A Profitable Smart Grid Penny Stock Aims for a NASDAQ Listing

Tom Konrad CFA A NASDAQ listing could bring a quick profit to investors who buy now, but beware the business risk. Ambient Corp. (ABTG.OB) offers an Internet Protocol (IP) smart grid communications platform to electric utilities. So far, they have exactly one customer: Duke Energy (DUK). Duke selected Ambient's X-series communication node solution, which flexibly gathers data from multiple smart meters and relays it to the utility. For instance, in some cases Duke is using Ambient's nodes to gather data from both Echelon Corporation's (ELON) smart meters using data over powerline technology, and Badger Meter's (BMI) smart...

Is Ruggedcom, Inc. as Solid as its Networks?

Tom Konrad, CFA Our recent article on Ruggedcom's (RUGGF.PK, RMC.TO) technology for a smart grid that's also robust against a number of threats such as cyberterrorism and electromagnetic pulses prompted a long-time reader to ask if we also think it's a good investment at these prices. Good question. As outlined in the article, Ruggedcom, Inc. has a robust business providing ruggedized routers for mission-critical networks, including electric utilities growing smart grids. But not every great business is also a great stock. What Makes a Great Stock There are several things I look for in a great stock, and a...

The Value of Net Metered Electricity in New York

by Tom Konrad, Ph.D. Net metering is unfair and is dangerous for the long term health of utilities, at least according to Raymond Wuslich, when he spoke at the 2015 Renewable Energy Conference in Poughkeepsie, NY. Wustlich is an attorney and partner at Winston & Strawn, LLP., and advises clients across the electricity and natural gas industries on Federal Energy Regulatory Commission (FERC) matters. To make his point, Wuslich used a simplified New York residential electric bill. In this simplified bill, the customer was charged 12¢ per kWh for...

Energy Infrastructure Construction Made Easy

by Debra Fiakas CFA Electric power companies need plenty of generating plants and distribution works to bring electricity to our doors. Electric utilities are very good at generating electricity and managing relationships with the families and businesses that use the power, but building all that infrastructure - drawing up plans, hauling in materials and fastening girders - is not necessarily a power company’s strong suit. Enter Quanta, Inc. (PWR: NYSE) with a full menu of design, engineering and construction services for electricity generation and distribution infrastructure. Solving problems for electric utilities is good business for Quanta. The...

Our Smart Grid Stock List

Tom Konrad, Ph.D., CFA I've been writing about the smart grid and its potential since before I joined AltEnergyStocks, in 2007, although at the time, I wasn't using the term: I mostly called it "Smart Metering." Now, Smart Grid is a central part of federal stimulus plans, and the term is firmly ensconced in the popular lexicon. GE even created a Super Bowl ad around the Smart Grid (video). It was far past time to create a Smart Grid category in our Alternative Energy Stock List, but now we've done it. The companies in the Smart Grid Stock List...

Hammond Power Solutions: A Cheap Power Regulation Play?

We have discussed on several occasions the investment opportunities related to power regulation and renewable energy. I have also recently written about the value approach to investing. I came across a stock today that I believed fell into both categories: power regulation (transformers) and value. The stock is Hammond Power Solutions (HPS-A.TO or HMDPF.PK), a firm that makes transformers for a number of applications, including wind turbines. While revenue and earnings have been ramping up quite nicely over the past four years, the stock price has been trending mostly laterally (albeit in a volatile manner) over the...

Ten Solid Clean Energy Companies to Buy on the Cheap: #2 National Grid (NGG)

Like Quanta Services, (#8 in this series), National Grid PLC (NYSE:NGG) allows investors to participate in the massive build out of electricity transmission and distribution infrastructure necessitated by years of neglect and the growing need to decarbonize our electric infrastructure. See the article linked above for more detail on these two forces driving the sector. Having its origins in British electricity deregulation in the 1990s, Nation Grid is a regulated utility in Britain and the United States, and operates high pressure gas pipelines and high voltage transmission in Britain, and electricity transmission and natural gas distribution in the Northeastern...

My Portfolio’s Latest Casualty And Addition

The Casualty Last Monday, I discussed how I had recently reviewed Railpower Tech with a view to potentially adding to my position on grounds that: (a) the company had a fair amount of cash in the bank, which reduced the need to go to capital markets for financing for a while; and (b) that it was getting badly battered by general market conditions, potentially offering an attractive entry point. Although my portfolio has taken a beating in recent weeks, I remain ready to take small positions in stocks if I feel they are being unfairly bashed, including in...

Clean Energy Stocks Shopping List: Five Electricity Transmission Stocks

We may be headed into a renewed market slump. If so, it will pay to wait before buying, but when the time does come to buy, here are 5 electric transmission stocks I have my eye on. Tom Konrad, Ph.D., CFA On June 2, I wrote that I thought the market was near its peak. That day, the S&P 500 closed at 944.74. On June 12, it closed up 0.15% at 946.21, and has since trended down, currently trading down 5% as I write. I expect further declines this year, either with the market heading straight down from here,...

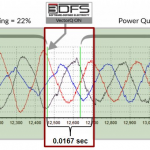

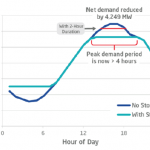

Digital Electrification: Less Waste, More Capacity

One potentially huge contributor to decarbonization of the economy could come from dramatic efficiency gains obtainable from digitally improving the power quality of electricity, as it is being generated, transmitted & being consumed. The enabling technology is emerging from developments in computing that is associated with the Internet of Things (IOT).

DOE estimates indicate that approximately 38.2 quads of electricity are produced, from all sources, but that 25.3 quads, or 66.2% is deemed “Rejected Energy”, so only 33.8% of generated electricity is actually being used. Within that 66% a distinction is recognized between “Losses” & “Waste”:

Loss is non-recoverable, I2R...

Wise Energy Use Stocks, Part 6: Smartgrid Pioneers

Companies taking steps towards the Smart Grid: Xcel Energy, Duke Energy, Whirlpool, Samsung Electronics, and Freescale Semiconductor.

Demand Planning: The Future of Demand Side Management

Electric utilities have a process by which they project future expected demand for electricity, and then find resources, either new electric generation or energy efficiency (Demand Side Management, or DSM) resources to meet that expected demand, or reduce that demand. Progressive utilities and utility regulators now include DSM among the mix of resources as a matter of course. According to Martin Kushler, of the American Council for an Energy Efficient Economy (ACEEE) who spoke at the Southwest Regional Energy Efficiency Workshop about an upcoming report from ACEEE, DSM resources cost an average of 3 cents per kWh of energy...

Democratizing the Grid

by Daryl Roberts

In a previous article I investigated the question of whether private sector capital was being stimulated sufficiently enough to build out renewable infrastructure on pace to reach climate goals. I found that on the upper end, giant institutional funds were only mobilizing a tiny fraction of their total Assets Under Management, due to regulatory constraints and uncompetitive yields. On the lower end, smaller scale funding seemed to be growing, with facilitation from intermediaries, fintech aggregation services, and increased access at lower levels to complicated derisking strategies.

But I now find reporting that capital is over-mobilized, that solar may...

List of Wind and Solar Inverter Stocks

This article was last updated on 12/20/2022.

Inverter stocks are publicly traded companies that manufacture or are suppliers to companies whose products, called inverters, convert power from direct current (DC) to alternating current (AC). Inverters are used to allow power from solar, wind, and batteries to feed the electric grid. They are also included in the list of electric grid stocks.

Advanced Energy Industries (AEIS)

Darfon Electronics Corporation (8163.TW)

Enphase Energy, Inc. (ENPH)

Hoymiles Power Electronics Inc. (688032.SS)

Schneider Electric (SU.PA, SBGSF, SBGSY)

SMA Solar Technology (S92.DE)

SolarEdge (SEDG)

If you know of any inverter stock that is not listed here and should be, please let us know by...

Transmission Stocks: Bringing Wind Power to Where it’s Needed

Last week, Charles told us to expect wind power industry suppliers to benefit from shortages in wind turbine components. Owens Corning (NYSE:OC) which I mentioned in my Blue Chip Alternative Energy Portfolio fits nicely into this category with their composites for turbine blades, as do the power converter stocks I mentioned two weeks ago. As essential to wind power as any of these is improved power transmission. The National Wind Coordinating Collaborative states, Electrical transmission facilities connecting windy areas and load centers are sometimes non-existent or minimal. Even in cases where a good wind resource has...

Will Surging Smart Grid Investments Result in Surging Electric Prices?

John Petersen The electric power system in the U.S. is dirty, antiquated, stupid, unstable, and a security nightmare. After years of discussion and debate, consensus now holds that the generation, transmission and distribution infrastructure will need hundreds of billions in new investment to reduce emissions, improve reliability, minimize waste and inefficiency, improve security, and facilitate the integration of wind, solar and other emerging alternative energy technologies. Commonly cited capital spending estimates range from $200 billion globally by 2015 to $2 trillion overall. In his November 2008 report, "The Sixth Industrial Revolution: The Coming of Cleantech," Merrill Lynch strategist...