Selling Pressure Comes Off Lime Energy

Tom Konrad CFA When Lime Energy (NASD:LIME) reported accounting problems, including the possibility of fictitious revenue on July 17th, investors abandoned the stock, unwilling to own a company in which they knew the financial statements to be misstated. Over the next two weeks, Lime found a floor around $0.90 (down from over $2 on July 16th), as those investors who would sell at any price were replaced by those who, like me, feel that $0.90 is less than any reasonable estimate of LIME’s true value even in liquidation. Volume then dried...

Lighting Science Group Purchase

Lighting Science Group Corp. (LSGP.OB) has been on my watchlist for several months. They design and market energy efficient lighting solutions with long lasting LED bulbs that can be quickly deployed in existing lighting applications and produce immediate cost savings and environmental benefits. Some key events that have attracted me to this company: They recently moved to the OTC BB off the pink sheets.They recently received a private placement of almost $7 millionAfter a several year absence they are finally a fully reporting companyThey are currently far from being profitable, but the trend on the balance sheet is...

Orion Energy Systems: Seeing The Light

by Debra Fiakas CFA On Monday Orion Energy Systems (OESX: NYSE) issued a press release to reiterate previous guidance for sales in the quarter ending March 2015. Given that the quarter has already ended, it is more like a pre-announcement of results than guidance. At any rate management has indicated the results, when finally reported will bring sales for the fiscal year ending March 2015, to some point in a range of $72 million to $74 million. The announcement might not be so much motivated by a need to assure shareholders of financial performance, as much as...

PFB Corp Integrates Upstream, Just in Time for Green Housing Market Upturn

Tom Konrad CFA On May 9, green building firm PFB Corporation (TSX:PFB, OTC:PFBOF) announced that it had signed a letter of intent with NOVA Chemicals for PFB to acquire NOVA’s Performance Styrenics business. The all share deal will give NOVA an equity stake in PFB as well as two seats on PFB’s board. PFB’s Plasti-Fab subsidiary currently sells Expanded Polystyrene products (EPS) such as Insulated Concrete Forms and Structural Insulated Panels into the North American green building market, and as a result is a customer for the Performance Styrenics division’s EPS resins. Over the last few years,...

LED Stocks Get Some Respect

Cree's Wild Ride On May 21, I noticed a big up-move in Cree, Inc. (CREE), a company I've been adding to most of my managed portfolios for the last year, at prices averaging around $18. Checking recent news stories, I noted two articles on TheStreet.com which had recommended it over the weekend (as a beaten down stock and chart of the day.) It turns out this was just the beginning of a feeding frenzy among the media which has gone on for the last couple weeks, bringing a lot of attention to what I call "the next compact fluorescent:"...

Ten Solid Clean Energy Companies to Buy on the Cheap: #10 United Technologies

Like most conglomerates, United Technologies Corporation (UTC), (NYSE:UTX) won't be found in any of the Clean Energy indices, but its growing portfolio of clean energy businesses makes it fit well into a diversified portfolio with a clean energy tilt. A conservative capital structure and solid earnings and cash flow, and a decades long history of constantly increasing dividends make this a company that I'm comfortable holding for the long term. In terms of sustainability, the company has been recognized by Dow Jones as in the top 10% of the world's most sustainable companies. Long before it became fashionable for...

Who’s a Fat Cat?

Tom Konrad CFA A Fat Cat. Photo of "Cauchy" by author. Friday, in a generally positive article about Lime Energy (NASD:LIME), I noted that the top five executives at the company seemed overpaid in comparison to one of their nearest rivals, Orion Energy Systems (NYSE:OESX). Since this was not based on in-depth research, and is a pretty serious allegation about a company I’m otherwise enthusiastic about, I decided to do some more digging. Who is a Fat Cat? Using data on executive pay from Morningstar, I compared executive pay at...

Ameresco, New Flyer, PFB: Q1 Efficiency Earnings Highlights

Tom Konrad CFA Performance contractor Ameresco, Inc. (NYSE:AMRC) reported earnings on May 9th. Revenues were below analyst expectations, but Chairman, CEO, and President George Sakellaris put this down to timing issues, and stuck by his full year guidance. Strong growth in the firm’s backlog and awarded project’s seem to back up this relatively optimistic view. From the earnings call transcript e are very confident about the improving market conditions in few of our regions, as well as continued growth in our all other offerings. These are expected to be the growth drivers for the near-term. We are also...

Ten Alternative Energy Speculations for 2008: Batteries, CHP, and Transmission

This article is a continuation of my Ten Alternative Energy Speculations for 2008, with picks #8, 9, and10 published last Thursday. If you haven't already, please read the introduction of that article before buying any of the stock picks that follow. These companies are likely to be highly volatile, and large positions are not appropriate for many investors. My least risky picks (#8,9, and #10) are part of that same article; my most speculative plays (#1-3) will are here. #7 Electro Energy, Inc. (NasdaqCM:EEEI) $0.68 Electro Energy has risen 36% in the month and a half since I last...

How Infrared Imaging can Sell Energy Efficiency

Energy Efficiency breaks the laws of economics. Despite the fact that it's considerably cheaper then traditional energy sources, as well as providing substantial benefits in terms of comfort, economic growth, safety, and the environment, barriers arising from misplaced incentives and the attitudes, awareness, perceptions, and general level of knowledge all conspire to prevent people from taking steps which would otherwise be extremely rewarding. The key to better implementation of Energy Efficiency programs are programs to raise people's interest or awareness. For instance, there is the example of how Woodstock Hydro found that their customers' electricity usage dropped 15%...

Clean Energy Stocks Shopping List: Five Energy Efficiency Stocks

Stocks may be expensive now, but they won't be forever. Five energy efficiency plays to buy when they're cheap again in efficient HVAC, desalination, thermal imaging, and lighting. Tom Konrad, Ph.D., CFA This article continues my Clean Energy Stocks Shopping List series. In the first, I looked at five clean transport stocks I'll be looking to buy when the market falls. In the second, I took a step back, and outlined why it makes sense to wait for better prices than to buy these companies now. Here are five stocks I'll be looking to buy in my all time...

Energy Efficiency Policy Recommendations for State Legislators

On Monday, I had one of my favorite sorts of opportunities, which was a chance to influence future energy legislation. The National Conference of State Legislators invited me to give a short presentation as part of a two-day energy efficiency workshop for interested legislators from across the country. Given the short time frame, I couldn't say everything I would have wanted, but fortunately, I was part of a large group of excellent presenters, so what I didn't hit, they did. I focused on my ideas for transforming markets and tackling the many barriers to energy efficiency . Tom Konrad...

Alternative Energy Technologies and the Origin of Specious

John Petersen Thanks to a recent comment from JLBR, I've found a new hero in Dr. Peter Z. Grossman, an economics professor from Butler University who cogently argues that government attempts to force alternative energy technologies into an R&D model that was created for the Manhattan Project and refined for the Space Program will always result in commercial disaster because "the goal of the Apollo Program was the demonstration of engineering prowess while any alternative energy technology must succeed in the marketplace." In a recent article titled "The Apollo Fallacy and its Effect on U.S. Energy Policy" Dr....

Looking for Cash in Old Refrigerators

by Debra Fiakas CFA

Appliance Recycling Centers of America (ARCI: NYSE) is a typical small company, toiling away in seeming obscurity and struggling to get proper valuation of their success. There is little glamour in old refrigerators and washing machines, but ARCA has figured out how to wring cash from recycling our household appliances. In the last three fiscal years the company converted 1.6% of sales to operating cash flow.

Unfortunately, things have turned a bit sour in the world of old Frigidaires and tired Maytags. Last week ARCA reported financial results for the quarter ending September 2015. The company suffered...

Climate Change & Corporate Disclosure: Should Investors Care?

Charles Morand On Monday morning, I received an e-copy of a new research note by BofA Merrill Lynch arguing that disclosure by publicly-listed companies on the issue of climate change was becoming increasingly "important". The note claimed: "e believe smart investors and companies will recognize the edge they can gain by understanding low carbon trends." I couldn't agree more with that statement. It was no coincidence that on that same day the Carbon Disclosure Project (CDP), a non-profit UK-based organization that surveys public companies each year on the state of their climate change awareness, was...

Atlantica Q1, Buying Hannon Armstrong

By Tom Konrad, Ph.D., CFA

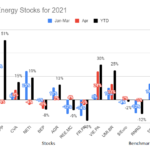

Here are two more updates from last week on Patreon. Also, I realize I neglected to publish the monthly performance chart for my 10 Clean Energy Stocks model portfolio here at the start of the month, so here it is as well:

Atlantica Sustainable Infrastructure Earnings

(published May 11th)

Atlantica Sustainable Infrastructure (AY) released its first quarter earnings announcement and financial statements on May 6th.

Atlantica is one of the higher yielding Yieldcos, 5.3% at the new quarterly dividend rate of $0.43 and a $32.50 stock price. The dividend is safe, since most of Atlantica's debt is fixed rate,...