begin the new year with an eye to safety more than growth. This means that the clean energy income stocks which are my focus should outperform...

Ten Clean Energy Stocks For 2018: Quick November Update

by Tom Konrad Ph.D., CFA

At the start of November, I abandoned my short-term bearish stance on the market, writing "I’m not confident that the correction is over, but we seem to be heading into a temporary lull, and so I’m going to abandon cash as my top pick for November." This turned out to be a good call, with my Ten Clean Energy Stocks model portfolio up 4.3% for the month, slightly behind its broad dividend income benchmark, SDY, which was up 4.9%. Its clean energy income benchmark YLCO gained 1.6%, as did the private portfolio I manage, the...

Ten Clean Energy Stocks For 2018: Terraform, Clearway, and Enviva

by Tom Konrad Ph.D., CFA

Last week, I neglected to discuss Terraform Power (NASD: TERP) in the third quarter update on the other ten clean energy stocks for 2018. I did not notice the omission until after the post had been published, so I decided to write a quick follow-up this week after I had a chance to digest the earnings announcements (including TERP's) which were scheduled for later in the week.

Stock discussion

Clearway Energy, Inc (NYSE: CWEN and CWEN/A)

12/31/17 Price: $18.90 / $18.85. Annual Dividend: $1.133(6.0%). Expected 2018 dividend: $1.26(6.7%) Low Target: $14. High Target: $25.

10/31/18 Price: $19.61/$19.42 ...

Ten Clean Energy Stocks For 2018: Third Quarter Earnings

Tom Konrad Ph.D., CFA

After a fairly brutal September and October my Ten Clean Energy Stocks model portfolio is barely hanging on to positive territory for the year (up 2.4%) as is the private portfolio I manage, the Green Global Equity Income Portfolio (GGEIP, up 0.8%). Yet I can take comfort in superior relative performance, since my broad dividend income benchmark SDY is now down 0.1% for the year, and the clean energy income benchmark YLCO has fallen 5.8%. All returns are total return after fees and dividends.

The strong relative performance in a weak market is most likely due to...

Ten Clean Energy Stocks For 2018: September Quick Update

As you can see from the chart, September was a tough month for my model portfolio of Ten Clean Energy Stocks for 2018. Seaspan (SSW) fell back on trade war fears and Green Plains Partners (GPP) fell on ethanol market weakness caused by retaliatory ethanol tariffs and the Trump EPA's continued undermining of the Renewable Fuel Standard. I'm less sure why Covanta (CVA) is down, but Clearway Energy's (CWEN and CWEN-A formerly NRG Yield) small decline is due to a recent secondary offering.

Two of these (CVA and GPP) were my top picks last month, while the third was Terraform Power (TERP). ...

Ten Clean Energy Stocks For 2018: Second Quarter Earnings

Tom Konrad Ph.D., CFA

July and August saw some mild recovery for the stock market after a difficult first half of 2018. Clean energy income stocks continue to lag the broader market, but my Ten Clean Energy Stocks model portfolio has managed to maintain its lead over its broad market benchmark.

Through August 31st, the model portfolio is up 7.5%, compared to its broad dividend income benchmark SDY, which is up 5.3%. Its clean energy income benchmark YLCO is down 1.2, even after dividend income. The private portfolio I manage, the Green Global Equity Income Portfolio (GGEIP), is slightly behind the...

List of Power Production Stocks

Alternative energy power production stocks are companies whose main business is the production and sale of electricity from alternative energy installations, such as solar farms, wind farms, hydroelectric generators, geothermal plants, cogeneration facilities, and nuclear plants.

This list was last updated on 9/11/2020.

7C Solarparken AG (HRPK.DE)

Acciona, S.A. (ANA.MC, ACXIF)

Atlantica Yield plc (AY)

Algonquin Power & Utilities Corp. (AQN, AQN.TO)

Avangrid, Inc. (AGR)

Bluefield Solar Income Fund Ltd. (BSIF.L)

Boralex (BLX.TO, BRLXF)

Brookfield Renewable Partners L.P. (BEP)

Capital Stage AG (CAP.DE)

Edisun Power Europe AG (ESUN.SW)

Elecnor, S.A. (ENO.MI)

Foresight Solar Fund plc (FSFL.L)

Global X YieldCo ETF (YLCO)

Greencoat UK Wind PLC (UKW.L)

Innergex Renewable Energy Inc. (INE.TO,INGXF)

John Laing Environmental Assets Group Limited...

List of High Yield Alternative Energy Stocks

This is a list of renewable and alternative energy stocks with dividend or distribution yields above 4%. The list includes most Yieldcos (high distribution companies that own renewable energy operations), but is not limited to Yieldcos. Some Yieldcos may be excluded if their yield is below 4%.

Atlantica Yield plc (AY)

Algonquin Power & Utilities Corp. (AQN, AQN.TO)

Bluefield Solar Income Fund Ltd. (BSIF.L)

Brookfield Renewable Partners L.P. (BEP)

Clearway Energy, Inc. (CWEN,CWEN-A)

Companhia Energética de Minas Gerais (CIG)

Covanta Holding Corporation (CVA)

Crius Energy Trust (KWH-UN.TO, CRIUF)

Enviva Partners, LP (EVA)

Foresight Solar Fund plc (FSFL.L)

GATX Corporation Series A (GMTA)

Global X YieldCo ETF (YLCO)

Greencoat UK Wind PLC (UKW.L)

Green...

Ten Clean Energy Stocks For 2018: First Half Update

The first half of 2018 has been difficult for most investors, including clean energy investors and dividend income investors. Through June, my broad dividend income benchmark SDY lost 0.6%, while my clean energy income benchmark YLCO lost 4.7%, including dividend income.

My picks were also down for most of the year, finally struggling back into positive territory at the end of May. They finished the first half up a solid 5.9%. The real money strategy I manage, the Green Global Equity Income Portfolio (GGEIP), also squeaked in to positive territory by 1.2% at the end of June.

Details of then stocks'...

List of Solar Farm Owner and Developer Stocks

Solar farm owner and developer stocks are publicly traded companies who develop or manufacture equipment that converts sunlight into other types of useful energy. Includes manufacturers and developers of both solar photovoltaic and solar thermal equipment, as well as their supply chain.

This list was last updated on 3/21/2022.

See also the list of Solar Manufacturing Stocks, the list of Residential Solar Stocks, and solar and wind inverter stocks.

7C Solarparken AG (HRPK.DE)

Abengoa SA (ABG.MC, ABGOY, ABGOF)

Acciona, S.A. (ANA.MC, ACXIF)

Adani Green Energy (ADANIGREEN.NSE)

Algonquin Power and Utilities (AQN, AQN.TO)

Atlantica Yield PLC (AY)

Azure Power Global Ltd. (AZRE)

Bluefield Solar Income Fund (BSIF.L)

Boralex (BLX.TO, BRLXF)

Brookfield Renewable Energy...

List of Wind Farm Owner and Developer Stocks

Wind farm owner and developer stocks are publicly traded companies that site, permit, develop, construct, own, or operate wind farms for producing electricity.

This list was last updated on 3/22/2022

Acciona, S.A. (ANA.MC, ACXIF)

Adani Green Energy (ADANIGREEN.NSE)

Algonquin Power and Utilities (AQN, AQN.TO)

Atlantica Yield PLC (AY)

Atlantic Power Corporation (AT)

Avangrid, Inc. (AGR)

Boralex (BLX.TO, BRLXF)

Brookfield Renewable Energy Partners (BEP)

China Longyuan Power Group Corporation Limited (0916.HK, CLPXF)

China Ruifeng Renewable Energy Holdings Limited (0527.HK)

Orsted (ORSTED.CO, formerly DENERG.CO)

E.ON AG (EONGY)

Enel SpA (ENEL.MI, ESOCF)

Greencoat UK Wind (UKW.L)

Infigen Energy Limited (IFN.AX, IFGNF)

Innergex Renewable Energy Inc. (INE.TO, INGXF)

Neoen S.A (NEOEN.PA)

NextEra Energy Partners, LP (NEP)

NextEra Energy, Inc. (NEE)

Nordex AG (NRDXF, NDX1.DE)

Northland Power Inc....

Ten Clean Energy Stocks Back In Positive Territory Year To Date

Stay tuned for a full update next month, but it's nice to be back in the black... especially with the benchmarks still struggling. Thanks to Enviva (EVA), Covanta (CVA), and Seaspan (SSW). Until then, here's the May update, where I said EVA and CVA were two of my 3 top short term picks , and I commented that "I still think Seaspan has significant room to the upside."

AY (at $18.91) and TERP (at $10.83) are my top short term picks right now.

Disclosure: Long EVA, HIFR, GPP, BEP, TERP, PEGI, AY, NYLD, NYLD/A, CVA, SSW.