Ramp-Up Delay Sends Solazyme Stock Into Free-Fall

Jim Lane Revenue and customer numbers are up at Solazyme (SZYM), 60% YOY growth from Q3 2013 to Q3 2014. But a slowdown in the rollout at Moema capacity leads to a spectacular 58% one-day drop in the stock price. What happened? Solazyme has been on a relatively steady downward trajectory for the past few quarters, dropping from the $11-$13 range and down into the $6-$8 range. And then plunged a stunning 58 percent to $3.14 yesterday – amidst downgrades by Cowen & Company, Pacific Crest and Baird generally to Market Perform or Neutral, and remains...

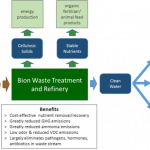

Bion: Waste To Dollars

Earlier this week Bion Environmental Technologies (BNET) received approval of a patent for its proprietary ammonia recovery process. Bion’s technology converts livestock wastes into ammonium bicarbonate. Patent protection in the U.S. paves the way for Bion to deliver an environmentally friendly chemical to the market at attractive profit margins.

Ammonium bicarbonate is used for a variety of purposes from leavening to crop additives. It is the fertilizer market that has caught Bion’s attention. The company intends to ‘close the loop’ for the agricultural sector by helping livestock producers economically dispose of waste and then delivering a fertilizer for food crops that qualifies as organic.

It is an attractive...

Gevo Begins To Ship Missing Link For 100% Renewable Plastic Bottles

Jim Lane From Colorado, news has arrived that Gevo (GEVO) is now selling paraxyleme to Toray (TRYIF), one of the world’s leading producers of fibers, plastics, films, and chemicals. It’s producing PX from isobutanol, one of its three molecules in production (the others are jet fuel and iso-ocrane) at its complex in Silsbee, Texas. Toray expects to produce fibers, yarns, and films from Gevo’s PX. While any new molecule attached to a major customer relationship is always big news for any producer this has special significance. Let’s review exactly why....

Biofuels & Biobased Earnings Roundup: Amyris

by Jim Lane

The Top Line. In California, Amyris (AMRS) reported Q2 GAAP revenue for the second quarter of 2018 of $24.8 million, compared with $25.7 million for the second quarter of 2017. Grants and collaborations revenue was $11.4 million for the second quarter of 2018 compared with $10.3 million for the year-ago period. The company noted that Q2 revenue was $24.8 million compared with the same period in 2017 of $21.7 million when adjusted for the low margin product sales on contracts assigned to DSM (DSM.AS). This reflects 15% growth on an absolute basis. GAAP net loss for the first half was $89.1...

Interview With Dan Oh, CEO Of Renewable Energy Group

Jim Lane Leading a series this week, “The Strategics Speak", in which we’ll look at what a number of major strategic investors see in the landscape relating to industrial, energy and agricultural investment, Biofuels Digest visited with Dan Oh, CEO of Renewable Energy Group (REGI), which has long been the US’s leading independent biodiesel producer but in recent years has steadily diversified and expanded operations. In many ways, REG is the entire industrial biotech business in a nutshelll. They’re fermentation (through REG Life Sciences), and thermocatalytic (through REG Geismar and their extensive biodiesel business). They use both...

Amyris Launches Leading Hand Sanitizer and Receives Initial Positive Result for Vaccine Adjuvant

by Jim Lane

In California comes the news that synthetic biology leader Amyris (AMRS) is stepping out to help fight COVID-19. Amyris may be more well known for its sustainable ingredients for the Health & Wellness, Clean Beauty and Flavors & Fragrances markets, but as you all know, things have changed a lot over the last few months and Amyris is now launching a hand sanitizer to help address the high demand triggered by COVID-19. Additionally, the company has completed initial testing of a leading vaccine adjuvant.

Amyris is leveraging its existing capabilities to fast track the availability of a safe...

Solazyme Shares Soar On Sasol Deal

Jim Lane Bioenergy’s #1 company surges on the exchanges after big Sasol, AkzoNobel partnership announcements. In California, Solazyme (SZYM) announced a Q2 loss of $25.8M, compared to a Q2 2012 loss of $19.2M, on revenues of $11.2M, down from $13.2M for Q2 2012, as government funded revenues declined as expected. Excluding the government sector, sales jumped 28% year on year despite the lack of the big capacity that Moema and Clinton will represent when completed. Product gross margins were a very healthy 70%, in line with guidance. Solazyme shares were up 12.95 percent today at market close....

BioAmber Goes Ballistic

Jim Lane Word arrived from Minnesota that BioAmber has signed a 210,000 ton per year take-or-pay contract for bio-based succinic acid with Vinmar International. Explaining why BioAmber (BIOA) stock shot up nearly 17% in today’s trading despite a global equities pullback that affected almost everyone else in industrial biotech. Under the terms of the 15-year agreement, Vinmar has committed to purchase and BioAmber Sarnia has committed to sell 10,000 tons of succinic acid per year from the 30,000 ton per year capacity plant that is currently under construction in Sarnia, Canada. Bottom line, BioAmber continues to roll and roll....

Avantium IPO “Many Times Oversubscribed:” What Buyers Are So Excited About

Jim Lane In France, Avantium completed its highly-anticipated initial public offering, raising $109.5M (€103M) via the sale of 9,401,793 shares at $11.70 (€11) per share, giving the company a market capitalization reaches of $294M (€277M). Trading will begin on March 15th 2017 on Euronext Amsterdam and Euronext Bruxelles under the symbol AVTX. The Company anticipates to use €65-75 million of the net proceeds of the Offering for the funding of the Joint Venture, enabling it to construct and operate the reference plant for the commercialization of the YXY technology. The company’s first world-scale plant is a 50,000 tons...

Why Traffic Lights Are Turning Green For BioAmber

Jim Lane As many technologies pivot or delay, one train keeps chugging on its route to biosuccinic acid, and markets like BDO, resins and polyols. What is it about the business model that keeps on working? What can every integrated biorefinery learn from its approach? In Minneapolis, BioAmber (BIOA) just announced a contract to supply a minimum of 80% of PTTMCC Biochem’s total bio-succinic acid needs until the end of 2017. PTTMCC Biochem is a joint venture established by Mitsubishi Chemical and PTT, Thailand’s largest oil and gas company, to produce and sell polybutylene succinate (PBS),...

New Bio-Based Tacky Resins Launched With Amyris Technology

Jim Lane In France, Cray Valley has launched new tackifying resins produced with Amyris’ (AMRS) biologically derived Biofene branded farnesene. Tack is the measure of stickiness vital to everything from adhesives that need to hold things in place to inks that need to stay on the printed page. According to independent market research firm, MarketsandMarkets.com, the global tackifier market is projected to reach USD 3.56 billion by 2020. This poses a large opportunity for renewable farnesene-based tackifiers and Amyris believes it can access a large market share as its product applications within the space achieve commercial scale. Cray...

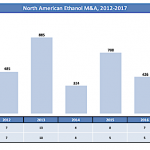

Biofuels M&A: 2017 Review and Outlook

by Bruce Comer, Ocean Park Advisors

More industry players chose to develop and build new capacity rather than buy plants

The North American biofuels industry experienced the fewest merger and acquisition transactions in recent history in 2017. There were only six M&A transactions, with a total estimated value of more than $100 million. They involved eight plants with 297 million gallons per year (MGPY) of production capacity. Half of these deals were for non-operating plants. A fourth deal was for a sub-scale demonstration plant. Contributing to the limited deal flow, two historically active acquirers, Green Plains and REG, did not close...

Solazyme: Now, Express Yourself in the oils you choose.

Jim Lane In an on-time arrival, Solazyme starts up at 500,000 liter scale in Clinton, Iowa. In California, Solazyme (SZYM) announced that commercial operations have commenced at both Archer Daniels Midland Company’s (ADM) Clinton, Iowa facility, and the downstream companion facility operated by American Natural Products in Galva, Iowa. Highlighting the flexibility of Solazyme’s technology platform, Solazyme, ADM and ANP have successfully manufactured three distinct and unique tailored oil products at the facilities, and products are currently being sold and distributed in both the U.S. and Brazil. Volumes shipped to Brazil are being utilized for...

Beets to Gas

by Debra Fiakas, CFA

In recent weeks management from Global Bioenergies (ALGBE: EURONEXT)made the rounds among New York City investors. The French specialty chemical developer is trying to win new friends in the U.S. for its bio-isobutene made through the fermentation of organic materials. Isobutene, also called isobutylene, is a four-molecule hydrocarbon that is a foundational chemical in a wide range of common products from gasoline additives to cosmetics. Until recently, isobutene was made exclusively in the crude oil refinement process. It is one of the many by-products of crude oil refining that helps pad the profit margins of big oil...

Dyadic Sells Industrial Technology Business To Dupont

Jim Lane As Dyadic cashes out of industrial biotech and retains a C1 license for pharma, DSM and Syngenta also announce a partnership. Companies are girding their loins for the long haul. The Digest takes a look, In Florida, DuPont (DD) Industrial Biosciences will acquire substantially all of the enzyme and technology assets Dyadic’s (DYAI) Industrial Technology business for $75 million, including Dyadic’s C1 platform, a technology for producing enzyme products used in a broad range of industries. DuPont has granted back to Dyadic co-exclusive rights to the C1 technology for use in human and animal pharmaceutical...

American Refining Group Joins Amyris And Cosan In Renewable Base Oil JV

Jim Lane IIn California, American Refining Group has committed to a 33.3% equity investment into Novvi , a joint venture of Amyris (AMRS) and Cosan (CZZ). Both Amyris and Cosan will continue to hold share ownership stakes in Novvi, together with ARG. It’s not a tiny market by any means. The global markets for base oils and lubricants, are expected to reach $42 billion and $70 billion in size, respectively, by 2020, according to Amyris. For ARG: Why Novvi, why now? Think novel performance. It goes in two directions. First, there’s low-carbon performance customers want...