What I’m Selling (and will be Buying) in the Market Turmoil

The market is in turmoil, and it seems like everyone I talk to wants my take on what's happening this week. So here's my take: I really don't know if the various bailouts and decisions not to bail out made by Paulson et al will turn out to be good decisions or not. I do know that the mess we're in is due to hard decisions which have been put off for years at the highest levels, and I do know that the American taxpayer is going to be feeling the pain for a generation, if not...

Green Energy Investing For Beginners, Part IV: Model Portfolio

Tom Konrad, CFA My target sector allocation for Green Energy Sectors: How much to put in Solar, Wind, Geothermal, Biomass, Biofuels, Energy Efficiency, Alternative Transport, and enabling technologies such as Smart Grid and Transmission. In Part I of this series on green energy investing (see also Part II and Part III), I suggested readers "structure your portfolio to reflect the technologies which are actually going to make a difference." This is not the same as investing in a market portfolio, because the market tends to overemphasize the most exciting or familiar (as opposed to the most useful) technologies. This...

A Year Later: Market Up, Clean Energy Down

Tom Konrad, CFA When I called the peak a year ago, it was too soon for the broad market, but not for clean energy stocks. I think both have room to fall, but clean energy may bottom first. Almost a year ago at the start of June, I wrote saying "we're near the peak" of the stock market. I was too early, and admitted it in August. But I also said that it was a bad time to be in the market: the risks of a decline far outweighed the potential gains of remaining in an...

Green Energy Investing For Beginners, Part III: Before You Invest

Tom Konrad, CFA Before you consider green stock market investments, invest in yourself. A reader of my article on asset allocation for green energy investors brought up an important point: we may have green opportunities in our own lives, such as improving the energy efficiency of our homes, which will return much safer and higher returns than green stocks, especially when the market as a whole is as overvalued as I currently believe it is. Homeowners typically have a large number of high-return energy efficiency investments they can make. Since energy efficiency reduces energy use, it both produces returns...

2023: Looking Up Like the 2009 Disney Movie

There is no shortage of things to worry about as we start 2023. The Federal Reserve is (rightly, in our opinion) worried about inflation becoming entrenched, and so is likely to continue hiking interest rates for much of 2023. Putin looks unlikely to concede defeat in Ukraine, and his desperation may lead to escalation, potentially even of the nuclear variety. California seems to be washing away while remaining in a drought.

China has loosened the zero-Covid policies that helped the country continue functioning during the first stage of the pandemic, while much of the rest of the world shut down. ...

Asking the Right Questions: Why Invest in Clean Energy?

Tom Konrad, Ph.D., CFA Often, knowing more about a company is less useful than knowing just a few of the right things. Knowing the right questions to ask can help investors wade through a sea of mostly irrelevant information. Take a moment to answer the following poll: Suppose you want to know if fictional solar Company MySolar will outperform other solar stocks. Which fact would be most useful in your decision?(poll) The key to this question was the stated goal of "outperforming other solar stocks." An investor who is only hoping to achieve returns equal...

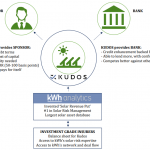

How Weather Risk Transfer Can Help Wind & Solar Development

by Daryl Roberts

The Need To Accelerate Renewables Adoption

Renewables are growing rapidly as a percentage of new electric generation, but are still being assimilated too slowly and still constitute too small of a fraction of total generation, to be able to transition quickly enough to scale into a low carbon economy in time to mitigate climate change.

The issue of providing public support, with subsidies and other reallocation methods, is a politically charged subject. High carbon advocates, for example American Petroleum Institute, argues that support for renewables distorts the market. On the other hand, it has been argued, for example by...

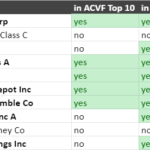

Are ESG Funds All That Different?

by Jan Schalkwijk, CFA

ESG investing is all the rage these days. That is, investing that includes the non-traditional environmental, social, and governance factors in the investment process. Its appeal to the broader investment industry is twofold:

1) The writing is on the wall: as wealth is passed down to younger generations who in the aggregate care more about values alignment, the asset management industry does not want to lose the assets and the fees they generate.

2) Thematic investing is popular and ESG is one of the hottest themes. Wall Street is not going to miss out. Much like crypto...

Preparing for Catastrophe: Is your global warming portfolio ready for rising sea levels?

A Worse-Case Scenario I believe that a large part of global warming denial is fear: fear that if we acknowledge that global warming is happening, we will be morally obligated to do something about it, and that the problem is too large for us to do anything effective. I also believe that denying the problem is certain to render us all ineffective in dealing with it. But getting over our global warming denial is not the only obstacle in our way to dealing with it. Global warming is already happening, and future temperature rises are already inevitable given the...

Stocks We Love to Hate

Investing in clean energy is both an economic and a moral decision. From an economic perspective, I believe that constrained supplies of fossil fuels (not just Peak Oil, but also Peak Coal and Natural Gas) are leading to a permanent rise in the value of all forms of energy. From a moral perspective, I know that we and the vast majority of our children are limited to this one planet for generations to come, so we should abuse it as little as possible, so, of all the possible forms of energy to invest in, clean energy (Renewable and...

Five Hedging Strategies for Stock Pickers

Investors who feel the market is overvalued have two options: move into other asset classes (cash, bonds), or hedge their market exposure. Hedging your exposure does not have to be rocket science, but it does require diligent attention to the market and your portfolio. I recently discussed how it makes sense to be out of the market if you expect that there is a good chance of a large decline, even if that means there is as much of a chance of missing a large upswing as there is a large decline. In my estimation, this is one of...

The Catholic Church Shouldn’t be Investing in Abortion Clinics

Tom Konrad CFA Jesus Saves, but where does he invest? Photo via Bigstock. This article is not about the Church, or abortion. As far as I know, the former does not invest in the latter. This article is about investing, and morality. Since 350.org began its campaign to get endowments and pensions to divest from fossil fuels, I've heard two basic criticisms of the movement from my colleagues in the investment management profession. Endowments selling their fossil fuel investments won't stop us from using fossil...

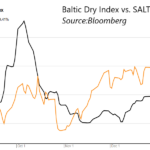

SALT: Buying the Balitc Dry Dips

by Tom Konrad, Ph.D. CFA

The Baltic Dry Index (BDI) is a shipping and trade index created by the London-based Baltic Exchange. It measures changes in the cost of transporting various raw materials, such as coal and steel.

Since the BDI is a measure of the income which firms that own dry bulk cargo ships can earn, changes in the BDI tend to drive changes in the stock prices of such companies.

Stock Price Correlation

Until recently, one such company was Scorpio Bulkers (SALT), one of my Ten Clean Energy Stocks for 2021 picks. The chart below shows the last 5 years, with...

When to Sell: Five Rules of Thumb

A common complaint about investment writers is that we are always willing to tell you the next stock to buy, but we don't always get around to telling you when to sell. I'm as guilty of this as most: generally, I write about the stocks I'm interested in... which are the ones I'm buying, not selling. And, although I write the occasional negative article (Petrosun Drilling most recently, but also US Sustainable Energy and Global Resource Corporation), these were more stocks to avoid, rather than stocks which had seen their run. This is unlikely to change. For a start,...

Green Energy Investing for Beginners: A Small Investor’s Perspective

This is a guest post by Brad Wright, who felt that my "Beginners" series was a too high level to really live up to the name. He's probably right about that, so here is his effort to bring it down to basics for the small Canadian investor. The links and section headers are mine. Tom Konrad. Motivation The goal of this article is to assist with your future investments by explaining investment options, how they work and potential alternatives that may be of interest to you. The take away I’m looking for is with a little research you can...

The Short Side of Clean Energy

Green Energy Investing For Experts, Part I Tom Konrad, CFA You don't have to be long Renewable Energy stocks to have a green portfolio. Shorting, selling calls, or buying puts on companies and industries which are heavily dependent on dirty and finite fossil fuels not only makes a portfolio greener, it can protect against the effects of a permanent global decline caused by peak oil. Nate Hagens presented this slide at the 2009 International Peak Oil Conference: It shows his conception of the different schools of thought among those of us who understand peak oil. Those represented in...