Scrappy Companies For Scrappy Investors

By Tom Konrad, Ph.D., CFA

Supply and Demand

One uncomfortable fact for green investors is that the clean energy transition is going to require a lot more mines. Lithium, nickel, cobalt, copper, manganese, graphite, even steel: just name and industrial commodity, and we’re probably going to need a lot more of it.

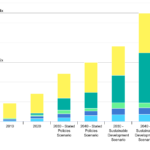

Total mineral demand for clean energy technologies by scenario, 2010-2040

Even worse, it’s not at all clear where all these materials are going to come from. While there are plenty of all the elements we need in the Earth’s crust, actually mining them all in the next 20 years is not...

Will Rare Earths Cripple the Green Economy? Part 3

Eamon Keane This is Part Three of a three part series based on a rare earth elements (REE) review which is available for download at slideshare, where references can be viewed. Part 1 is an introduction to REEs. Part 2 analyzes REE consumption and refining and Part 3 looks at how REEs might affect the green economy. There have been several forecasts made for future demand. Approximate data was derived from Byron Capital Market’s own estimate and the data contained in Oakdene Hollins’ May 2010 report “Lanthanide Resources and Alternatives” for others . Figure...

Clean Energy M&A: Is the Glass Half-Empty or Half-Full?

Dana Blankenhorn Some reporters are calling the latest PwC Renewables Report a sign of a “renewables frenzy,” in that the number of merger deals in the space climbed to 530 last year, from just 319 in 2009. But is it? The total value of all deals in the space, according to the same report, actually fell sharply, to $33.4 billion from $48.8 billion. Major indexes like the Wilderhill New Energy Index and the PowerShares Global Clean Energy ETF (PBD) both fell in value last year, even while the average stock was rising in value. There are many reasons...

How to Measure the Next Economy?

Garvin Jabusch In search of a sucessor to the Global Industry Classification Standard The Global Industry Classification Standard (GICS) is the framework within which finance types organize companies and their stocks into industries and sectors. You've heard the names for these groups many times: energy, transportation, materials, commercial services, etc. These divisions have been useful in attempting "to enhance the investment research and asset management process for financial professionals worldwide" (mscibarra.com, 3/2010). And, for a while, GICS did a decent job of keeping portfolio managers, investment advisors and their clients reasonably well organized in their thinking about...

Graphene Stock Investing: What The Pros Think

Tom Konrad CFA Flexible Graphene Sheet image via BigStock Graphene is a crystalline form of carbon in which carbon atoms are arranged in a regular hexagonal pattern. It is very strong, light, and an excellent conductor of heat and electricity. It is also nearly transparent. New laboratory techniques for creating large sheets of graphene, including a roll-to-roll production process, have triggered an explosion of research into new practical applications taking advantage of graphene’s unique properties. Some potential cleantech applications are solar cells, ultracapacitors, water filtration and...

Inevitable Shifts and Indispensable Technologies

Next Economy Inflection, Pt. III Garvin Jabusch Back at the New Year, I thought it’d be fun to write up a short recap of some of the evidence that, finally, the world is waking up to the real need to get our economies on a footing that can allow it to persist indefinitely. In that post I wrote of those observations that “these are just the first few recent ‘tipping point’-like stories to come to mind. I've read dozens more examples recently, and I feel the fact that I can no longer be aware of all the evidence...

Top Questions to Ask a Venture Capitalist in the First Pitch

David Gold Katherine Connors, Miss Iowa USA 2010 throws the ceremonial first pitch. Source: Cathy T, via Wikimedia Commons You landed your first pitch at a venture capitalist’s (VC) office. You’ve practiced the pitch and have your laptop fired up to deliver. So, like a sprinter at the sound of the gunshot, you dive in hard and heavy to make sure you get through the deck. After all, you might only have one chance to excite them with your company’s story. Inevitably, with all the questions...

Japan Wants to be World Leader in Rare Earth Recycling

by Kidela Capital Group Necessity is the mother of invention and Japanese industry is discovering just how true that old saying is. Last year, a diplomatic spat between Japan and China led the world’s largest supplier of Rare Earth Elements (REEs) to suspend exports of Rare Earth oxides and other critical metals to its largest single client. Japan, like the rest of the world, is almost totally reliant on Chinese Rare Earth (RE) exports and the China’s action, which came as a shock to Japanese industry, is a sentient warning for the rest of the world....

Why Alternative Energy Stocks Are Down Despite An Obama Victory

By Harris Roen If you follow the energy sector closely, then you know that many questions regarding the direction of alternative energy companies were looming during the 2012 campaign season. Was the country going to continue with the Obama Administration’s “all-of-the-above” strategy with its strong emphasis on renewables, or would there be an accelerated domestic drilling and pipeline bonanza under Republican leadership. When the election finally ended last week, many pundits expected investors to pour money into the beleaguered alternative energy sector resulting in a surge of stock prices. So why, instead, did alternative energy...

The iCloud’s Green Lining

Meg Cichon Just one year after Greenpeace called out Apple, Inc. (AAPL) for its use of fossil fuels in its "How Green Is Your Cloud" report – which graded Apple no higher than a "D" in four categories consisting of energy transparency, infrastructure siting, energy efficiency, and renewables and advocacy – Apple announced that its data centers are now powered by 100 percent renewable energy. In fact, renewables contribute to 75 percent of its entire corporate operations energy needs, according to its website. The 2012 report cites Apple’s planned expansion into “iDataCenters” to support its booming iCloud services,...

Top 5 Things Cleantech Entrepreneurs Fail to Understand About Raising Capital

David Gold After decades of venture capital investment, growth and exit, the traditional focus areas of venture capital (such as IT, web and software) have developed strong entrepreneurial ecosystems. A high percentage of start-ups in these traditional areas come to market with one or more experienced entrepreneurs or with a strong and active network of investors/advisors who have “been there, done that.” They know what it takes to raise capital and to build a great fast-growing business. Cleantech companies, however, are much more likely to be led by first-time entrepreneurs who often struggle to create an ecosystem of...

Sprott’s Peak Oil Watch

While browsing the web this morning, I came across a very interesting section on Peak Oil on Sprott Asset Management's website (best viewed with Explorer). Sprott Asset Management is a Toronto-based boutique investment management company that I consider, for lack of a better term, pretty cool. They have taken some relatively unorthodox commodities bets in the past and have often won them. For instance, they spotted the bull market in uranium very early on and did well as a result (PDF document). There are many web-based Peak Oil resources out there, so you may wonder why I decided...

Who’s Winning the Clean Energy Race?

Tom Konrad CFA Highlights from a report on Clean Energy investments from the Pew Charitable Trusts. The Pew Charitable Trusts just released their report on Clean Energy, finance, and investment in the Group of Twenty (G20) economies in 2010 . I had the opportunity to review a pre-release version of the report. Some 2010 trends they discovered were encouraging or exciting, some were disappointing. I also had the chance to speak to the director of Pew's Clean energy Program, Phyllis Cuttino, about the report. Here are the highlights from the report and our discussion. Clean Energy Sectors...

Sages and Seers: Warren Buffett, Bill Clinton, Oxford University Prof. Nick Bostrom, and the...

Garvin Jabusch The last couple of weeks have seen some remarkable next economy pronouncements from three of the world's smartest people, each representing a different realm of human endeavor: business, politics and academics. Warren Buffett, Bill Clinton, and Oxford University professor Nick Bostrom are among the world's highest achievers, and each has remarkable visibility in to the real, actual state of the world. As such, I couldn't help but notice their recent confluence of messaging. In his most recent annual shareholder letter, release February 25th, 2012, Warren Buffett touted Berkshire Hathaway's significant, recent investments in renewable energies:...

10 Stocks To Last The Decade…

Someone recently sent me a link to a Motley Fool piece entitled "10 Stocks to Last the Decade, Revisited". It appeared on Feb. 2 so some of you may have already read it. For those who have not, I thought it might be an interesting read because so many parallels can be drawn between the tech euphoria of the '90s and the cleantech euphoria of today. In a nutshell, the author looks back at a summer of 2000 Fortune article in which 10 stocks were identified as sure winners for the next decade based on how hot...

REDI-ing Your Portfolio for a Low-Carbon Economy

Tom Konrad, CFA Colorado's recently released Renewable Energy Development Infrastructure (REDI) report looks at what the resource-rich state needs to do to accomplish the state goal of reducing CO2 emissions 20% from 2005 levels by 2020. Investors who expect the developed world to attempt similar cuts in emissions should take note of the report's conclusions, and invest accordingly. Since Colorado Governor Bill Ritter recruited my friend Morey Wolfson for the Colorado Governor's Energy Office (GEO) he's had a lot less time to socialize with the rest of us in the clean energy community, but we caught up over lunch...